The defining events that shaped iGaming in 2024

2024 transformed iGaming with Olympic highs, cricket fever, and regulatory shifts. From Brazil's market strides to Ecuador's tax challenges, bold strategies and key moments shaped the industry’s future. Discover the wins, missteps, and trends that defined a groundbreaking year

2024 turned out to be a wild ride for the iGaming industry. From the Olympic spotlight in Paris to the cricket-fueled madness of the ICC T20 World Cup, it felt like there was always something big happening. But it wasn’t just about the games. New regulations in places like Brazil shook things up, while smaller markets found their own ways to shine.

This was a year of bold moves and creative strategies. Some operators hit the jackpot by tapping into local pride, while others stumbled trying to navigate shifting rules. The result? A fascinating mix of growth, challenges, and lessons that will shape the future of the industry.

In this piece, we’ll break down the key moments from 2024—the wins, the missteps, and everything in between. Buckle up, because it’s been a year like no other. Let’s dive in.

The Olympic effect on iGaming.

The Paris 2024 Olympics brought a fresh perspective to the iGaming industry. Traditionally overlooked as a betting event, the Games this year showed that when approached smartly, even fragmented competitions could offer huge opportunities.

How the Netherlands turned Olympic wins into betting spikes.

In the Netherlands, a record 34 Olympic medals sparked betting spikes. On August 3, when the country brought home five medals, engagement shot past the levels seen during the Euro 2024 final. For Dutch operators, the message was clear: national pride sells.

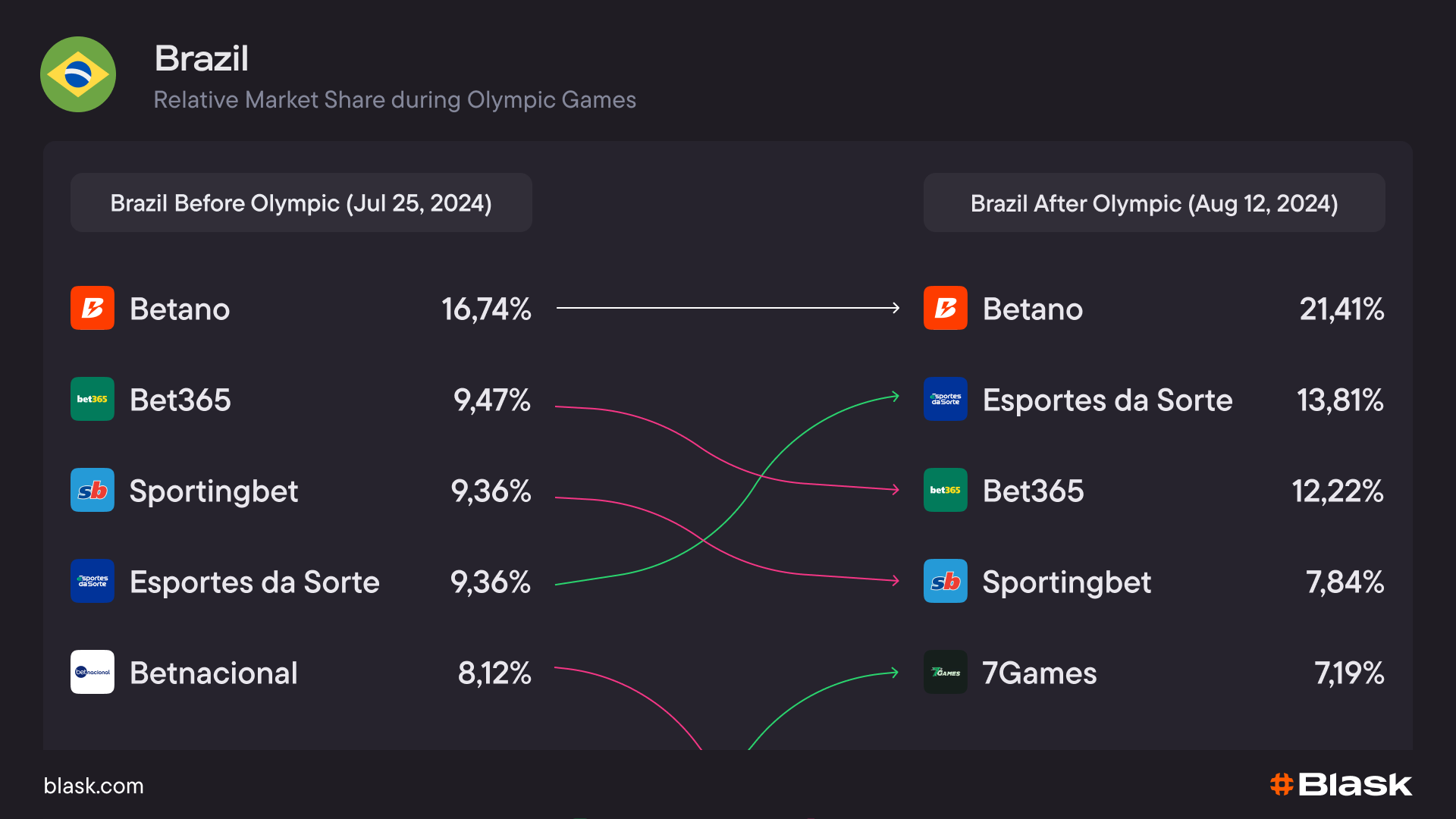

Brazil’s Olympic sponsorship strategy paid off big.

Brazil saw a different kind of win. Esportes da Sorte used strategic sponsorships, including collaborations with famous athletes and CazéTV, to grab market share. Their gamble paid off, with a jump from 9% to 14% in just 17 days.

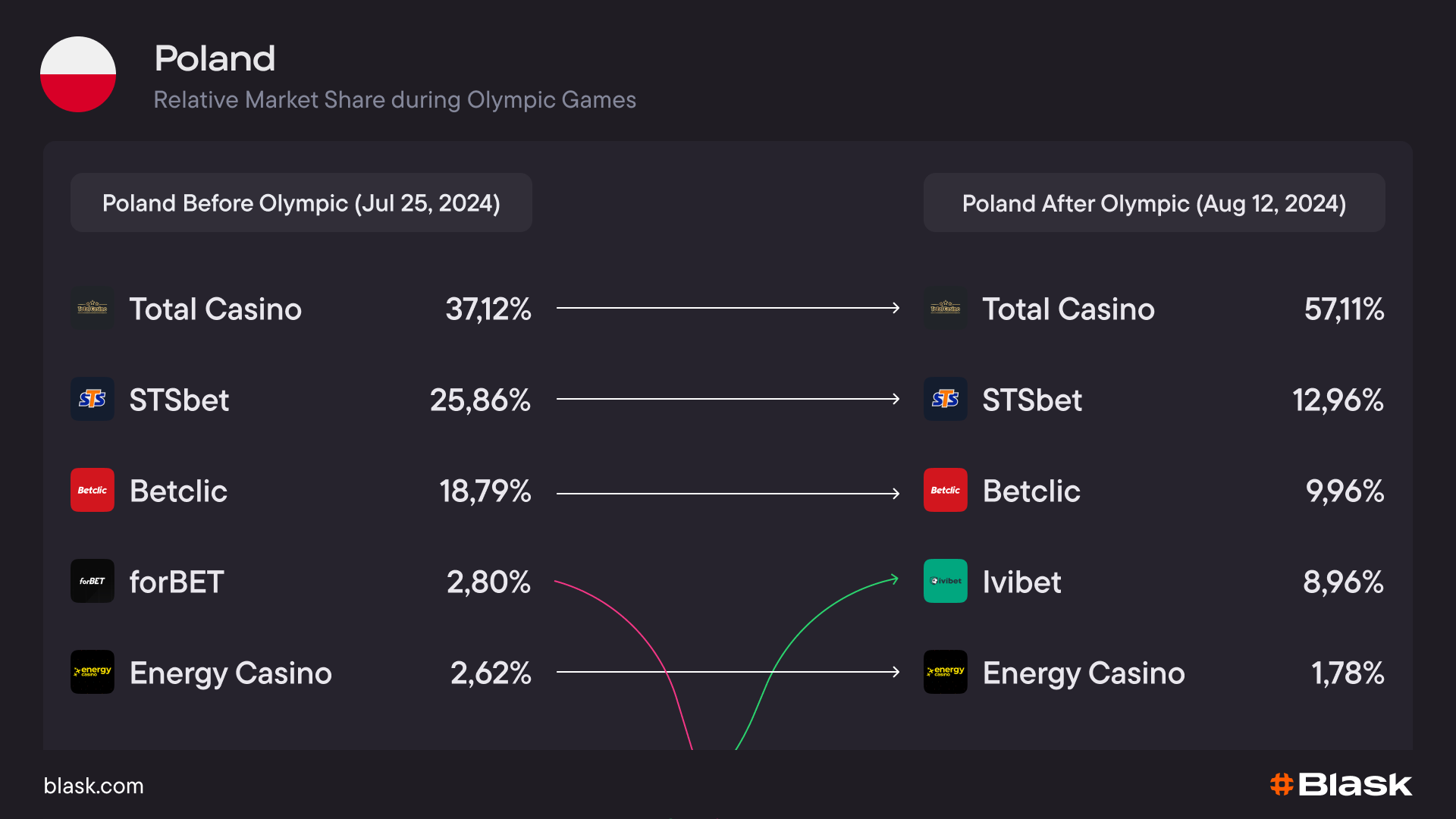

Poland’s winning formula for Olympic betting success.

Poland played its cards right too. Totalizator Sportowy’s deep connection to its Olympic team drove market share from 37% to a dominant 57%. Days with medal wins, especially speed climber Aleksandra Mirosław’s gold, saw the biggest spikes in engagement.

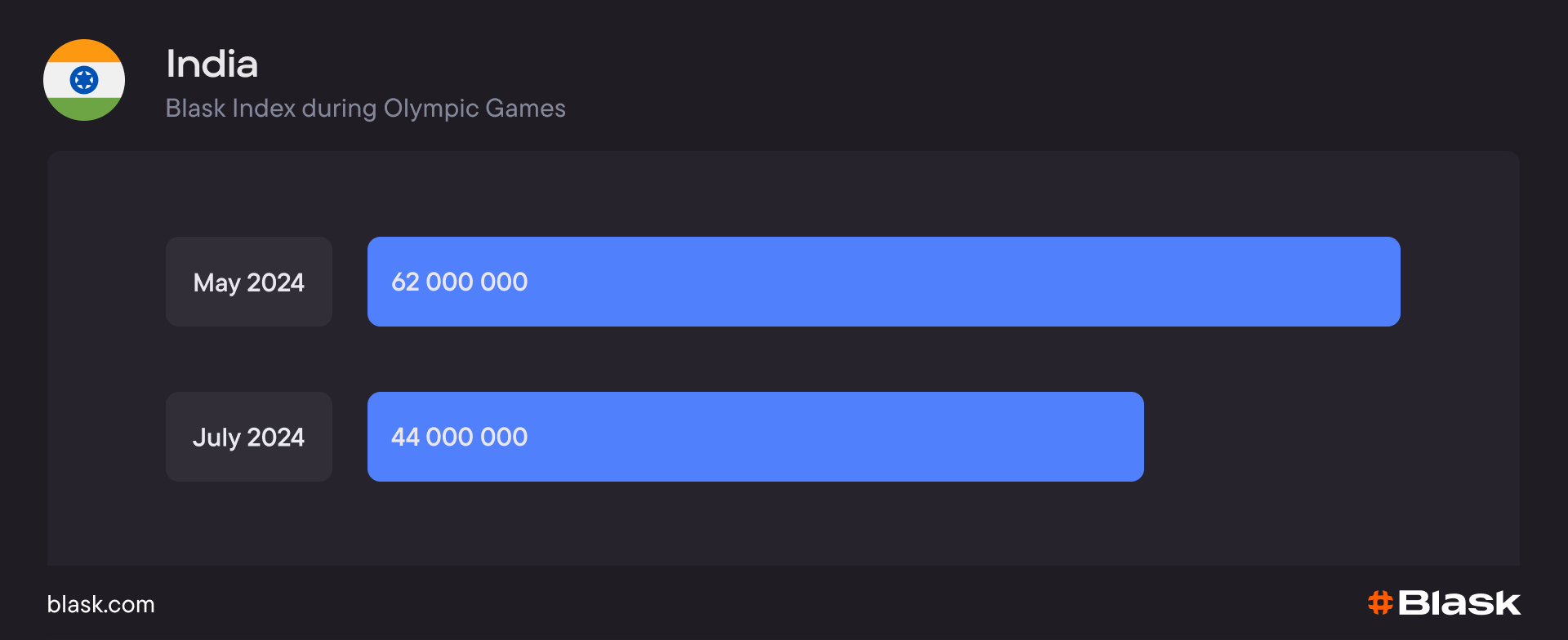

Why the Olympics missed the mark in Argentina and India.

Argentina and India told a different story. Argentina’s betting interest stayed glued to football, with the Copa America overshadowing the Olympics entirely. Meanwhile, India’s weak Olympic showing couldn’t compete with cricket’s ongoing grip on the market. For these countries, the Games were a blip, not a boom.

Cricket betting soars during the ICC T20 World Cup.

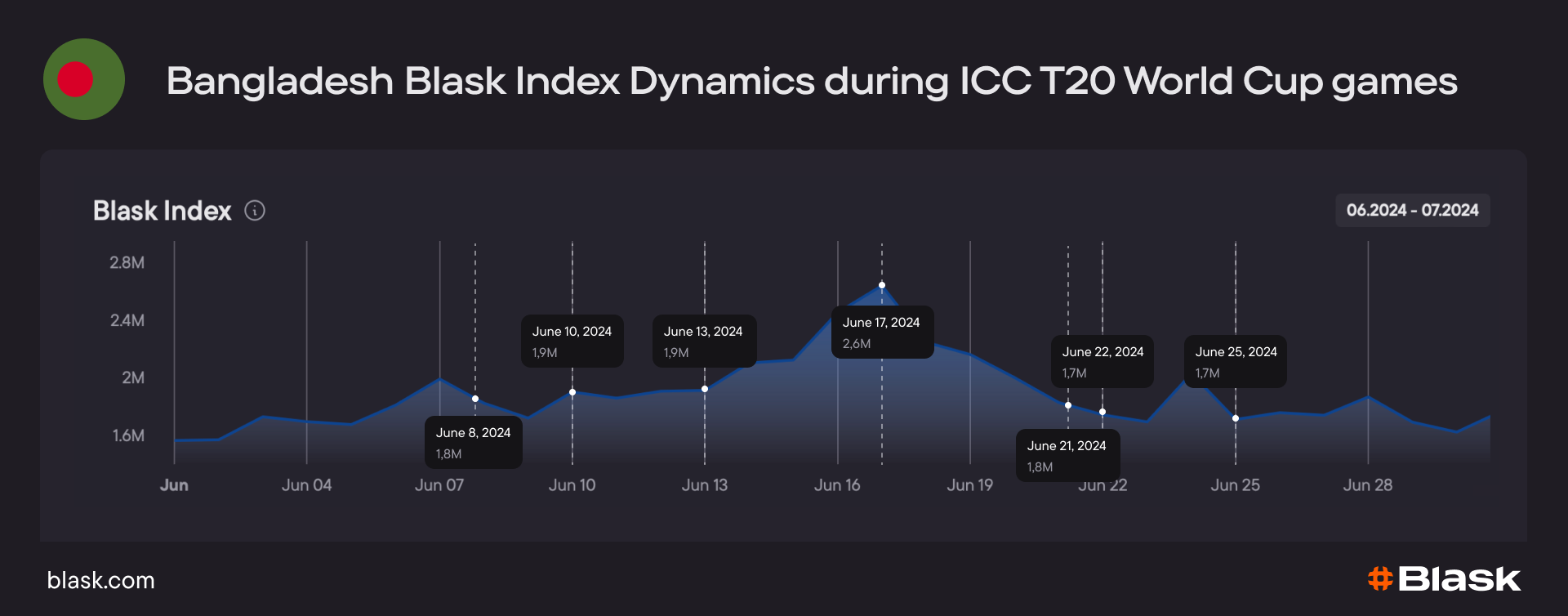

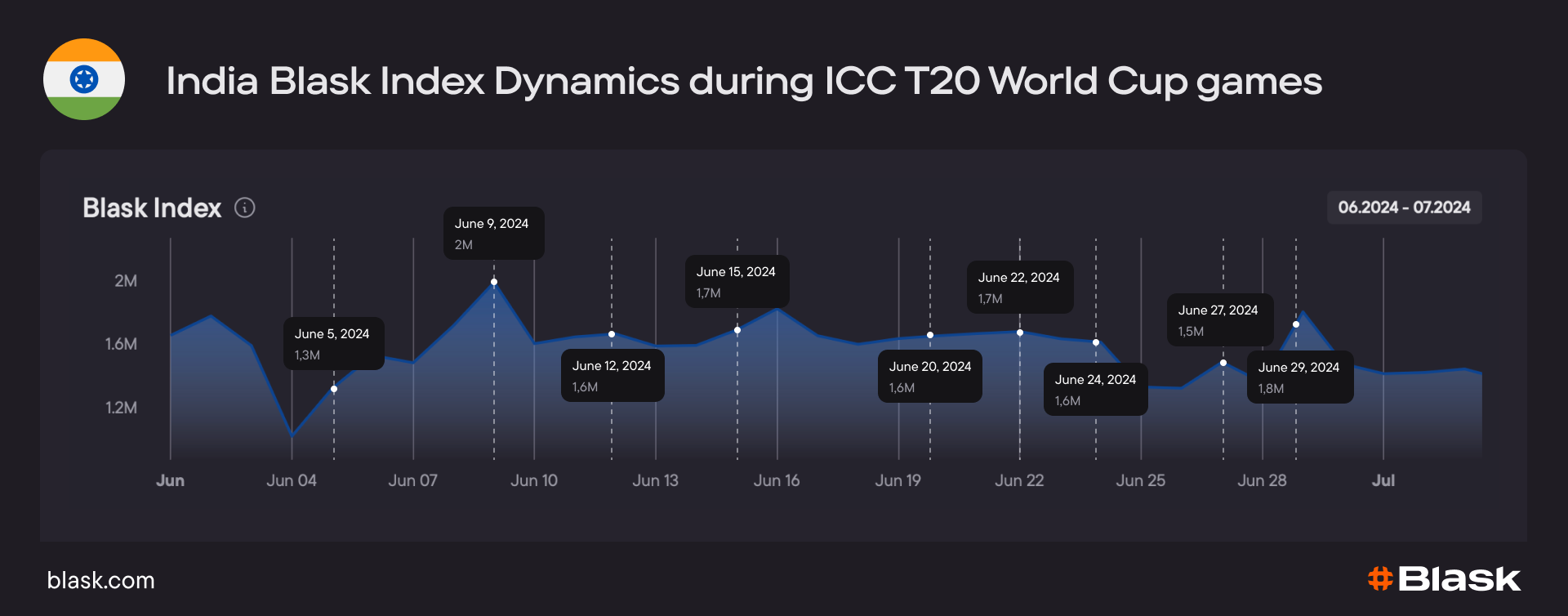

The India-Bangladesh Super Eight match on June 22 was a standout moment. Both nations recorded 1.7 million in betting activity on Blask Index, showcasing the intensity of the rivalry. However, the dynamics of their markets are worlds apart. Bangladesh remains fragmented, with operators like JeetBuzz and Baji sharing the lead. Meanwhile, India’s market is firmly dominated by Stake, which consistently holds over 30% of the Relative market share.

Bangladesh betting hits new heights.

The ICC T20 World Cup lit up betting markets in Bangladesh, especially during the team’s strong early performance. Wins against Sri Lanka, the Netherlands, and Nepal fueled massive interest, peaking at 2.6 million on Blask Index during the Nepal match. But the excitement faded as Bangladesh exited in the Super Eights, with activity settling at around 1.7 million. Despite the ups and downs, the country generated $133 million in Gross Gaming Revenue (eGGR) from 1.7 million First-Time Depositors (eFTDs) in June.

India betting fever reaches its peak.

India, on the other hand, kept fans and bettors hooked throughout their unbeaten run to the final. Matches like the clash with Pakistan on June 9 spiked Blask Index to 2 million, the highest of the tournament. Even the final against South Africa saw 1.8 million active bettors. By the end of June, India’s cricket betting market had raked in $191 million in eGGR from 1.6 million eFTDs, proving cricket’s unmatched dominance in the region.

Regulatory developments and market dynamics.

2024 wasn’t just about the games—it was also a year of regulatory shake-ups that redefined how operators approached the iGaming industry. From Brazil’s steady march toward regulation to Ecuador’s game-changing tax policy, governments played a central role in shaping market strategies. Let’s break it down.

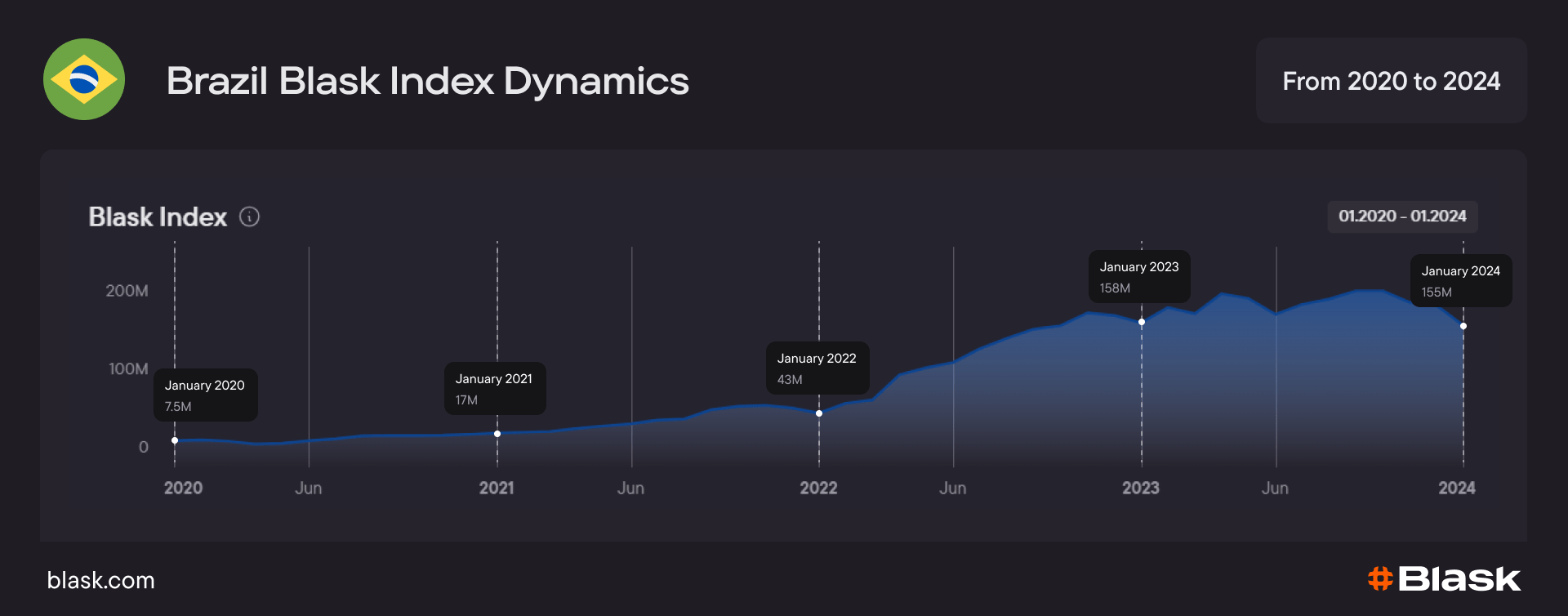

Brazil’s path to a regulated iGaming market.

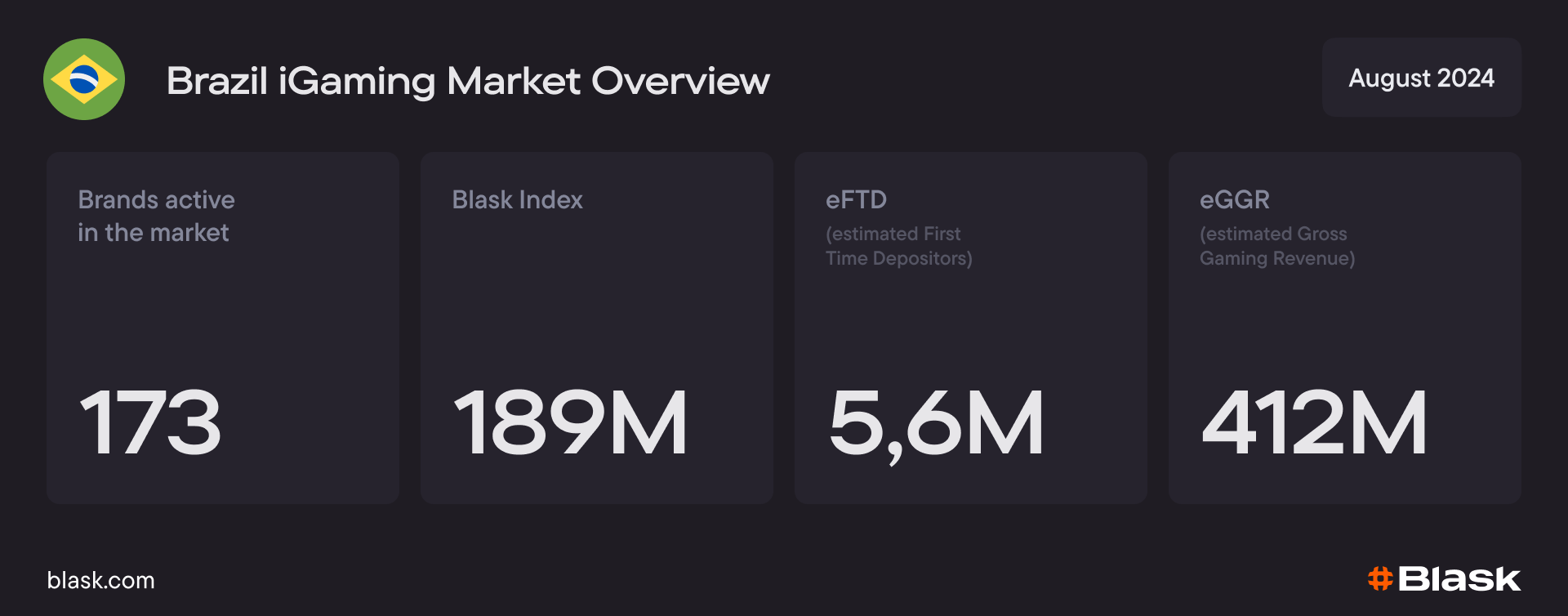

Brazil spent the year laying the groundwork for its long-anticipated regulated iGaming market, and the journey wasn’t without its twists. In a multi-stage process that stretched across 2024, the country’s Ministry of Finance introduced clear guidelines, culminating in a licensing application deadline on August 20.

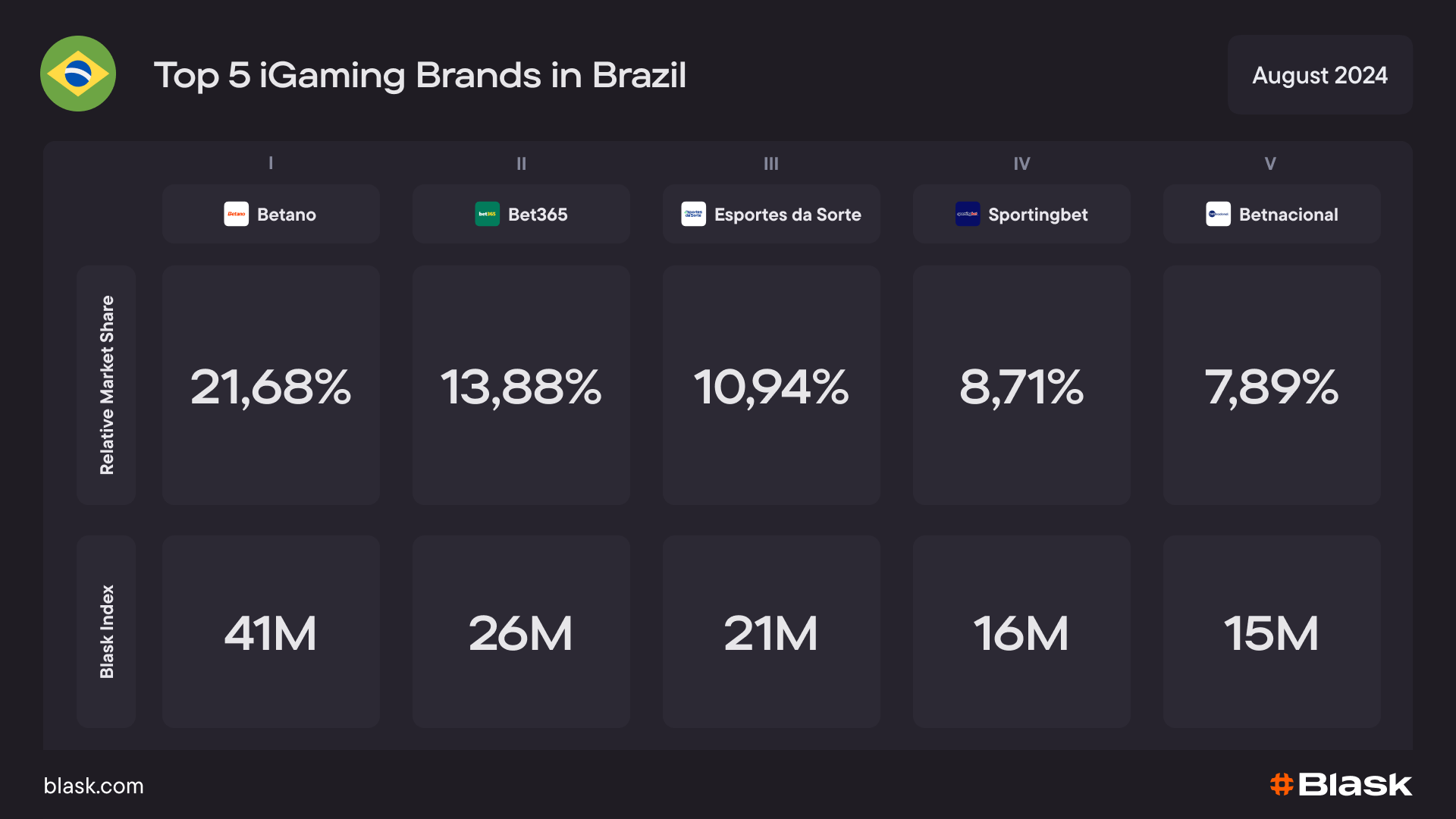

A whopping 113 operators submitted applications for federal licenses, proving just how attractive Brazil’s market is, despite its challenges. Market activity mirrored the regulatory timeline. After a slump in February—linked to political uncertainty—operators rallied, with Blask Index climbing to 189 million by August. Leading brands like Esportes da Sorte seized the moment, leveraging aggressive marketing campaigns to grow their market share.

For smaller operators, the high licensing fees and strict compliance requirements were daunting. Many found themselves struggling to keep up in an environment favoring well-resourced competitors. By the end of the year, the stage was set for a highly competitive market launch in 2025.

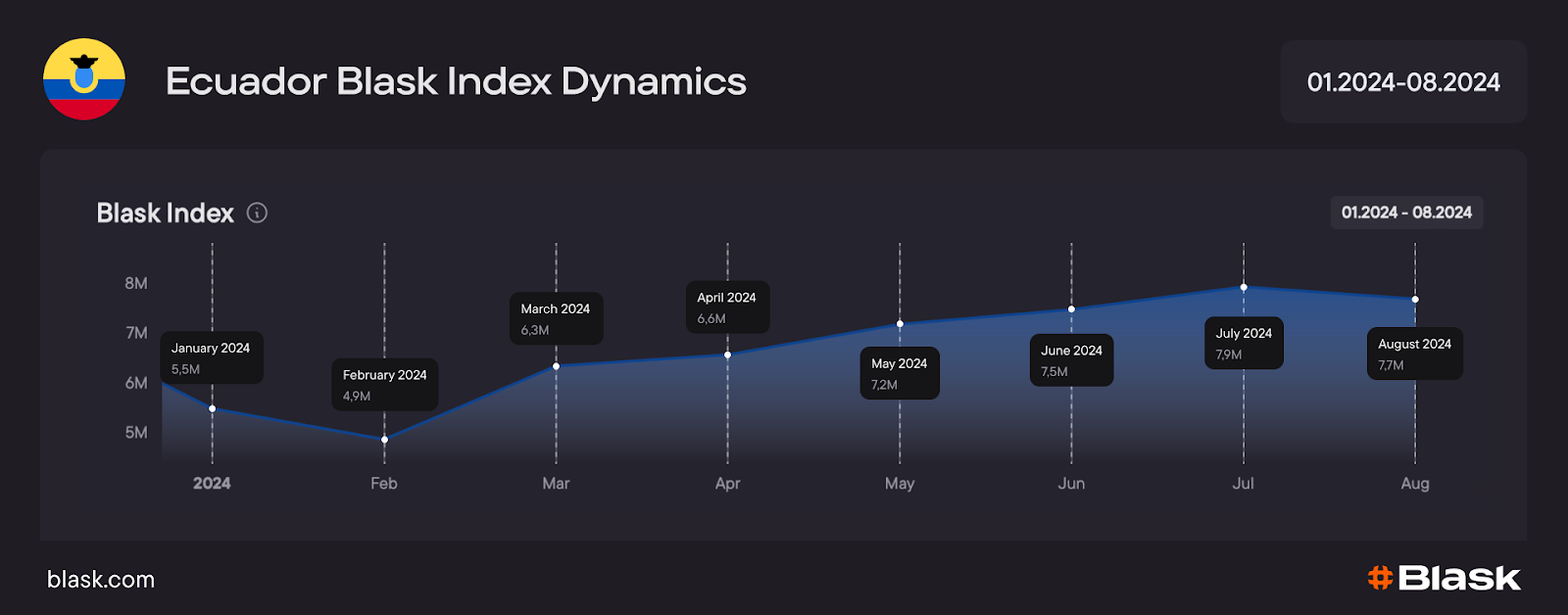

Ecuador’s new tax law disrupts the game.

In September, Ecuador flipped the script on its iGaming market with the introduction of a 15% tax on Gross Gaming Revenue (GGR). While the policy aimed to boost government revenue, it sent shockwaves through the industry, forcing operators to rethink their strategies almost overnight.

The immediate effect was a divide between large, established operators and smaller, regional players. Big brands with deep pockets adapted by doubling down on high-margin games and premium offerings, protecting their bottom lines. Smaller operators, however, found it hard to absorb the tax, leading to closures and consolidation across the market.

Players didn’t escape the ripple effects, either. To offset the tax, many operators introduced tighter payout rates and reduced bonuses, making the games less appealing to bettors. While this strategy kept businesses afloat, it risked pushing players toward unregulated platforms with better odds and incentives.

Ecuador’s tax policy underscored the fragility of emerging markets facing sudden regulatory changes. For operators still active in the country, 2024 became a year of trial and error. Brands that found success leaned into more sophisticated retention strategies, like loyalty programs and exclusive events, to keep their player base engaged despite the less favorable environment.

Looking ahead, Ecuador’s experience serves as a cautionary tale for other governments considering similar taxation models. Striking a balance between regulation and market sustainability will be critical to ensuring long-term growth.

Regional highlights and unique trends.

2024 was a year where regional dynamics in iGaming became increasingly prominent. Across continents, local heroes, national pride, and cultural preferences played a critical role in shaping betting behaviors.

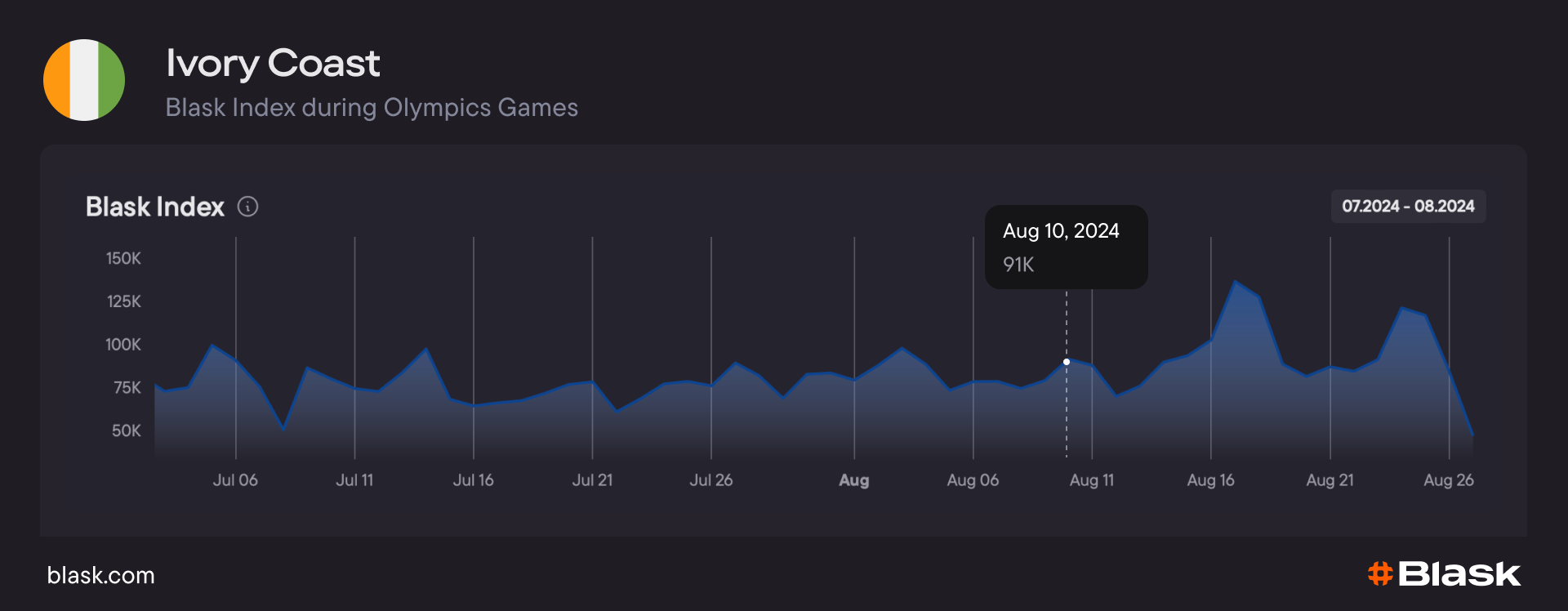

Betting on local heroes in Africa.

In the Ivory Coast, a single bronze medal at the Olympics demonstrated the power of individual athletes to move markets. Cheick Sallah Cissé, a taekwondo champion and national hero, reignited betting activity in his country on the penultimate day of the Paris Games. Engagement surged by 15% as fans placed bets not just for monetary gain but to celebrate a symbol of national pride.

This highlights an emerging trend in smaller markets: operators can benefit by focusing on individual athletes and culturally resonant events, rather than waiting for broader market opportunities.

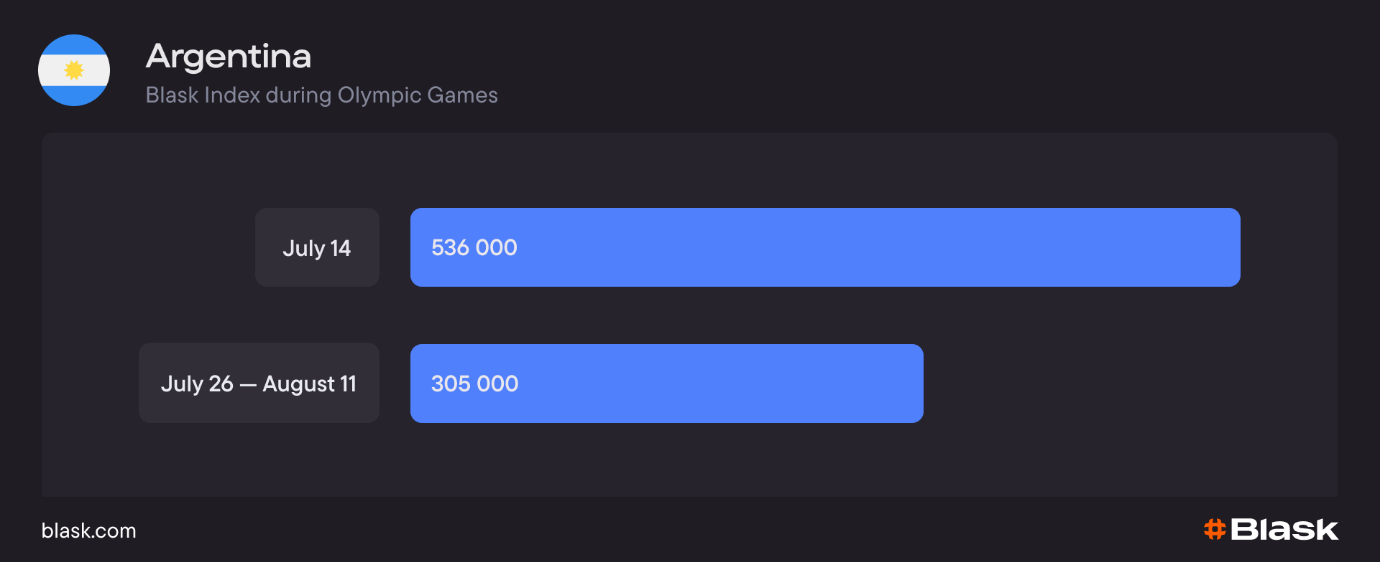

Argentina loves football.

While Brazil dominated the headlines with its regulatory evolution, Argentina offered a strikingly different picture. Despite participating in the Paris Olympics, the nation’s betting focus remained firmly on football.

The final of the Copa America in July saw Blask Index soar to 536,000, eclipsing any Olympic-related activity. Argentina’s performance at the Games—a single gold medal and an overall rank of 52nd—failed to capture the imagination of bettors, who prioritized football over all else.

The game-changer year.

2024 wasn’t just another chapter in the iGaming industry—it was a full-blown rewrite of the playbook. From the Olympic highs in Paris to cricket fever in South Asia, this was a year where local heroes, cultural passions, and regulatory shifts pushed the industry into new territory. Markets like Brazil embraced regulation, Ecuador tested the limits of sudden taxation, and smaller players, like the Ivory Coast, showed how even one athlete can move the needle.

The lesson? In this rapidly evolving landscape, waiting for annual reports or monthly updates isn’t enough. The iGaming industry moves fast, and success belongs to those who can track trends and respond in real time. That’s where Blask changes the game. With tools like real-time data updates and detailed customer insights, you don’t just react—you stay ahead.

Why wait for someone else to interpret the big moments when you can see them unfold? Blask empowers you to track everything—hourly spikes, daily trends, and long-term shifts—right when they happen. Whether it’s a sudden surge in cricket betting during a World Cup match or the first ripple from a new regulation, you’ll already have the data to act decisively.

Here’s how Blask gives you the edge:

- Blask Index: A comprehensive metric to measure market interest, enabling you to monitor the overall popularity of iGaming entertainment and track growth across regions.

- Competitive Earning Baseline (CEB): Updated monthly, this metric provides insights into revenue trends, helping you strategize for maximum profitability.

- Acquisition Power Score (APS): Stay on top of player acquisition trends by tracking the number of new players entering the market.

- Real-time data updates: With hourly insights, you can respond instantly to events like sports finals or regulatory announcements.

- Customer Profile: Dive into player demographics and motivations to tailor your marketing efforts and product offerings.

2024 has proven that the iGaming industry is only getting more dynamic. With Blask, you’re not just playing catch-up—you’re leading the way. Don’t just watch the industry change. Shape it.

Game on, with Blask.

Unlock your iGaming potential with Blask!

Blask empowers you to make data-driven decisions, optimize marketing strategies, and drive significant GGR increases by providing unparalleled clarity about the iGaming market and your performance.

Curious about our precision? Discover our article "What is Blask?" and how Blask's cutting-edge technology is transforming iGaming analytics.

Ready to experience Blask in action?

Request a personalized demo with full access to data tailored to your niche and objectives. Fill out the form at blask.com to help us prepare use cases specific to your needs.

Need assistance?

Our support team is always here to help. Click the chat icon in the bottom right corner of your screen to connect with us instantly and get the answers you need.