The iGaming landscape is a dynamic, fast-moving space—one where opportunities can be as vast as they are fleeting. But 2025 brings new challenges and questions that operators need to consider when evaluating where next to plant their flag.

From shifting regulations to evolving player behaviors, expanding your iGaming brand into a new market requires more than just market research — it demands a nuanced, data-driven approach to make the right decision. With the global iGaming market poised for continued growth, projected to reach a $159 billion valuation by 2025, operators must prioritize thoughtful market selection if they are to capture their fair share of this growing pie.

The growing appeal of market expansion in 2025

The expansion of iGaming into new geographies has been a common thread for operators looking to diversify their market risk and grow their brand beyond saturated regions. As traditional markets in Europe, North America, and Oceania become increasingly competitive, new markets are emerging in regions that have previously been considered secondary.

Yet, entering these markets isn't a simple matter of opening shop and waiting for the profits to roll in. In fact, some markets may appear promising at first glance but turn out to be more complicated or volatile than expected.

Consider India, a massive market with a growing appetite for online gaming, but one that is still navigating complex legal and cultural hurdles. Or Brazil, a country that has made significant strides in legalizing online gambling, but whose regulatory framework still remains in flux.

Navigating the ever-shifting sands of global iGaming requires a thorough understanding of the underlying dynamics at play. So, before you dive headfirst into a new market, here are the core factors to evaluate when choosing the right market for your iGaming brand.

1. Regulatory landscape: a minefield or a pathway?

If there’s one factor that can make or break an iGaming expansion, it’s regulation. The iGaming regulatory landscape has always been in flux, with governments scrambling to catch up to the rapidly growing industry, often adjusting their approach to online gambling at a breakneck pace. But in 2025, regulators are stepping up their game, becoming more rigorous with compliance enforcement and regulatory frameworks.

Take Europe as an example.

While many of the region’s markets are well-regulated and offer a relatively predictable environment, regulatory differences across jurisdictions can complicate cross-border expansion. Countries like the UK, Malta, and Sweden boast some of the most robust regulatory structures, offering clarity and security for operators. But other jurisdictions, such as Germany or the Netherlands, are more complex. Germany's fragmented market, for instance, has made it challenging for operators to expand without navigating a confusing web of federal and state laws.

And while Europe has established its regulatory backbone, the US is only just beginning to mature as a market. The repeal of PASPA in 2018 opened the floodgates to sports betting across multiple states, but each state retains the power to implement its own set of rules. That means an operator must adapt to a patchwork of state-specific licensing and compliance requirements.

But it’s not just the U.S. that presents a regulatory puzzle. Many Asian and African countries have, until recently, been relatively untapped by iGaming operators due to murky or non-existent legal frameworks. As of 2025, Thailand, Japan, Vietnam, and India are at varying stages of considering or implementing online gambling laws. In some countries, iGaming still resides in a legal grey area, with no clear path to licensing, leaving operators in limbo.

To effectively assess the regulatory environment, operators need to evaluate several key aspects:

- Licensing requirements: How difficult is it to obtain a license, and what are the fees involved?

- Compliance standards: What measures are in place regarding responsible gaming, anti-money laundering (AML), and data protection?

- Government attitude: How open is the government to foreign operators, and what is the likelihood of legal changes?

2. Understanding player behavior: one size does not fit all

Once you've navigated the regulatory maze, the next hurdle is understanding local player preferences. Player behavior can vary widely across regions, influenced by factors such as culture, economic status, and even technological access. What appeals to European bettors may not necessarily resonate with an audience in South America, and even within a single region, gaming preferences can differ from country to country.

In Europe, players might gravitate toward traditional games like slots, roulette, and poker, while in the Middle East, sports betting has been a major driver of online gaming. Meanwhile, in Africa, mobile gaming has dominated due to higher mobile penetration rates and a lack of access to desktop-based internet connections.

Latin America, with its growing mobile-first audience, offers a fertile ground for operators that can adapt their offerings. Popular games in Brazil and Argentina often center around sports betting (especially football), whereas in Mexico, there's a greater preference for live dealer games and online poker.

Based on the Blask Customer Profile analytics, we can see clear differences in player preferences between India and Brazil:

- In India, Poker or Rummy is the most popular product, used by 50% of players, followed closely by traditional sports betting at 70%.

- Esports are less popular, with only 15% engagement.

- In contrast, Mexico shows a higher interest in Live casino at 50%, while traditional sports betting remains the top choice at 60%.

Economic conditions also play a significant role in determining the kind of games and wagering amounts players are willing to engage with. For instance, in high-GDP regions like Australia and the UK, players may be more inclined to place larger bets on a broader variety of games. Conversely, in emerging markets, where disposable income may be more limited, the focus could shift to low-minimum stakes, promotions, and more localized payment methods.

3. Economic factors: purchasing power, GDP, and growth potential

The economic viability of a new geo plays a crucial role in determining whether your iGaming expansion will succeed. Simply put, an iGaming market isn’t sustainable if players can’t afford to gamble—or if economic instability makes the market too risky.

Markets in Western Europe and North America generally offer higher purchasing power, meaning players are more likely to spend on both high-stakes betting and premium gaming experiences. However, these markets are also saturated, and competition is fierce.

Emerging markets, on the other hand, may offer massive untapped potential, but come with the trade-off of lower purchasing power and a more volatile economic environment. Markets like Brazil, India, and South Africa have seen an explosion in the number of iGaming players, driven by expanding middle classes and increasing internet penetration. The Indian market, in particular, offers significant potential with its 1.4 billion population, but the purchasing power remains relatively low compared to Western countries.

4. Competition and market saturation: is there room for another player?

Before diving into any market, it’s essential to assess the level of competition. Established markets may seem like the obvious choice due to their large, mature player base, but they often come with steep competition and the risk of market saturation.

In North America, for example, the post-PASPA sports betting boom has led to intense competition among major operators, which could make it harder for newcomers to gain a foothold. Similarly, in the UK, while the market is well-established and regulatory certainty is a huge advantage, the competition is fierce, and profitability margins are thin.

Emerging markets, however, may offer a first-mover advantage if they’re still in the early stages of development. In markets like Tanzania, Nigeria and Cameroon, the lack of established competitors could provide significant opportunities for operators willing to invest in the right local partnerships, marketing, and customer support.

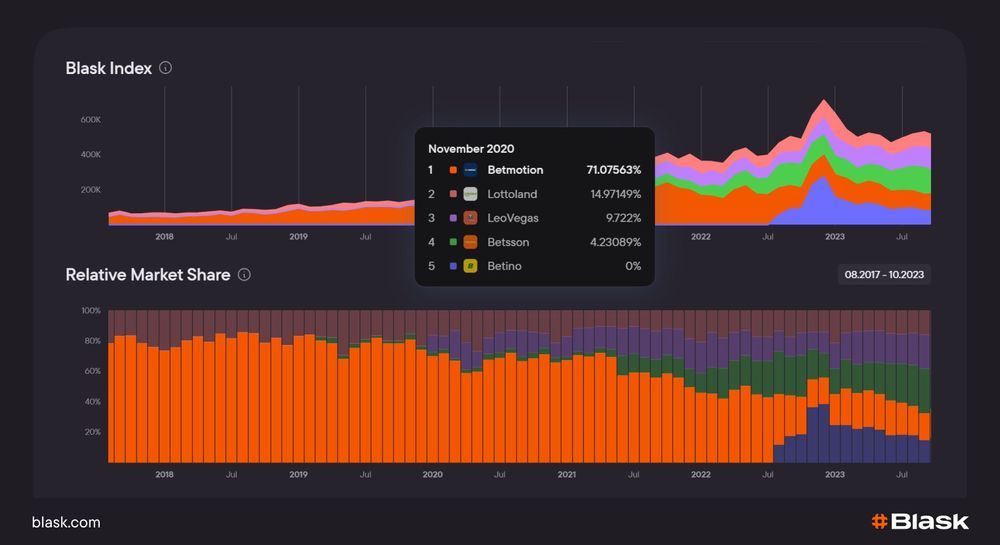

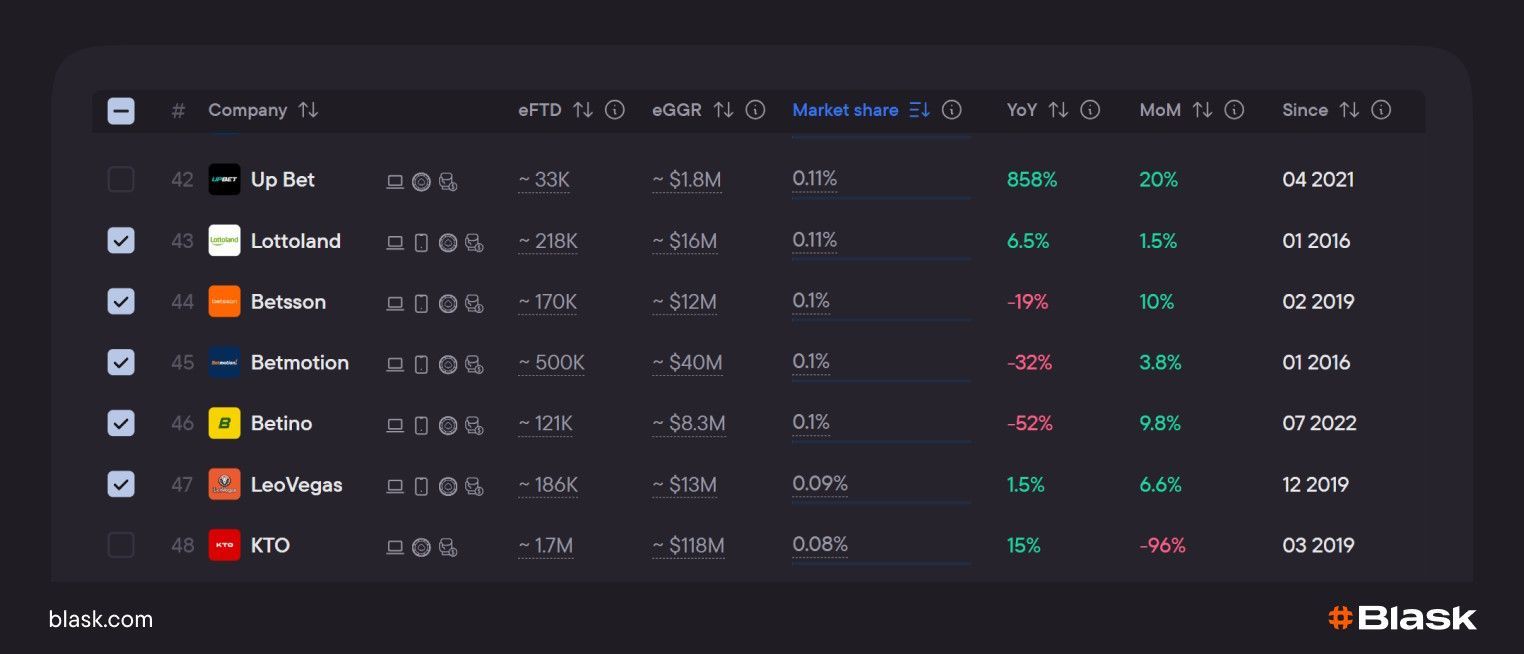

By leveraging Blask, operators can assess market saturation, identify gaps in the competitive landscape, and evaluate the potential for gaining market share.

Blask enables iGaming companies to easily compare countries and markets through its comprehensive data and analytics platform. With Blask, users can access real-time market share data, track competitor performance, and analyze industry trends across multiple countries simultaneously.

5. Local partnerships and affiliates: building trust in new markets

Entering a new market isn’t just about the games and the tech — it’s about relationships. Forming strong local partnerships is one of the quickest and most efficient ways to break into a new market.

Local affiliates and influencers are key to building trust in unfamiliar territories. In markets like Brazil and India, partnering with well-established local affiliates who understand cultural nuances can significantly boost your brand’s credibility. Additionally, local affiliates can drive traffic through region-specific promotions and localized content, creating a strong brand presence.

Check-list: overview of key iGaming markets

Below is a brief overview of some of the most significant iGaming markets around the world:

How AI simplifies market comparison.

Now that we’ve covered the basics, let’s talk about how AI steps in to make your life easier.

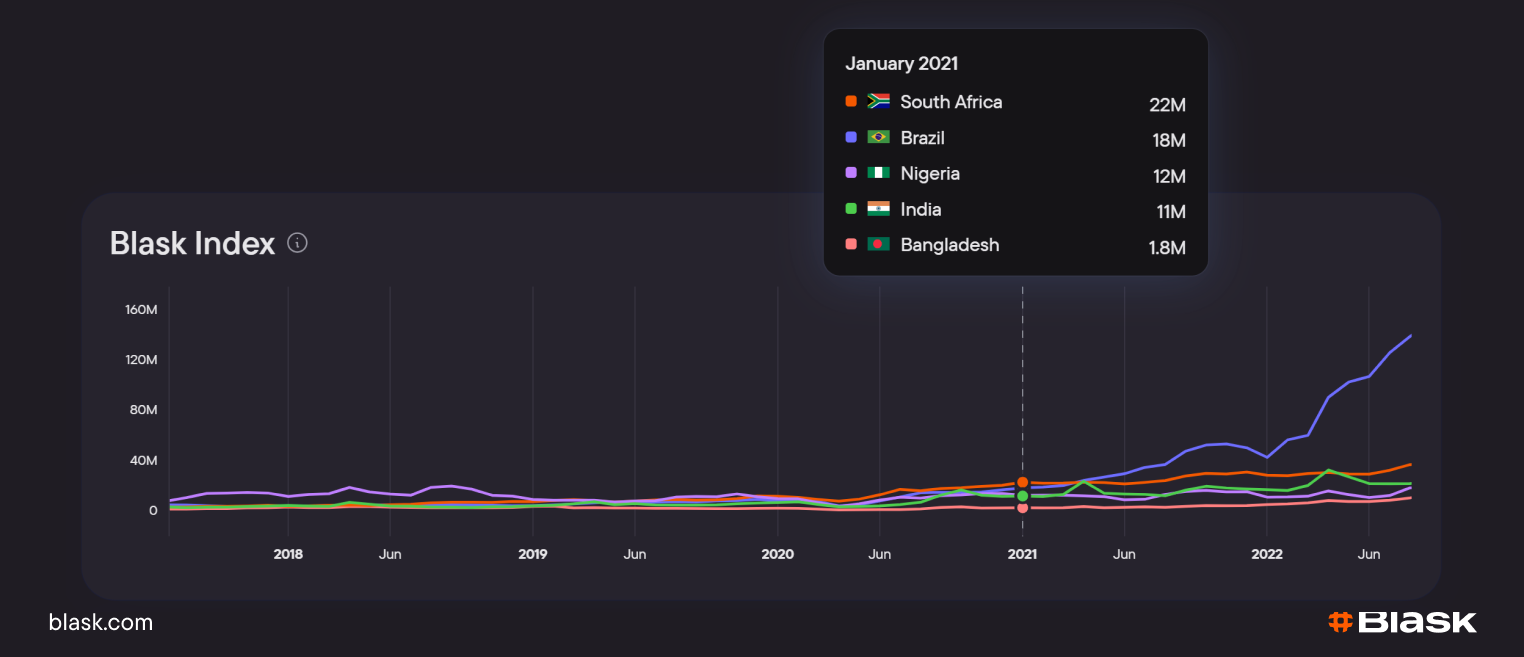

Automated data collection and analysis.

Blask leverages AI models to gather data on all brands in the market and analyze Market Volume for individual countries. This approach allows for a comprehensive view of market dynamics, answering crucial questions like: is the iGaming market in Brazil or Bangladesh growing? How many people in these countries are interested in iGaming? What's the capacity of these markets in terms of estimated First-Time Deposits (eFTD) and estimated Gross Gaming Revenue (eGGR)?

By leveraging such insights, operators can make data-driven decisions, adjust their strategies proactively, and stay ahead in an increasingly competitive landscape. Whether it's identifying emerging threats or capitalizing on market opportunities, AI-powered predictive analytics are becoming indispensable tools for success in the iGaming sector.

Blask tools at work: making market comparison effortless!

Now, let’s talk specifics. Blask offers a suite of tools designed to make comparing iGaming markets not just easy, but downright enjoyable (okay, maybe that's a stretch, but you get the idea).

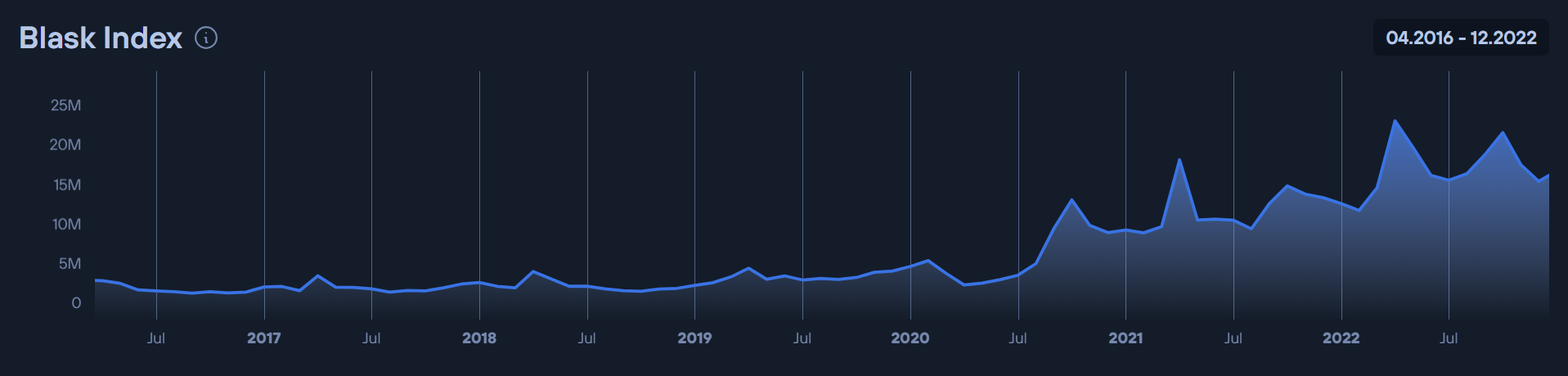

Blask Index.

At the heart of Blask’s offerings is the Blask Index. This metric aggregates market sentiment into a single, easy-to-understand score. Think of it as a snapshot of how the market feels at any given moment. Whether you’re looking at a specific region or comparing global markets, Blask Index gives you an instant overview.

For example, if you’re trying to decide whether to enter a new market, Blask Index can quickly tell you whether the timing is right. It’s like having a market sentiment compass that always points you in the right direction.

In-depth competitor analysis.

Of course, understanding the market is only half the battle. To truly stay ahead, you need to know what your competitors are up to. Blask’s AI tools provide detailed insights into your competitors’ strategies, market share, and growth patterns.

Want to know why a competitor is suddenly gaining ground in a particular market? Blask can tell you. Curious about which marketing strategies are driving the most first-time deposits for your rivals? Blask has you covered. This level of insight allows you to not only react to competitor moves but also anticipate them.

Conclusion: choosing the right market — a data-driven strategy for 2025

In 2025, the iGaming industry is poised for tremendous growth, but choosing the right geo for expansion requires a strategic, data-driven approach. Navigating the complex regulatory landscape, understanding local player preferences, evaluating economic stability, assessing competition, and forming key partnerships are all essential elements in this decision-making process.

By utilizing powerful analytics tools like Blask and staying informed with the latest market insights, iGaming operators can confidently enter new geographies, avoid costly missteps, and position themselves for success in the global market. While no market is without its challenges, those who approach geo expansion with a careful, informed strategy will be best positioned to capitalize on the immense opportunities ahead.

Unlock your iGaming potential with Blask!

Blask empowers you to make data-driven decisions, optimize marketing strategies, and drive significant GGR increases by providing unparalleled clarity about the iGaming market and your performance.

Curious about our precision? Discover our article "What is Blask?" and how Blask's cutting-edge technology is transforming iGaming analytics.

Ready to experience Blask in action?

Request a personalized demo with full access to data tailored to your niche and objectives. Fill out the form at blask.com to help us prepare use cases specific to your needs.

Need assistance?

Our support team is always here to help. Click the chat icon in the bottom right corner of your screen to connect with us instantly and get the answers you need.