At yesterday’s NEXT NY summit, Blask’s research team pulled back the curtain on America’s fast-growing but still-fragmented iGaming scene.

Key take-aways:

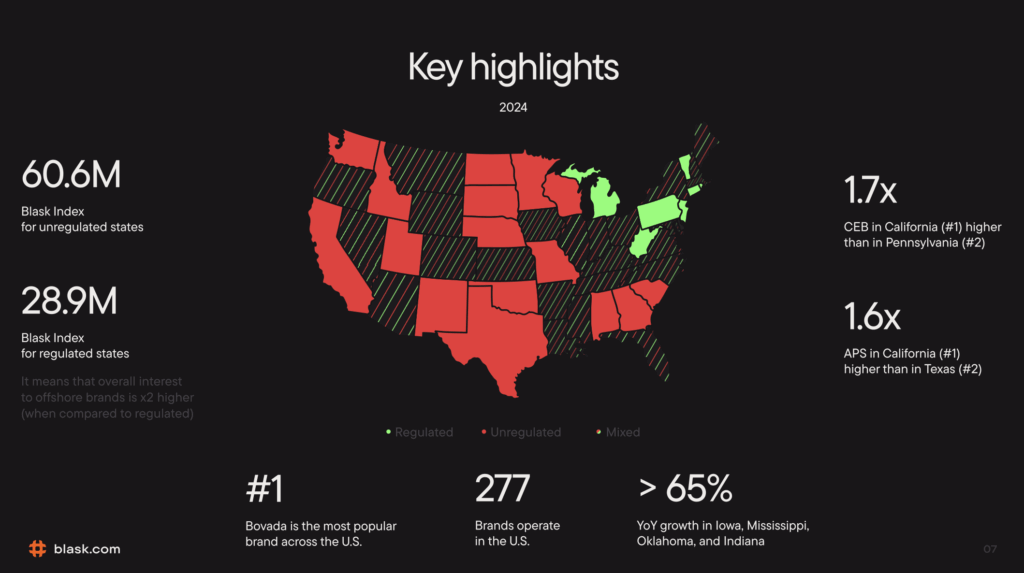

- International brands handle ≈ 2× regulated handle.

Blask’s model counts more than 300 active offshore operators taking U.S. bets—twice the dollar volume of state-licensed sites. - Five states = 75% of all legal GGR. New York tops the list, but California and Texas already rank #4 and #6 in raw search demand despite zero regulation — suggesting the next trillion-dollar battleground.

- Brand power is clustering. Just ten operators hold 64 % of total U.S. Blask Index, yet 50+ “long-tail” brands are nibbling market-share through TikTok-led acquisition runs.

- Regulatory drag is real. States with high tax or ad-caps (e.g., New York, New Jersey) see YoY Blask Index growth slip below 8 %, versus 19 % in lower-cost Indiana.

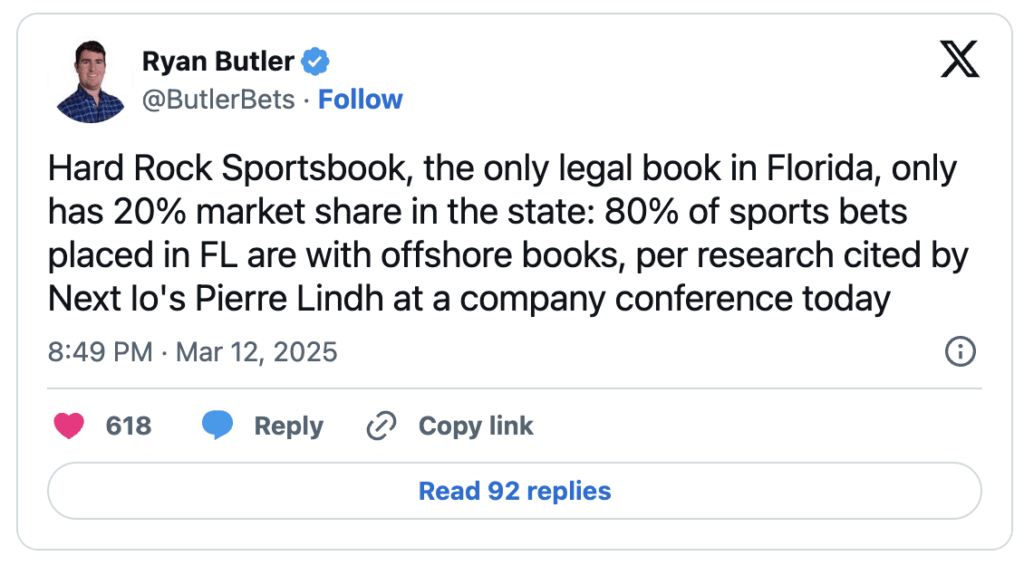

- AI-first KPIs beat ledger lag. Blask’s APS / CEB corridors flagged March’s Florida surge three weeks before Hard Rock’s revenue filing—proof that search-led signals can out-predict cash books.

— Ryan Butler, senior journalist, Covers.com

Why this matters

- Policy makers get a reality-check on leakage as they debate new licence frameworks.

- Operators & media can benchmark APS lifts before, during and after state launches — essential for bid decks.

- Investors see where Blask Index heat maps line up with impending legislative windows.