Blask reveals the fastest-growing iGaming markets of 2024, showcasing remarkable growth in Rwanda, Malawi, and beyond. Discover key trends, player insights, and market leaders driving the industry’s expansion. Stay ahead with Blask’s real-time analytics and seize early opportunities for success!

The end of the year is a time when everyone reflects on their achievements and sets goals for the future. Here at Blask, we’ve realized that the iGaming industry primarily revolves around money. That’s why we want to share with you the five markets that have experienced the most significant growth in 2024 — markets where you could potentially earn substantial profits early on.

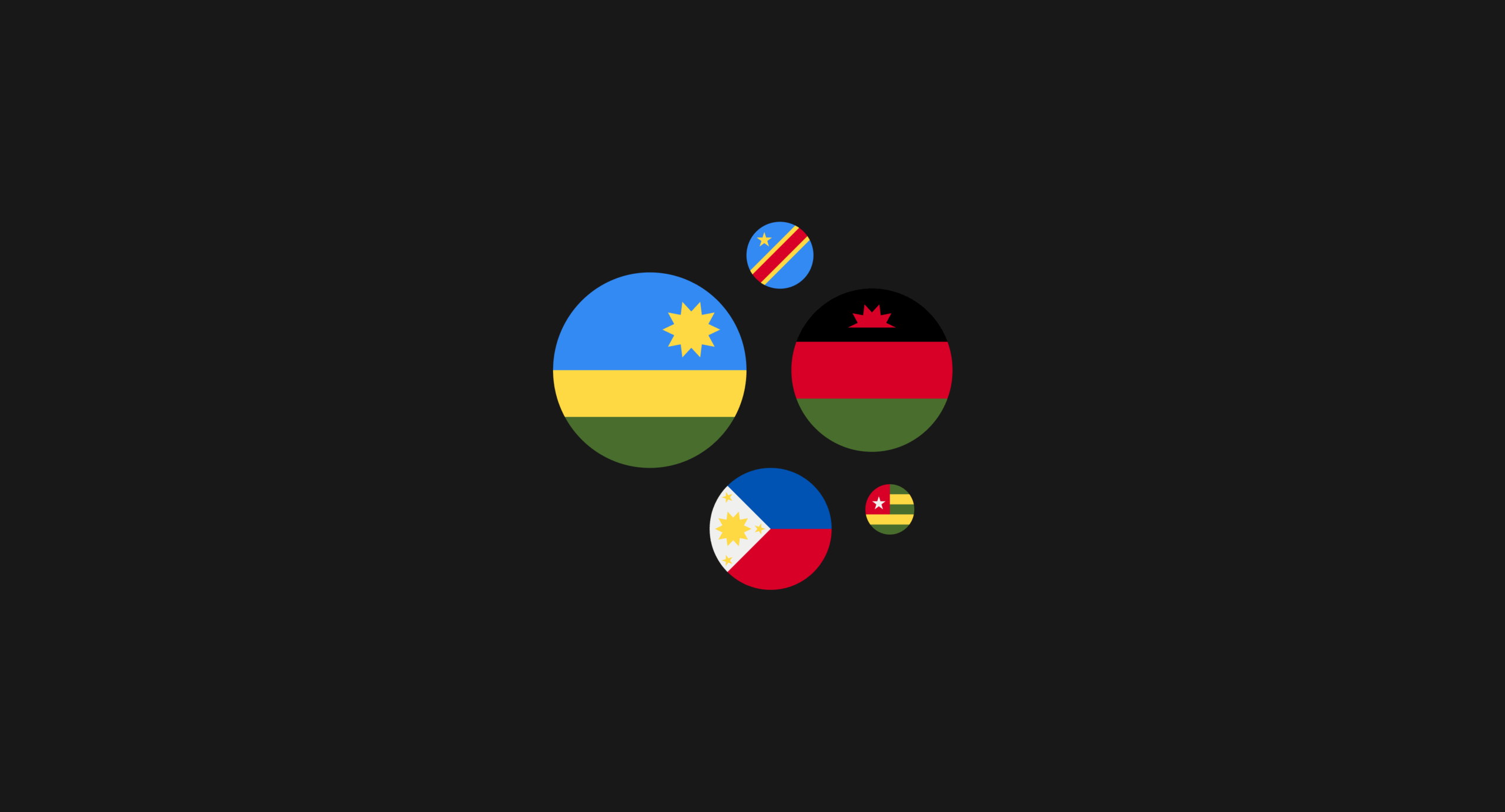

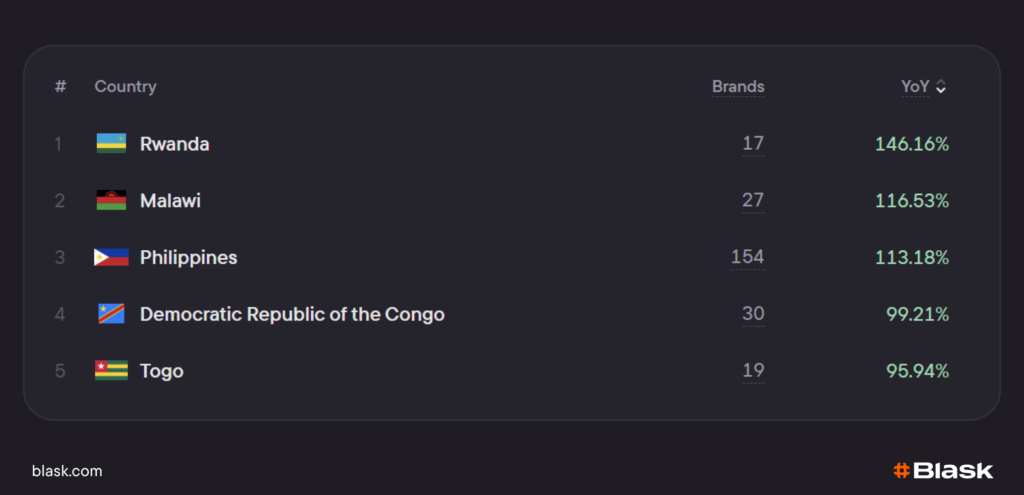

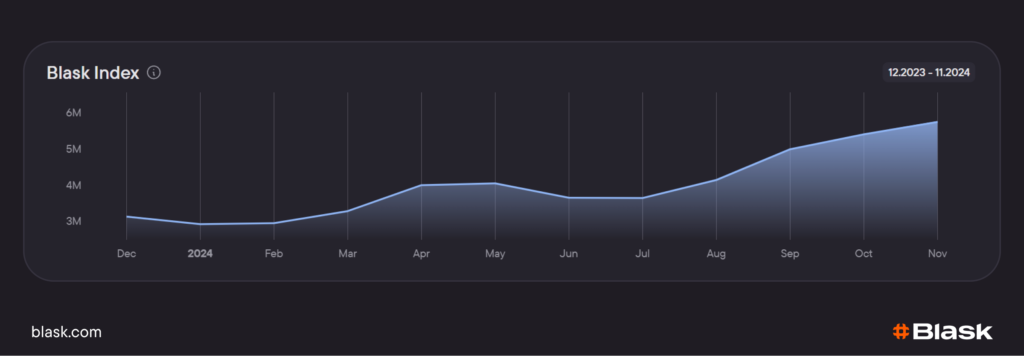

Without further ado, here are the top five fastest-growing iGaming markets of 2024:

- Rwanda — 146.16%

- Malawi — 116.53%

- Philippines — 113.18%

- Democratic Republic of the Congo — 99.21%

- Togo — 95.94%

🛠️ How we measure growth:

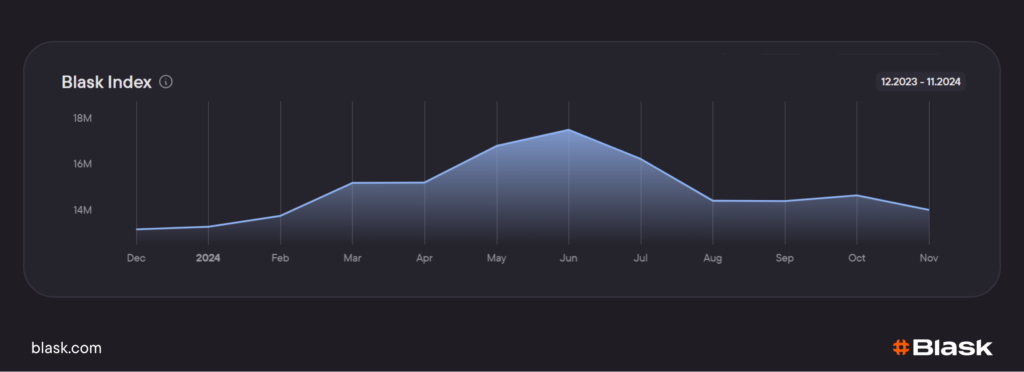

At Blask, we calculate growth using Blask Index, a comprehensive metric that reflects players’ interest in iGaming entertainment. Blask Index aggregates and normalizes data from search queries, social media activity, and other online trends to give a real-time overview of market interest and engagement.

For this report, growth percentages are based on a year-over-year comparison of Blask Index, analyzing the change between December 2023, and December 2024. This method provides an accurate snapshot of which markets have gained the most momentum over the full 12-month period.

If it weren’t for the Philippines, we could confidently say that 2024 was the year of Africa. Unfortunately, we can’t wrap this up with a brief conclusion; we now need to delve into each market in detail. Let’s get started!

The phenomenal growth of Blask Index in Rwanda.

Rwanda is a country in East Africa with a population of 13.6 million people. This is a nation aspiring to become the second Singapore through foreign investments, and it is experiencing rapid development on its own.

The iGaming industry in Rwanda began gaining traction rapidly at the end of 2022, and since then, a clear trend of growth has emerged, with record-breaking rates.

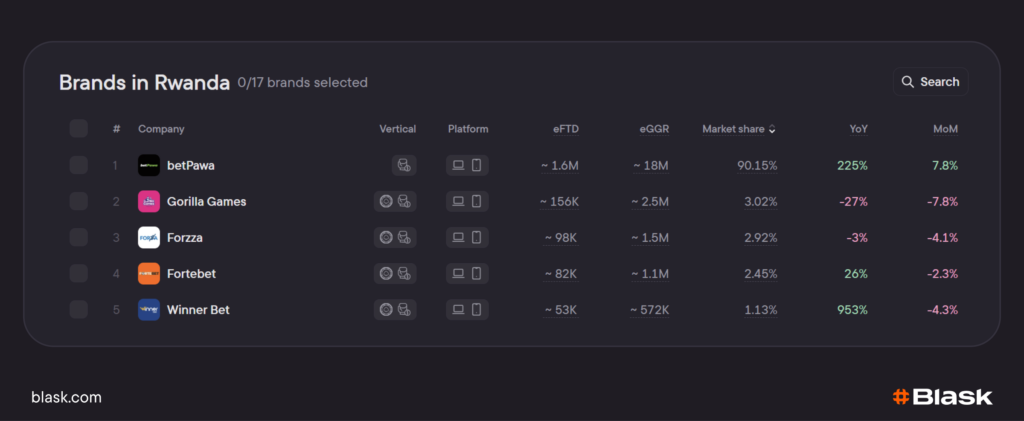

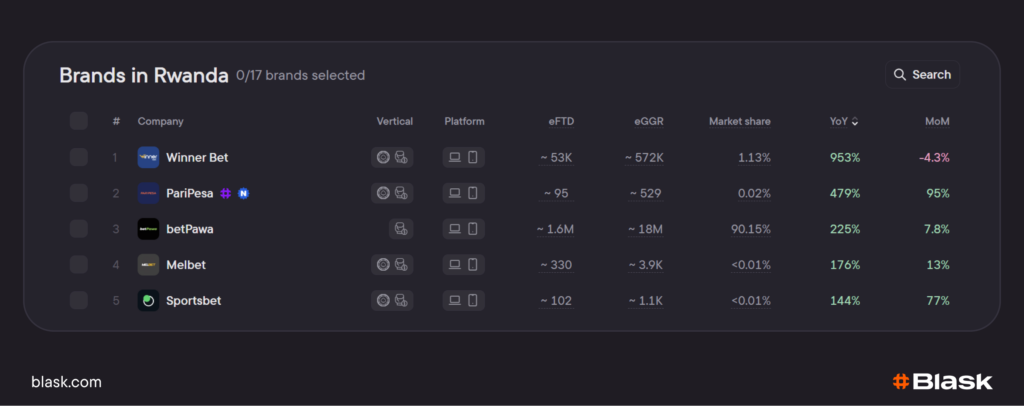

Currently, players in Rwanda are showing interest in 17 different brands, but a staggering 90.15% of the total market volume is occupied by a single brand, betPawa.

Notably, betPawa is not only the most popular and sought-after iGaming brand in Rwanda but also one of the fastest-growing. In contrast, the leader in growth rates, Winner Bet, saw an incredible increase of 953% over the past year, yet still holds a tiny market share of only 1.13%.

Despite the strong dominance of one brand, there is still an opportunity to enter this market with an innovative product, and there is time to ride the wave of growing interest in iGaming entertainment.

Key player characteristics in Rwanda include:

- A predominantly young audience, with 35% of players aged 18-24.

- 70% of players are interested in online betting on traditional sports.

- 60% of players engage in betting to make money.

- 50% of players use betting as a way to pass the time when they are bored.

- Only 5% of players are classified as problem gamblers.

🛠️ How we obtained this data:

These insights come from Blask’s Customer Profile, an advanced AI-driven tool that analyzes player demographics, behaviors, and motivations. This tool empowers operators to make informed, targeted decisions, maximizing their impact in any market.

Second place – Malawi.

Malawi is one of the smallest countries in Africa by area, home to nearly 22 million people. The country is renowned for its freshwater lakes, which host over 500 species of fish and crustaceans—making it the most diverse ecosystem in the world!

Regarding the iGaming industry, the situation here mirrors that of Rwanda. Just like in 2022, there has been rapid growth, and by 2024, this trend not only persisted but accelerated: Blask Index for 2024 grew from 4.1 million to 7.7 million.

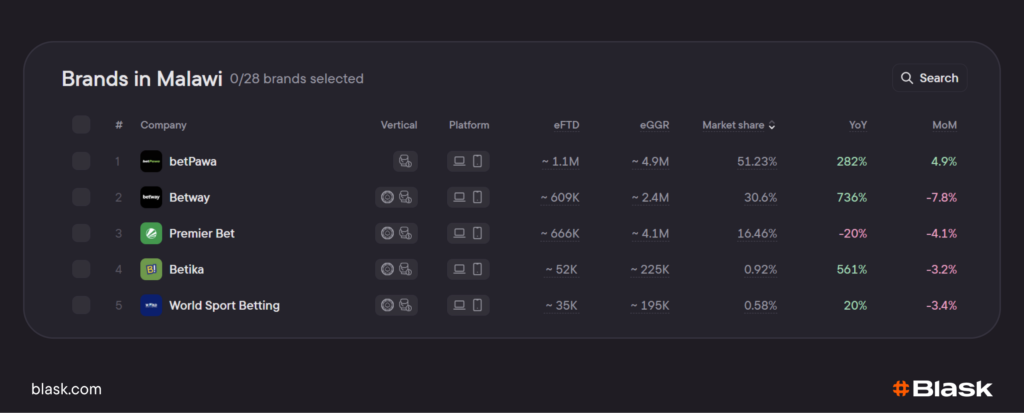

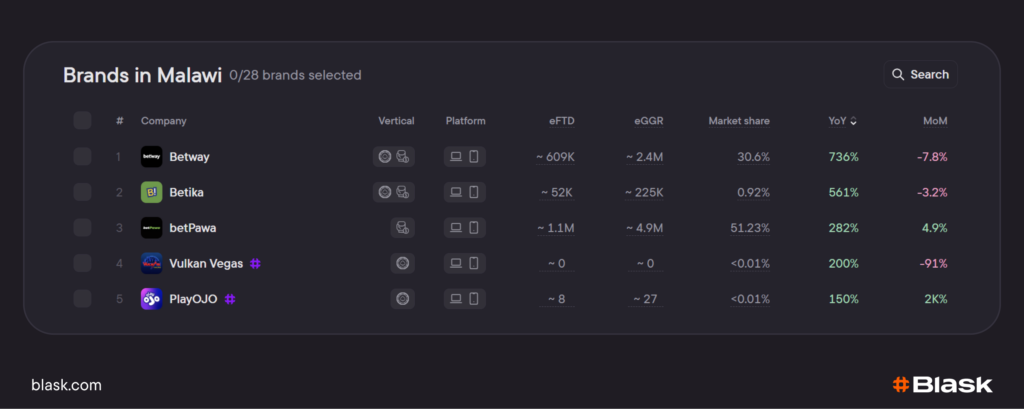

The Malawian market features 28 brands, with the largest and most recognized being betPawa, which now holds a market share of 51.23%.

Leading in growth rates for the year is the brand Betway, capturing 30.6% of the market and experiencing a staggering increase of 736%. Meanwhile, betPawa is also making strides and ranks third in growth rate with an impressive 282%.

👉 BTW, Blask’s “All Brands” dashboard has crowned betPawa as Africa’s top iGaming brand, achieving a record 22.24M APS.

Key characteristics of players in Malawi include:

- 40% of players are aged 25-34.

- 80% of players are interested in online betting on traditional sports.

- 70% of players place bets to earn money.

- 50% of players engage in online betting because it is convenient—there’s no need to leave home.

- Only 5% of players are classified as problematic gamblers.

The Philippines is an outlier in statistics.

The Philippines is an island nation in Southeast Asia with a population of 118.3 million. It ranks as the third most populous English-speaking country in the world and is the only country that is susceptible to all natural disasters, including typhoons, hurricanes, earthquakes, tsunamis, and volcanic eruptions.

Are tsunamis related to the interest in iGaming activities? That remains unclear. However, we can observe that the online betting and casino market experienced significant growth in 2024, only to then decline back to nearly its original levels.

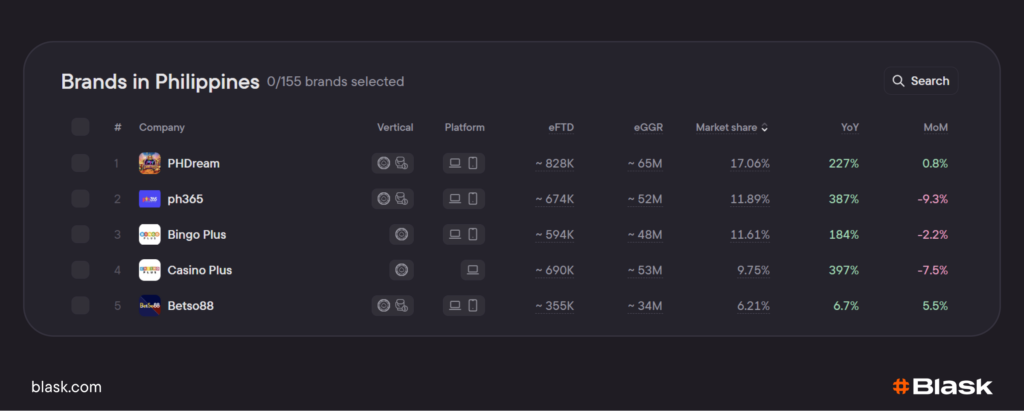

The largest and most well-known brand is PHDream, which holds 17.06% of the market. In total, players in the Philippines engage with 155 brands.

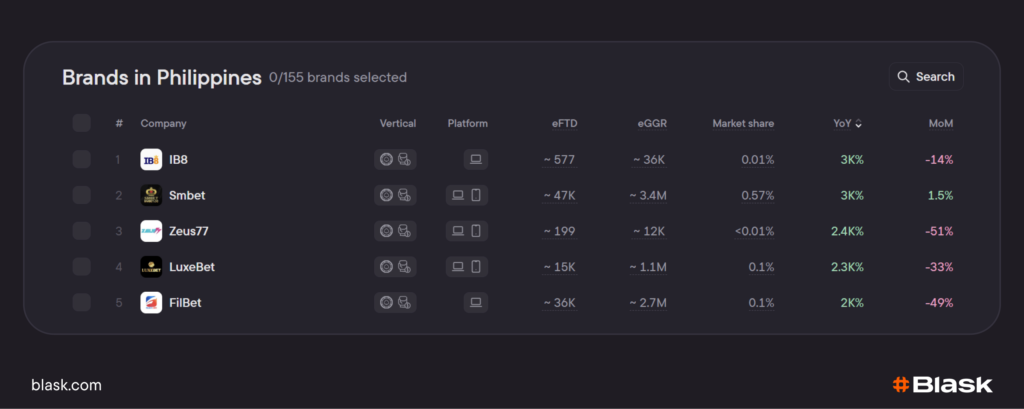

The fastest-growing brands are the smaller ones. For instance, IB8 saw an increase of over 3000%, yet it only captures 0.01% of the market.

Key characteristics of players in the Philippines include:

- 35% of players are aged 25-34.

- 50% of players are interested in online betting on traditional sports, while 45% participate in live casino games.

- 60% of players place bets to earn money.

- 40% of players engage in online betting for the thrill and adrenaline rush.

- 10% of players are classified as problem gamblers.

The Democratic Republic of the Congo ranks fourth.

The Democratic Republic of Congo, also known as the DRC, is the second-largest country in Africa and the eleventh largest in the world, with a population of 115.4 million people. According to data from 2012, it is one of the poorest countries globally.

Nevertheless, iGaming entertainment is extremely popular here. Interest in online betting and casinos is on the rise.

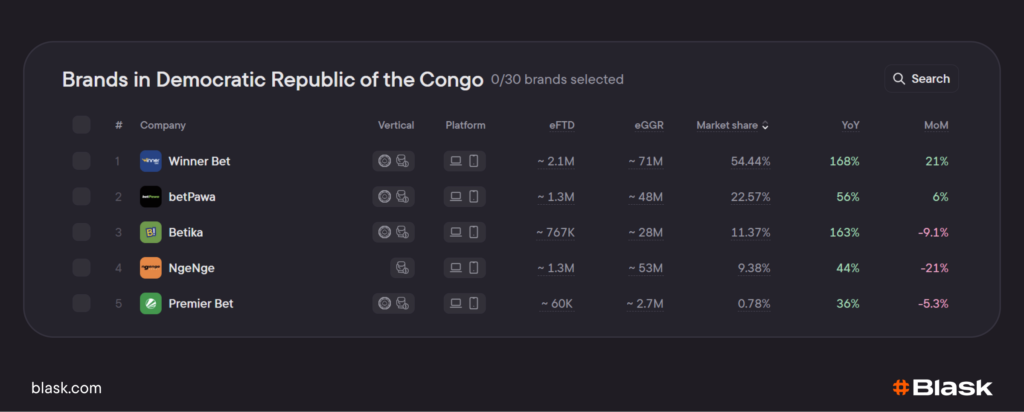

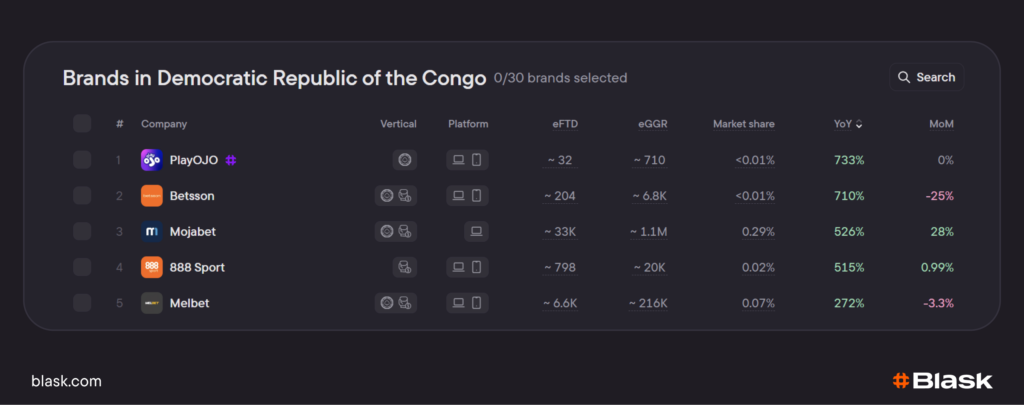

In total, there are 30 brands operating in the DRC market, with Winner Bet leading the pack, holding a 54.44% market share. Following closely is betPawa, with a 22.57% share. This already seems like a healthy competition, especially when compared to, for instance, Rwanda.

In terms of growth rates in the DRC, smaller brands are leading the way. The fastest-growing brand is PlayOJO, boasting an impressive growth rate of 733%, although it still commands less than 0.01% of the market. It’s noteworthy that the dominant brand, Winner Bet, continues to grow and expand; it ranks eighth in terms of growth rate with a commendable 168%, which is a very respectable achievement.

Key player demographics in DRC include:

- 35% of players are aged 18-24.

- 70% of players are interested in online betting on traditional sports, while 50% engage in live casino games.

- 60% of players bet to earn money.

- A significant 15% of players are categorized as problem gamblers.

Togo completes the list of iGaming leaders.

Togo is yet another impoverished country in Africa, with a population of nearly 9 million people. The population primarily engages in agriculture and fishing, and the presence of the tsetse fly makes livestock farming difficult.

However, no flies can hinder internet access, and with internet connectivity, residents can also access iGaming entertainment. Since 2022, the online betting and casino industry has demonstrated steady growth, a trend that is continuing into 2024. Notably, between July and August, an event occurred that nearly doubled the market within the following months.

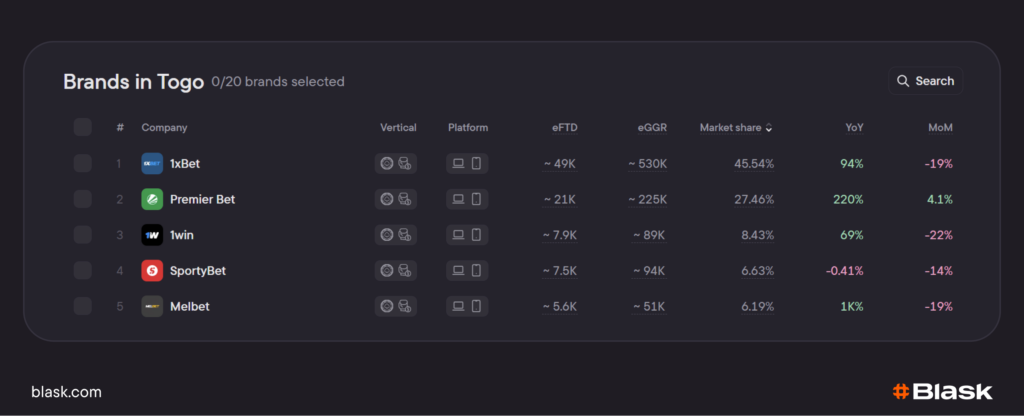

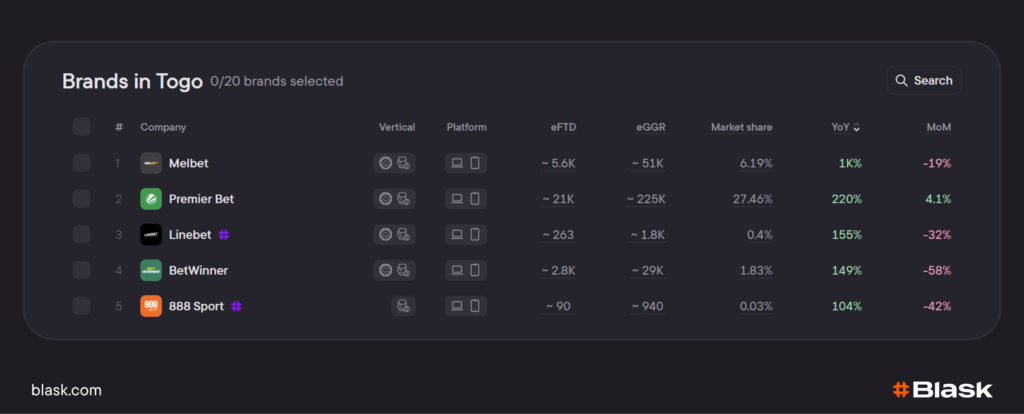

Currently, there are 20 iGaming brands operating in Togo, with 1xBet leading the market, holding a 45.54% share.

Moreover, Togo is witnessing fierce competition among brands. Melbet has made significant strides, experiencing a staggering 1000% growth and capturing 6.19% of the market.

Key characteristics of players in Togo include:

- 40% of players are aged between 25 and 34.

- 70% of players are interested in online betting on traditional sports, while 55% participate in online lotteries.

- 60% of players place bets with the intention of making money.

- Only 5% of players are classified as problematic gamblers.

Stay ahead of trends with Blask.

The year 2024 has shown significant potential for iGaming entertainment in emerging markets. This trend is likely to continue into the upcoming year, 2025. But how can you notice growth not after a year, but right at the beginning?

Use Blask! We have compiled comprehensive statistics from 35 countries (a number that will only grow in the future!), where we know every single brand, their market share, and financial metrics such as eFTD and eGGR.

Don’t wait a whole year for our next digest featuring the top 5 countries; instead, track all iGaming trends daily, or even hourly, by yourself.