- Updated:

- Published:

How Latin American players approach iGaming differently

Latin America’s iGaming players may share cultural ties, but their gaming habits are far from uniform. Blask’s Customer Profile uncovers unique behaviors by country, revealing trends in age, education, employment, and motivations.

Latin America is a region often perceived as a cohesive cultural space. The Spanish language, a shared colonial heritage, and a commitment to traditions create a sense of similarity among the local population.

However, a deeper examination of player behavior in the iGaming sector reveals that, despite this cultural kinship, average players from different countries in the region exhibit unique characteristics.

To uncover these insights, Blask’s Customer Profile tool was pivotal. This advanced AI-powered dashboard allowed us to analyze the broadest and most representative player groups in each country, based on demographics, motivations, and behavior patterns. By leveraging this data, we identified key trends and differences that define the iGaming landscape across Latin America.

📖 Read more: What is Blask Customer Profile and how it revolutionizes iGaming analytics

In this article, the analytical team at Blask will demonstrate how these groups differ in the following countries:

- Mexico

- Argentina

- Chile

- Ecuador

Player age.

At first, we wanted to assert that the trends would be the same across the board. Our internal voice confidently suggested that iGaming entertainment is most popular among the 25-34 age group.

We reviewed the first graph, and it confirmed our assumption. The second graph corroborated it as well. The third one seemed to align perfectly. However, when we got to Mexico, we found that the audience was younger.

At the same time, the next age group varies across different countries. In some places, there’s a predominance of younger individuals, while in others, it leans towards those aged 35 and older.

💡 The key takeaway is that if you hear advice to target a younger audience, you won’t go wrong. Blask Customer Profile analytics will help eliminate guesswork, allowing you to hit the mark right away.

Education status.

Once again, we are witnessing a recurring pattern in three countries, while a fourth stands out with a different result. This time, Argentina has emerged as a highlight.

In Argentina, leadership is shared equally between two categories: High School and University, each accounting for 30%. In other countries, the majority of players have only completed high school.

Interestingly, the percentage of players with university degrees in Argentina is significantly higher than in other Latin American countries, where the figure ranges between 15% and 25%.

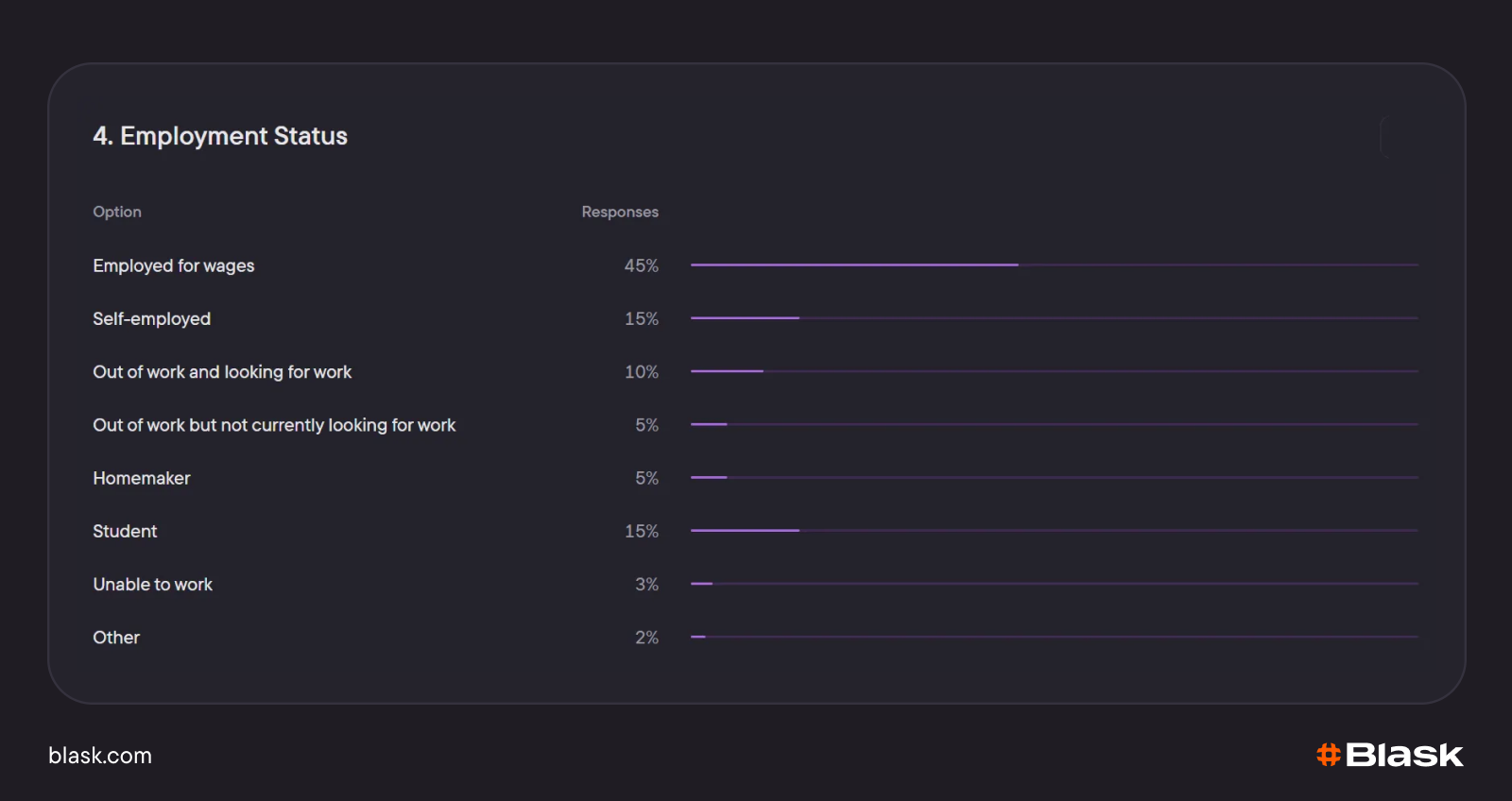

Employment status.

Finally, we have found something that is so similar across all countries that it could even be considered identical!

About 45-50% of players are employed, 15-20% are self-employed, roughly 15% are students, and another 15% are neither employed nor studying. In all Latin American countries, the employment distribution among iGaming entertainment fans is remarkably similar.

Interestingly, neither age nor education level appears to create any significant variations in the presence of paid employment.

📖 Want to learn more? Check use cases and benefits of Blask Customer Profile

Online betting motivation.

Ah, once again, we find ourselves in a moment where everything feels the same everywhere. In our sample from four Latin American countries, the primary motivation for players to place online bets is to make money.

Is this a characteristic of the region or simply human nature? Stay tuned to our blog, as we are preparing similar materials for other regions!

While the primary motivation is clear, the secondary motivations for players vary significantly.

- 40% of Argentinians are looking for a fun way to pass the time when they’re bored, which is why they place bets.

- In Chile, 30% of players want to make watching sports competitions more thrilling.

- In Ecuador, 40% of players seek an adrenaline rush.

- 30% of Mexicans bet on sports solely because they can do it from the comfort of their homes via the internet.

As you can see, although players in Latin America may seem similar at first glance, there are still crucial and noticeable differences depending on the country. How can this be utilized? Tailor your advertising campaigns to align with people’s motivations!

We can’t help but feel nostalgic for the times when the salary of an ordinary factory worker was enough to support a large family, buy a car, and live in a house of their own. In today’s world, people are seeking ways to earn a little extra beyond their salaries, which is why they turn to the iGaming industry, hoping for a stroke of luck.

📖 Read also: How does Blask AI power Customer Profile?

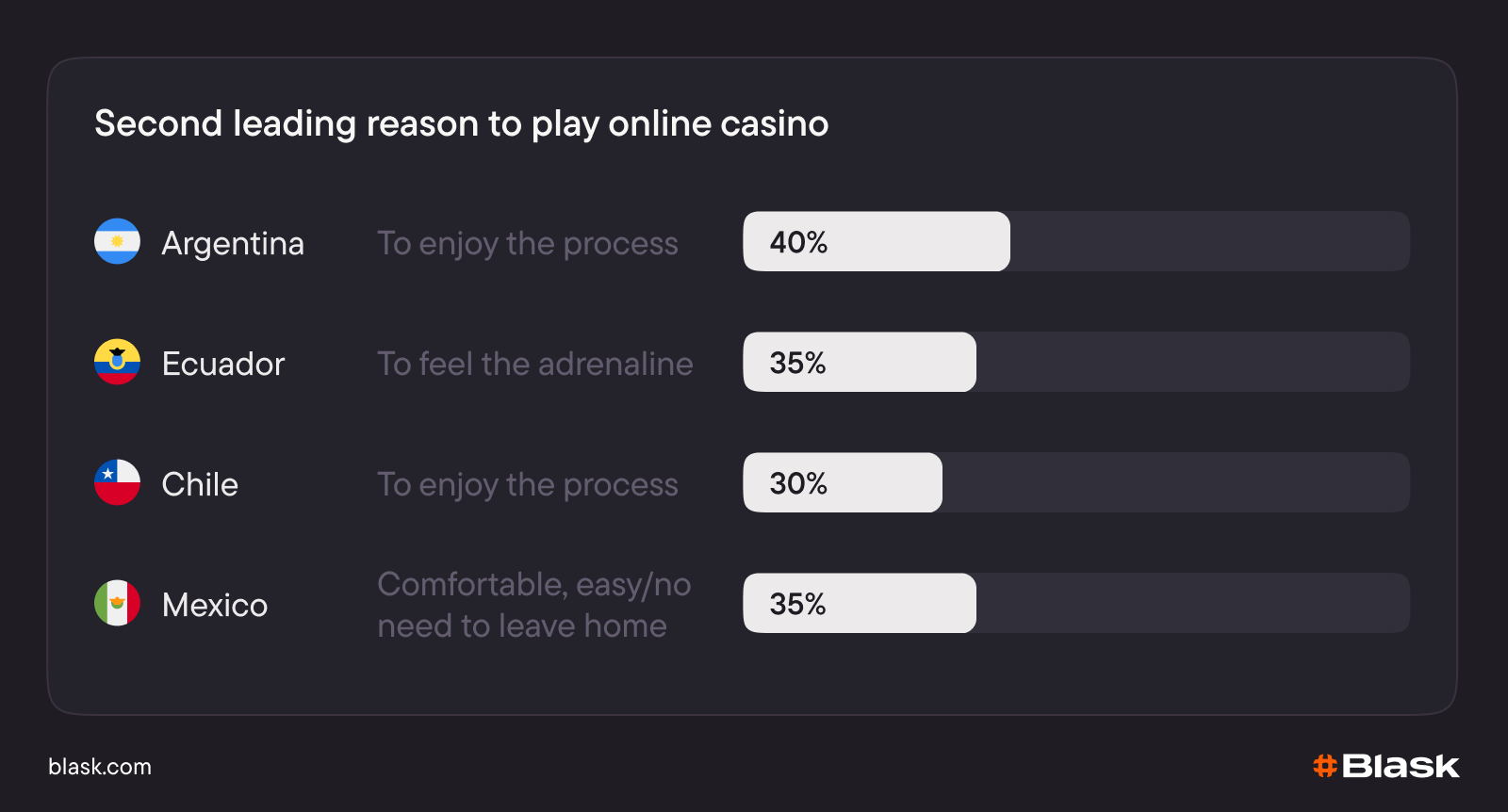

Online casino motivation.

The motivation to play at online casinos is quite predictable. The primary desire is to win money. 40-50% of players just want some extra money.

A silly joke: How can you tell if you are destined to be a millionaire? You bet one million on zero. From there, you either become a millionaire or it’s just not your fate.

Out of curiosity, let’s compare countries based on the next motivation on the list.

Wow! Now that’s interesting! Completely different motivations ranging from enjoyment to adrenaline.

What do people play?

Without a doubt, traditional sports betting takes the lead.

In all countries of Latin America, the iGaming industry is primarily driven by sports betting, which isn’t surprising considering that even those who are not particularly interested in football have heard of Messi at least once.

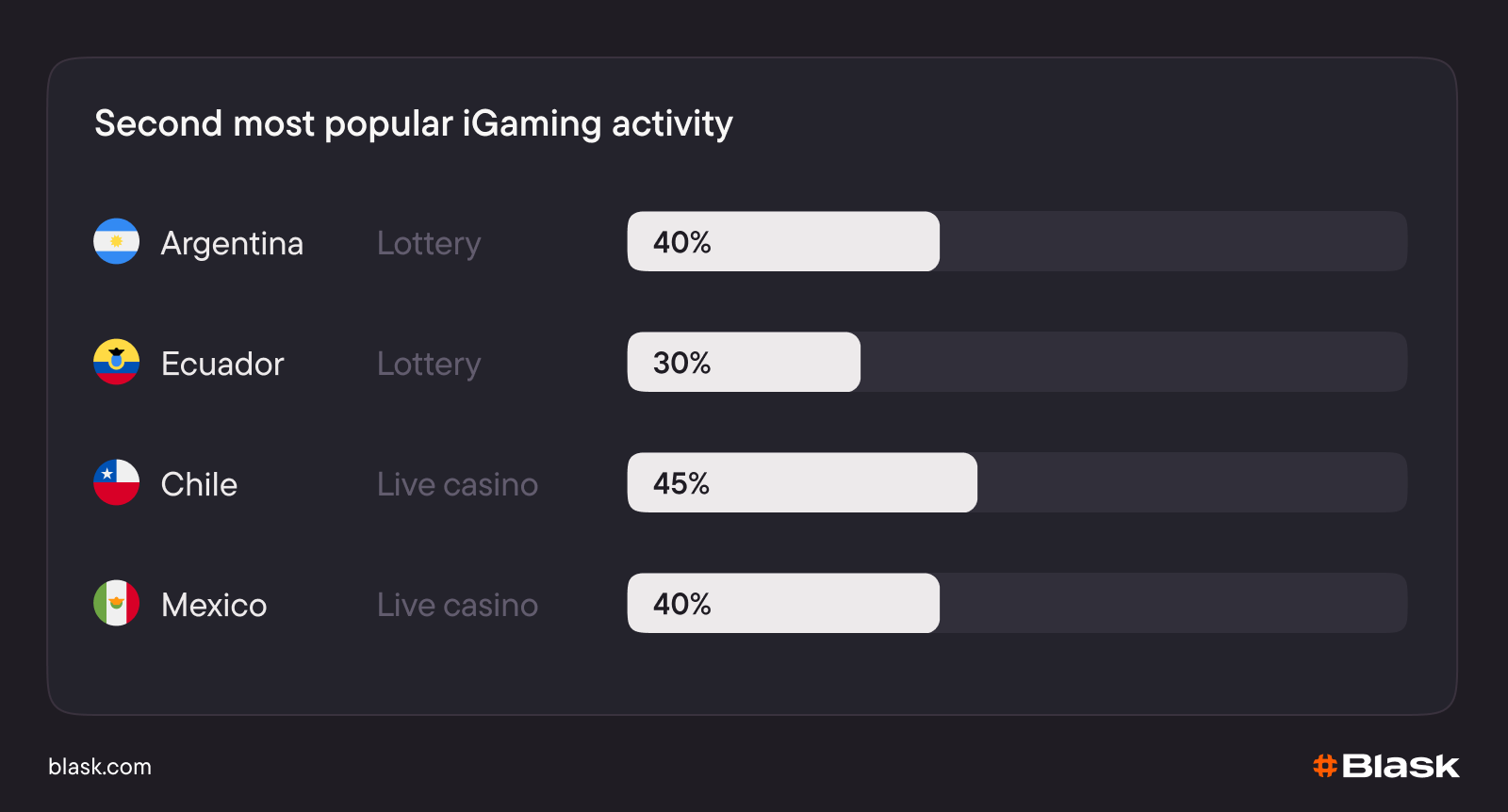

And what comes in second place? Here we have two winners: lotteries and live casinos.

Problem gambler status.

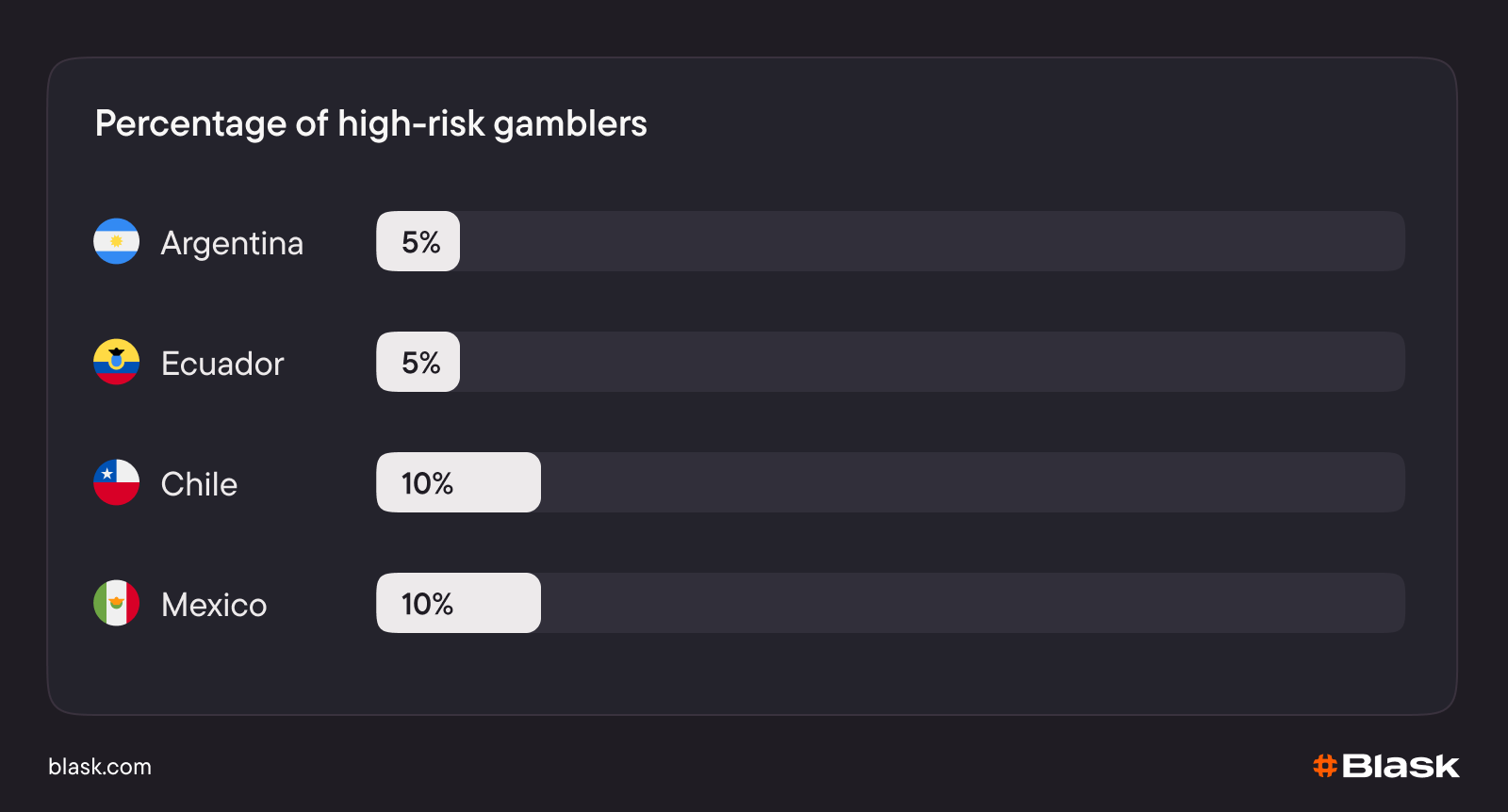

All four countries exhibit a very similar distribution of players based on their gambling and betting issues. There are 40-50% of non-problematic players, followed by low-risk players, and then medium-risk players. In this case, let’s compare the countries based on the number of players who need assistance.

Conclusion based on real data.

At first glance, the differences between countries may seem minor or even nonexistent. It’s highly likely that if you replicate your tactics from Argentina in Chile, you’ll achieve a certain level of success. However, you don’t want to settle for being just another average brand or a moderately successful affiliate; you aspire to dominate the market, right?

The key to success lies in the details. In this article, we’ve only explored the most popular games, motivations, and patterns — for all the other specifics, you can refer to the Customer Profile page from Blask.