Regional markets adaptation: how data and culture transform iGaming success

In iGaming, one-size-fits-all strategies fail before they begin. From India's mobile-first players to Brazil’s love for live betting, success lies in localization—tailoring content, payment methods, and cultural experiences. Here’s how operators adapt, connect, and thrive in diverse markets around the world.

Why regional markets hold the winning hand in iGaming

As iGaming continues its global expansion, one thing is certain: regional markets are not just opportunities—they are necessities.

Localized strategies—whether through tailored promotions, adjusted payment options, or culturally relevant content—unlock growth opportunities and build player loyalty where it matters most.

Culture and cash: what really drives iGaming growth

Cultural differences play a decisive role in shaping player behavior, preferences, and expectations.

Take India, for instance, where cricket reigns supreme.

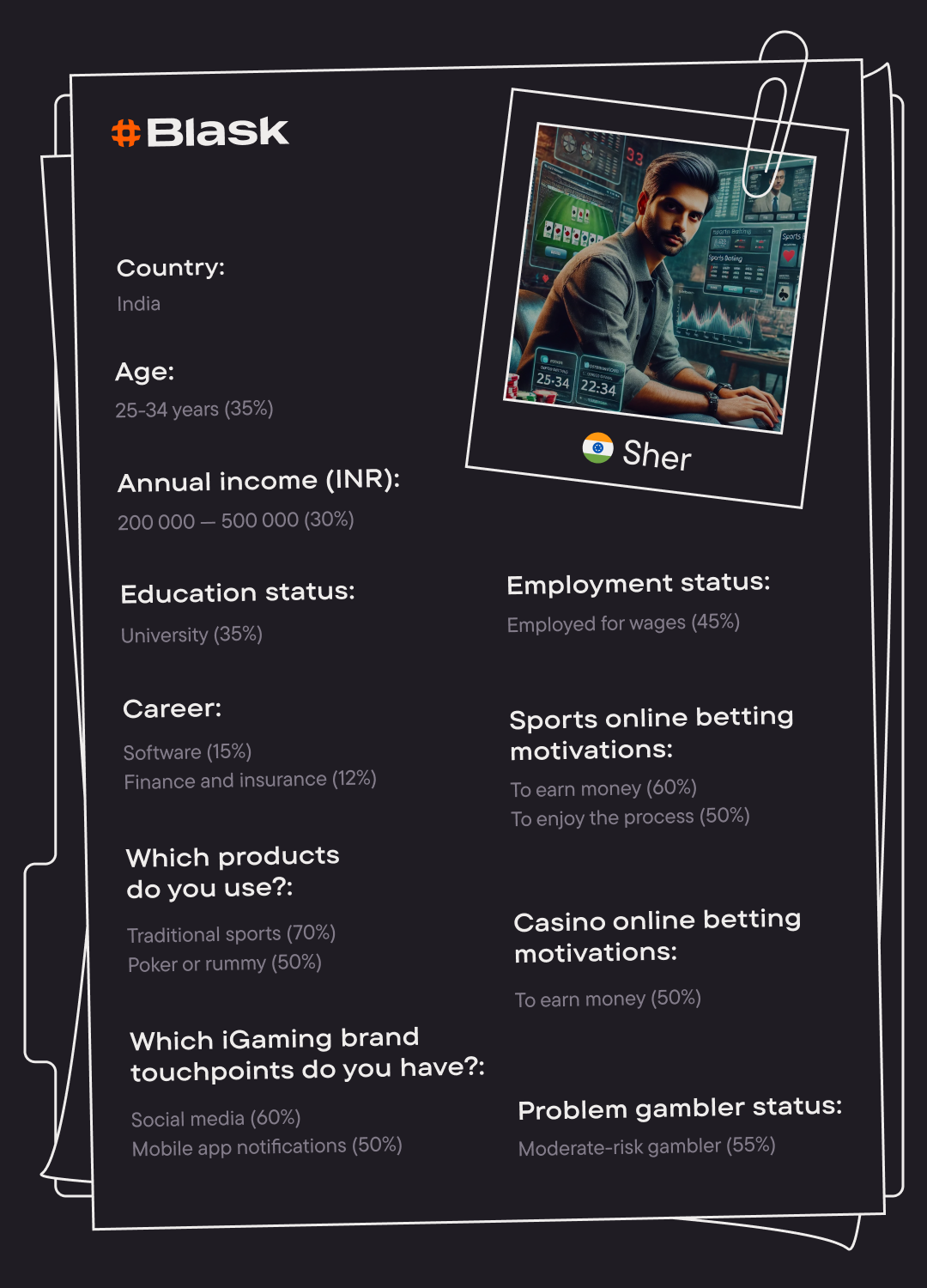

Blask Customer Profile, powered by AI and 80,000 surveys, reveals that 70% of Indian players bet on traditional sports like cricket, driven by both emotional and analytical motivations.

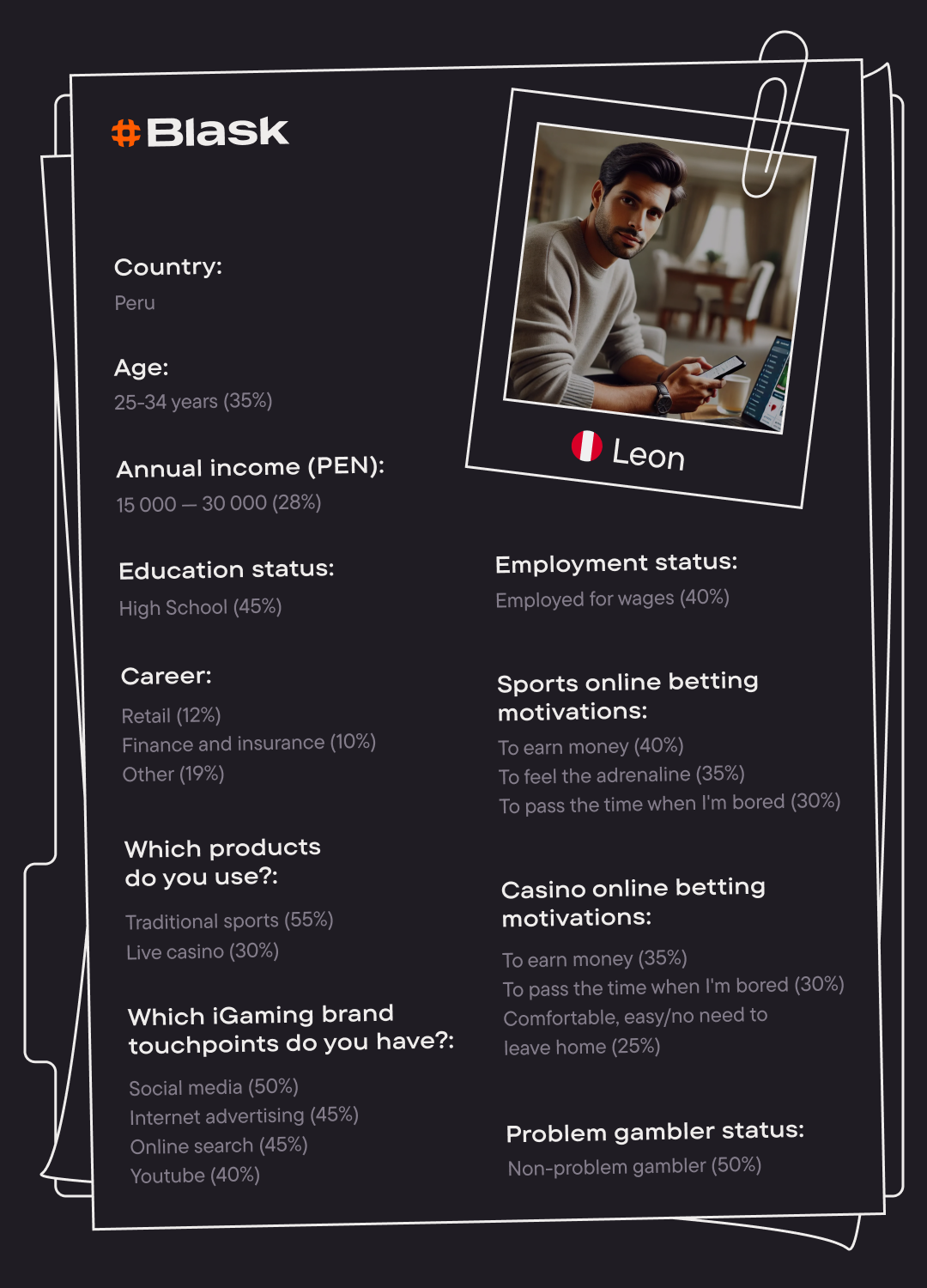

Meanwhile, South African players tend to balance entertainment with a practical approach to bankroll management, and Peruvians turn betting into a social and cultural experience, particularly around football.

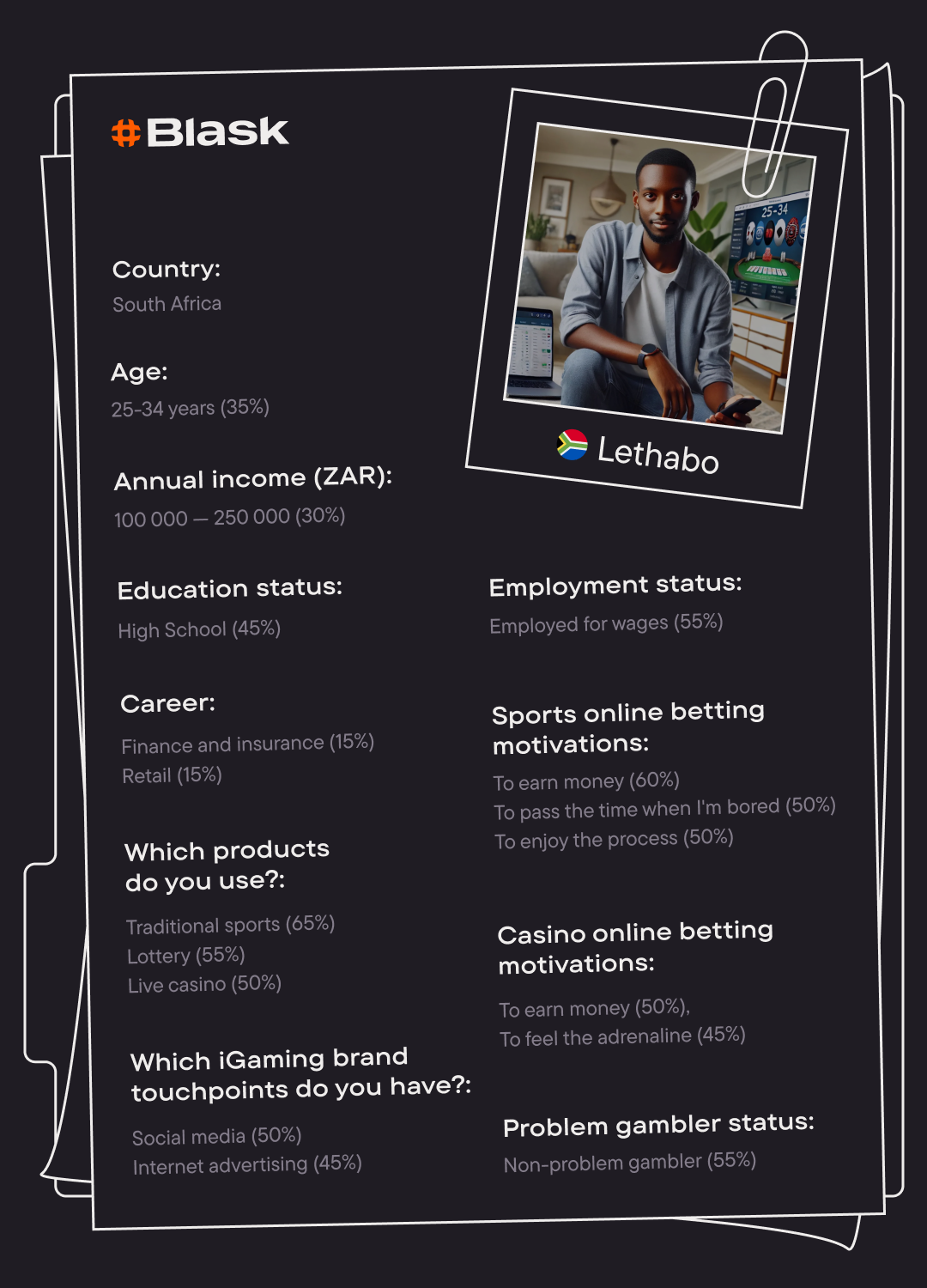

Blask Customer Profile: typical players in India and South Africa

Economic factors are equally pivotal.

For example, understanding income levels allows operators to adjust bonus structures and deposit minimums to meet local players’ spending power. In South Africa, where many players earn between 100,000-250,000 rand annually, promotions must be accessible and engaging. Similarly, in India, Blask identifies younger audiences interested in low-stakes options and high rewards.

This level of granularity ensures strategies are not only effective but resonate deeply with target markets. For instance, a younger audience in India might be drawn to slot games featuring trendy themes like sneakers, while tech professionals prefer poker, where skill and strategy are key.

Knowing your players: unpacking regional behaviors and preferences

Player preferences vary widely across regions, and understanding these differences is critical to tailoring offerings.

In Peru, for example, Blask Customer Profile shows that players engage heavily with football and live casino games. Their motivations include earnings potential and social engagement, aligning perfectly with culturally rich sports betting experiences. Meanwhile, South Africa’s rising interest in lotteries and live casinos highlights the need for localized content that balances simplicity and excitement.

What sets Blask Customer Profile apart is its ability to capture motivations and behaviors that drive engagement.

With this insight, operators can:

- Launch targeted marketing campaigns.

- Tailor game themes and promotions to regional interests.

- Ensure gameplay features align with local habits.

In short, data-driven strategies fueled by Blask allow operators to move beyond surface-level localization.

By understanding their players’ habits, economic conditions, and cultural contexts, operators can unlock the full potential of regional markets.

Cracking the code: winning in new regional markets

Expanding into new regional iGaming markets is no small feat. Each region brings its unique challenges, from regulatory hurdles to player preferences.

For operators, success lies in balancing compliance with a seamless player experience tailored to local behaviors.

Playing by the rules: navigating local iGaming regulations

The iGaming industry operates in a patchwork of regulations that vary dramatically across regions. What works in Europe may fall short in markets like Latin America or Asia, where governments are tightening oversight.

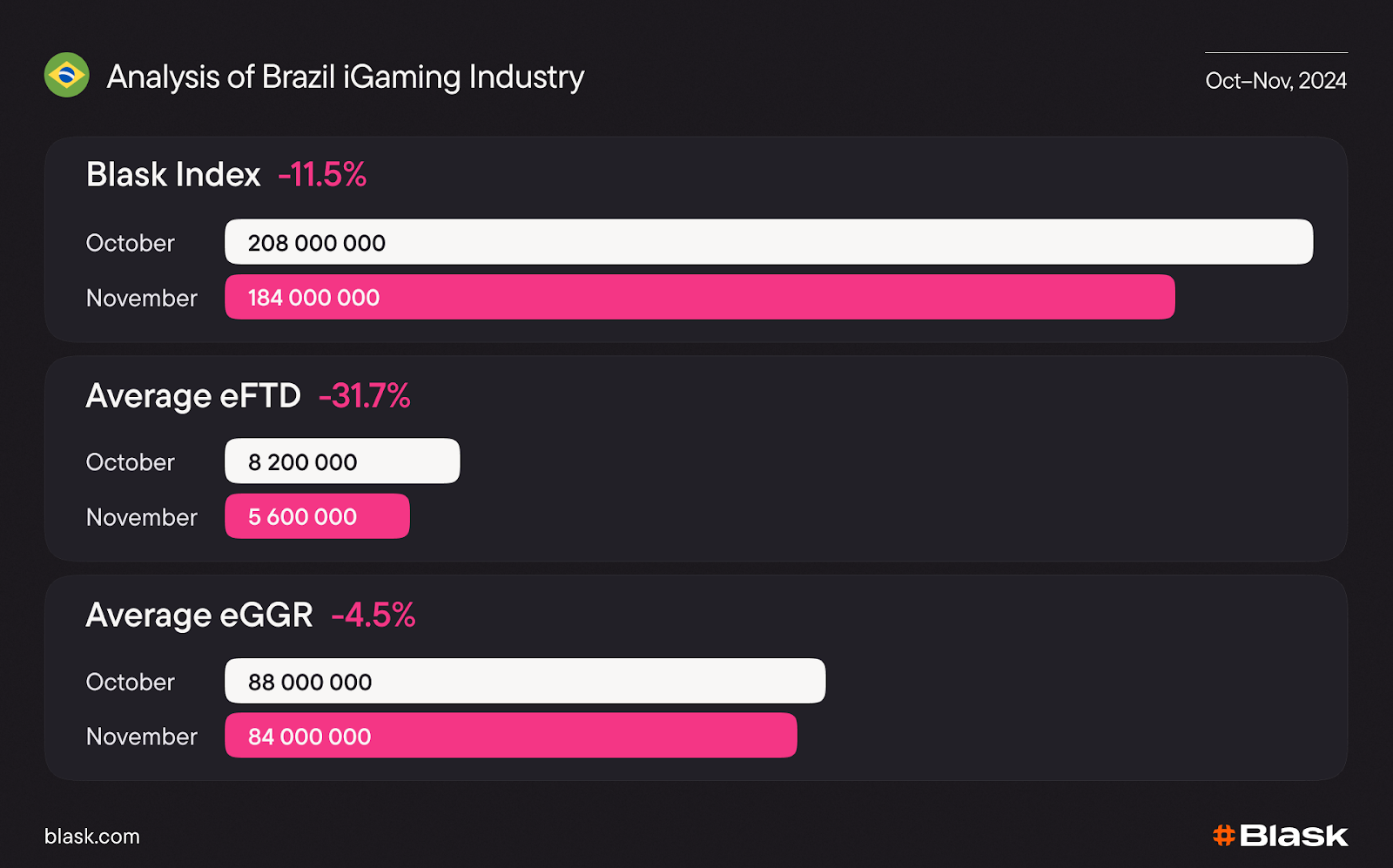

Take Brazil as an example: its newly regulated gambling market, launching in January 2025, requires operators to pay a $5.2 million licensing fee within strict deadlines. Beyond this, companies must prove their financial stability and comply with local advertising restrictions.

Yet Brazil’s case is not unique. Across emerging markets, operators face shifting legal frameworks, stringent tax requirements, and rising expectations for player protection.

Navigating these complexities demands more than guesswork.

Blask goes beyond traditional metrics like eFTD, eGGR, and Relative Market Share. It identifies whether brands operate under local or international licenses, empowering operators to make informed strategic moves without risking non-compliance.

Understanding local rules while assessing market potential can make or break an operator’s entry into new regions.

With governments worldwide cracking down on unlicensed operators—Brazil alone has blocked 5,000+ domains—the message is clear: iGaming’s future belongs to those who can adapt, comply, and earn player trust.

Payment systems that players trust

Nothing kills player engagement faster than clunky payment experiences. In emerging markets, seamless, region-specific payment methods aren’t optional—they’re essential.

Brazil’s players, for example, rely heavily on PIX and Boleto, while in India, UPI-based transactions and rupee-compatible systems are the gold standard. In South Africa, mobile money platforms bridge gaps in regions with limited internet infrastructure.

Getting it right goes beyond payment methods—it’s about understanding currency preferences, too.

Showing Yen in Japan or rupees in India isn’t just a detail; it’s a sign that you’re speaking the player’s language and respecting their experience. These thoughtful touches build trust, reduce drop-offs, and keep players coming back.

To win in regional markets, operators must balance local compliance, payment precision, and cultural awareness.

The result? A frictionless experience that feels tailor-made—because it is.

Winning over regional audiences: the art of tailored marketing

Crafting offers that speak the local language

Players respond to offers that feel personal and relevant, and this is where localized customization shines.

For instance, players in Brazil often gravitate toward football-themed bonuses tied to major tournaments like the Copa Libertadores. Meanwhile, in India, promotions linked to cricket, especially during the IPL season, generate significant engagement.

But it’s not just about the sport—timing matters, too. Weekend bonus rounds or mid-week cashback offers tailored to local betting habits can make all the difference.

Operators who dig into regional data to design offers that resonate with specific demographics consistently see higher retention and lifetime value from their players.

Blask Games takes this a step further by providing operators with real-time insights into the most popular games in specific countries. By applying metrics like Blask Index, Market Share, Year-over-Year (YoY) growth, and Month-over-Month (MoM) trends, operators can identify what players truly want and optimize their portfolios accordingly.

Whether it’s the hottest slots in Peru or live dealer games in South Africa, Blask Games ensures operators have the tools to deliver engaging, tailored experiences that drive player satisfaction and loyalty.

Language: the first step toward trust

When it comes to marketing, the language you choose is as important as the message itself. Players are more likely to engage with platforms that “speak” to them—both literally and culturally. But localization isn’t just about translation; it’s about adaptation.

In Japan, for example, promotional content that incorporates local proverbs or cultural touchpoints resonates far better than direct translations of Western marketing slogans.

Even something as seemingly small as formatting—like displaying dates or currency in a region’s standard format—can have a big impact on player trust.

Meanwhile, incorporating visuals, themes, and symbols familiar to the target audience can create a deeper connection, making your brand feel less like an outsider and more like a trusted companion in their gaming journey.

Making data your game-changer in regional strategies

Decoding player trends: what’s hot and what’s not

Preferences are deeply shaped by cultural, economic, and event-driven factors, often leading to strikingly distinct trends across markets.

Take India, for instance, where cricket reigns supreme.

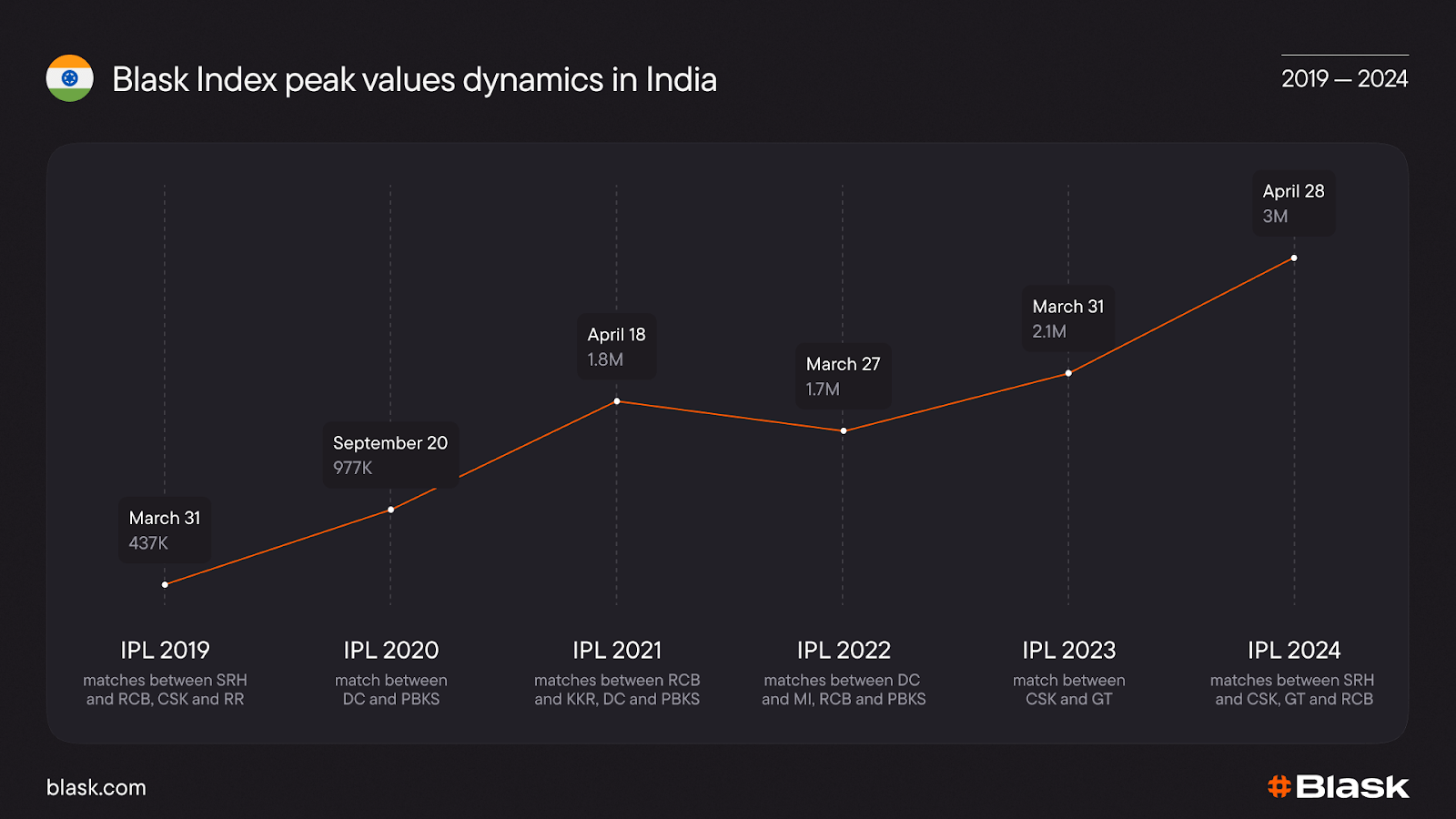

Over five years, IPL-related betting interest has skyrocketed, with the Blask Index growing from 437,000 in 2019 to an astounding 3 million in 2024, with a record-breaking 6 million anticipated for 2025.

These spikes aren't limited to season openers or finals; mid-tournament matchups involving popular franchises often attract the most activity.

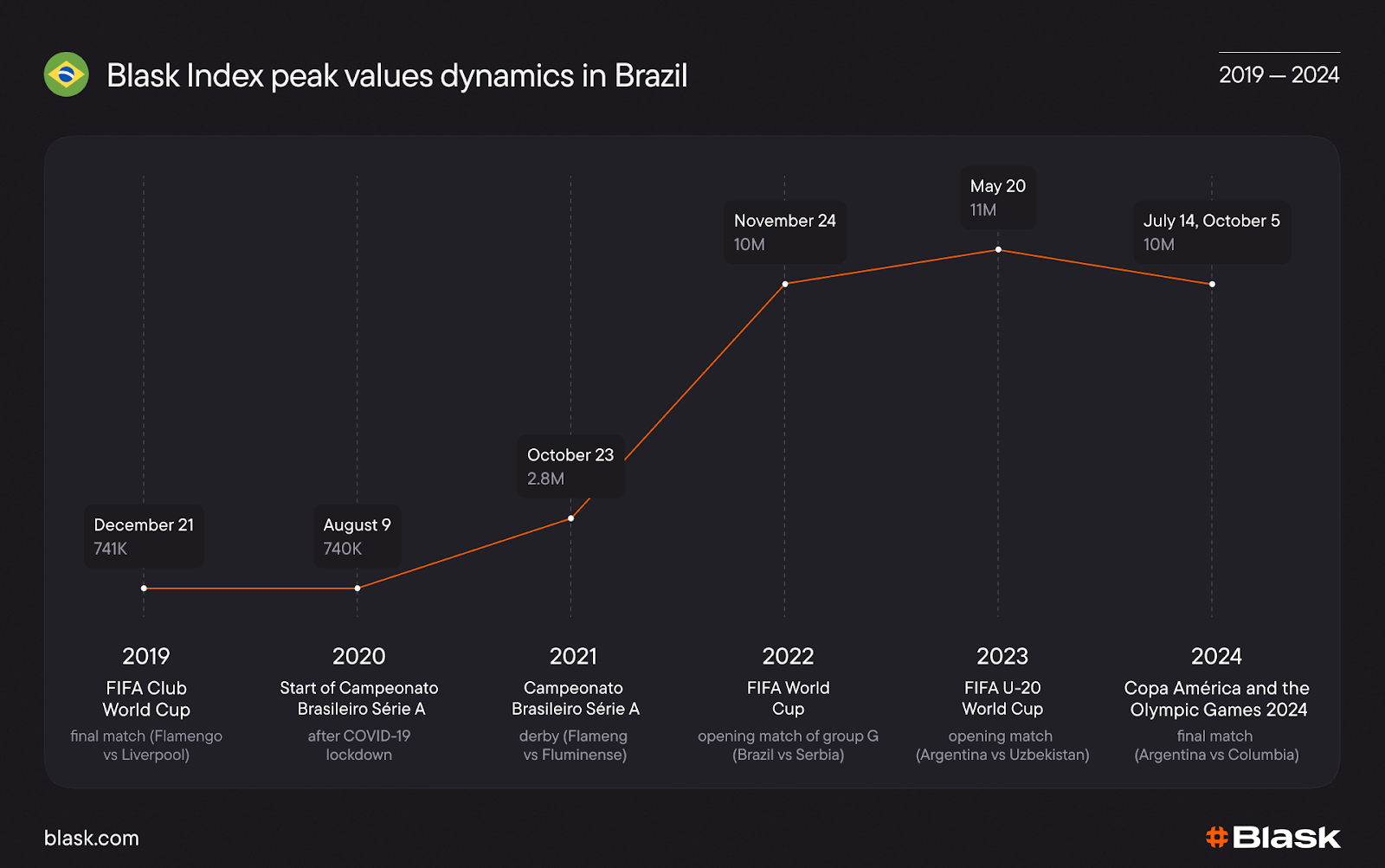

In Brazil, football dominates, but the picture is more diverse.

Peaks in betting interest are linked to both international and domestic tournaments, such as the World Cup, Copa América, and Campeonato Brasileiro.

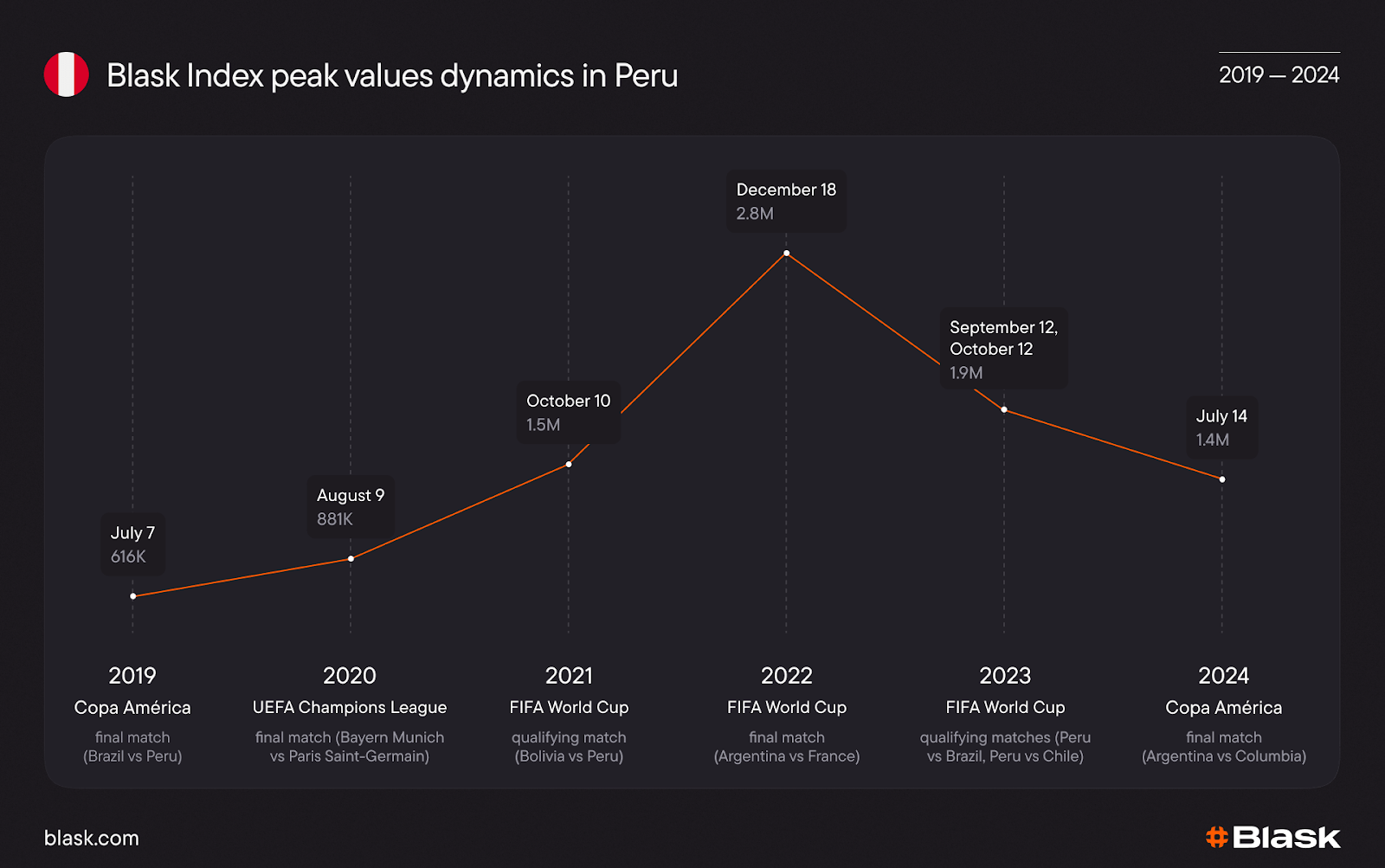

Meanwhile, Peru highlights the importance of national pride. Betting spikes often coincide with the national team’s World Cup qualifiers or Copa América games.

Surprisingly, even global events without local involvement—like the 2022 World Cup final between Argentina and France—can attract significant Peruvian interest, showcasing how global football resonates deeply across the region.

The ability to identify and anticipate these patterns enables operators to tailor their strategies effectively. Blask allows brands to pinpoint specific events that drive engagement and optimize their campaigns accordingly.

Whether it’s capitalizing on Brazil’s love for football, India’s cricket frenzy, or Peru’s loyalty to their national team, understanding these nuances ensures not just participation but dominance in regional markets.

A/B testing: refining strategies for regional markets

The iGaming industry's complexity requires constant experimentation to determine what resonates with local audiences.

A/B testing is a powerful tool for tailoring marketing campaigns, game offerings, and user experiences to specific markets. By testing variables—such as bonus structures, game themes, or promotional timing—operators can uncover what drives player engagement in each region.

Consider this: one campaign offers a weekend cashback bonus, while another promotes free spins tied to a local holiday.

By tracking player responses, operators can pinpoint which offer generates higher deposits or retention rates.

Platforms like Blask further streamline this process by providing granular data on market performance and player demographics, allowing for precise targeting and rapid iteration.

With the right data and tools, iGaming operators can navigate regional complexities, craft tailored experiences, and maintain a competitive edge in diverse markets.

The key is not just gathering data, but transforming it into actionable insights that drive smarter decisions.

Takeaways: winning in iGaming’s regional markets

- Localization is non-negotiable

A one-size-fits-all approach doesn't work in iGaming. Success lies in tailoring offers, payment systems, and user experiences to meet the cultural and economic nuances of each market. - Understand regional preferences

Players’ behaviors are shaped by their environment: cricket drives betting in India, football dominates Brazil, and Peru’s players rally around national pride during major tournaments. Identifying these patterns is key to engagement. - Leverage local payment systems

Seamless payment experiences foster trust. Prioritize region-specific options like PIX in Brazil, UPI in India, and mobile money platforms in South Africa, while ensuring currency displays match local expectations. - Adapt marketing to cultural contexts

Marketing that reflects local language, traditions, and visual cues establishes trust and deeper connections. From football-themed bonuses in Brazil to IPL promotions in India, relevance enhances retention. - Regulations require precision

Navigating diverse regulatory frameworks is critical. Tools like Blask Market Overview help operators comply with local laws while assessing market potential, avoiding pitfalls, and maintaining player trust. - Data-driven insights are essential

Granular analytics uncover event-driven spikes and long-term trends. Whether optimizing for IPL betting surges in India or capitalizing on World Cup fever in Brazil, data transforms strategies into measurable success. - Experimentation drives results

A/B testing allows operators to refine campaigns and game features, ensuring alignment with regional preferences. Iterative experimentation backed by real-time analytics enables smarter decisions and sustained growth.