Blask expands its market coverage with six new countries, unlocking data visibility across regions with diverse regulation, digital maturity, and growth trajectories.

Madagascar, Somalia, Tunisia, Zimbabwe, Jordan, and South Sudan are now fully tracked in Blask, offering fresh insight into emerging player dynamics, brand competition, and market development trends.

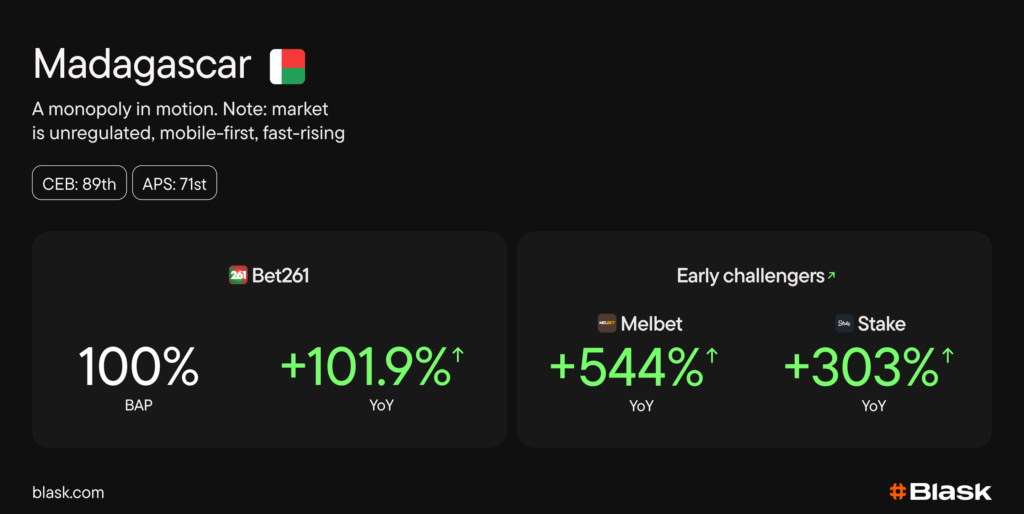

🇲🇬 Madagascar: Monopoly momentum

Blask data shows Bet261 holding a complete lead with 100% Brand Accumulated Power (BAP), making Madagascar one of the few single-brand markets currently observed.

Smaller international brands such as Melbet (+544% YoY) and Stake (+303%) are showing early growth signals. At the same time, overall engagement continues to rise in an unregulated, mobile-led environment with roughly 5.8 million internet users.

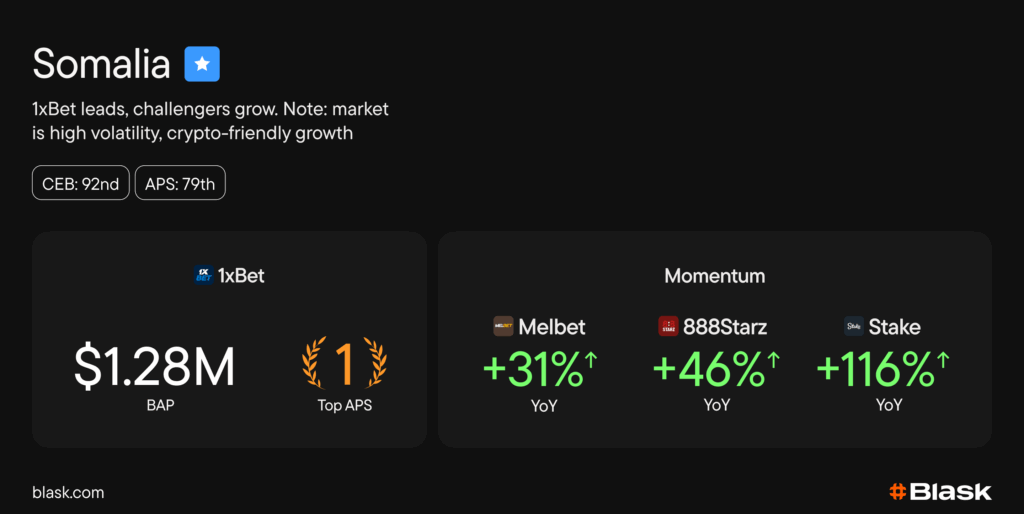

🇸🇴 Somalia: 1xBet dominates a fast-changing landscape

Somalia’s unregulated market is led by 1xBet, holding 88.7K APS and $1.28M CEB, followed by Melbet, 888Starz, and Stake, each recording double- and triple-digit growth.

Crypto-friendly brands are performing strongly, suggesting early player adoption of alternative formats and payment models.

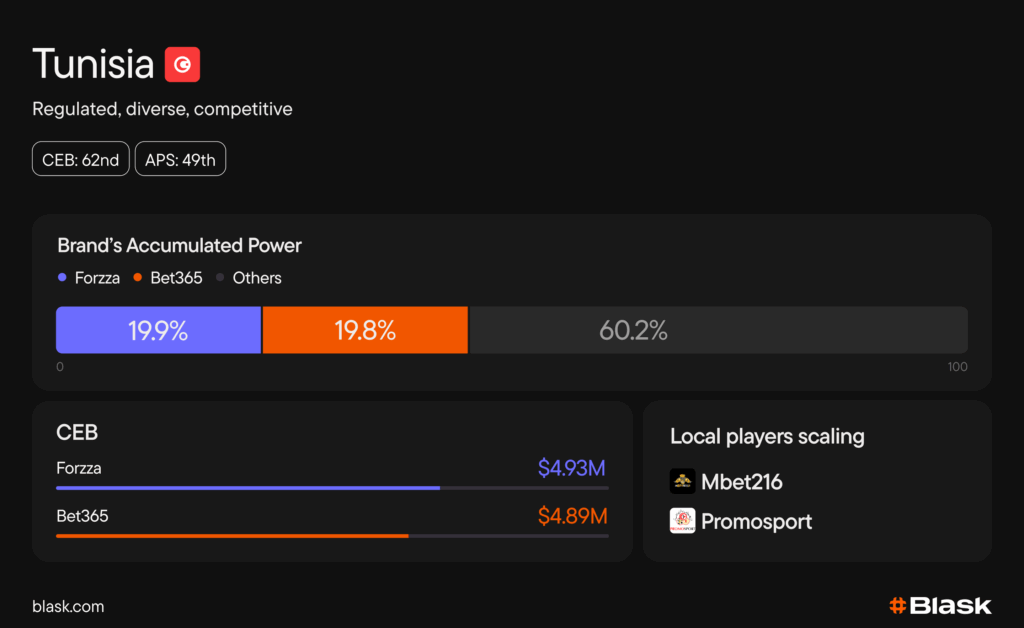

🇹🇳 Tunisia: Regulated and competitive

A regulated betting environment sets Tunisia apart among the new markets.

Here, Forzza (19.9% BAP) and Bet365 (19.8%) are in a close contest, while local brands such as Mbet216 (+26.9%) and Promosport (+10.5%) expand steadily.

High internet penetration and a maturing regulatory framework make Tunisia one of North Africa’s most structured online betting ecosystems.

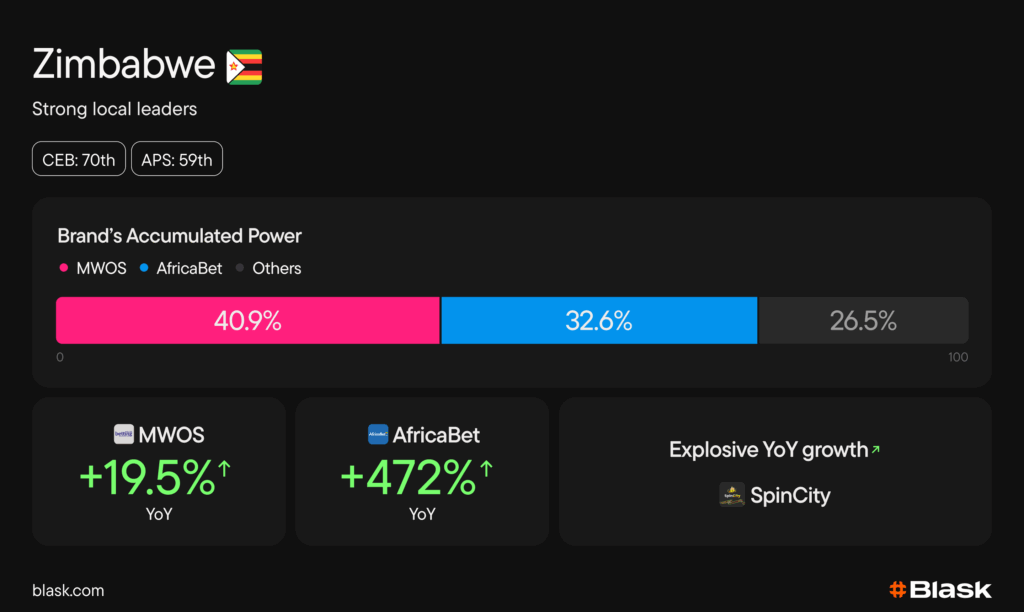

🇿🇼 Zimbabwe: Strong local leadership

Zimbabwe’s data reveals a locally dominated betting landscape.

MWOS leads with 40.9% BAP, followed by AfricaBet (32.6%) and SpinCity (18.1%), the latter showing a remarkable +6,590% YoY increase.

Rapid growth among local operators highlights the country’s expanding digital access and sustained interest in regulated betting.

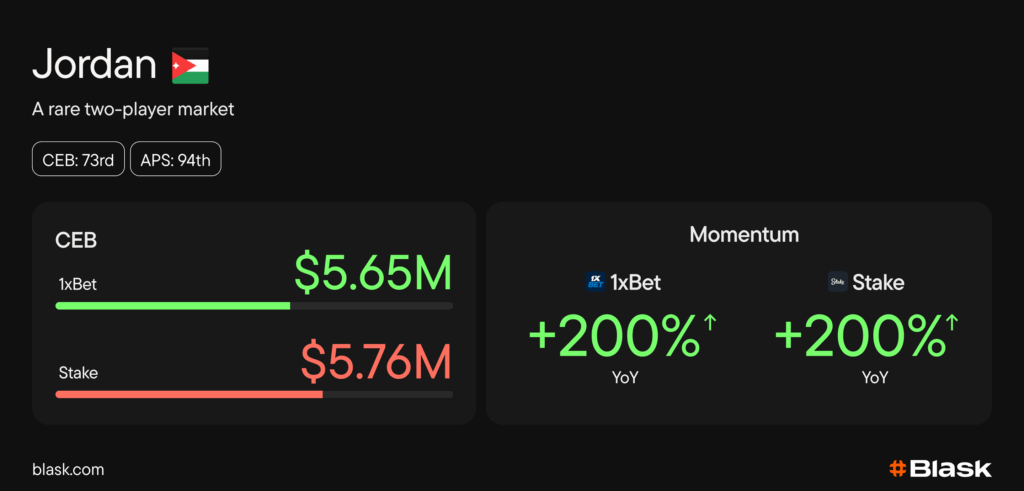

🇯🇴 Jordan: A balanced duopoly

Jordan’s market is shaped by a near-even split between 1xBet and Stake, holding 50.5% and 49.5% BAP, respectively, and both recording over +200% YoY growth.

This symmetry points to a stable two-brand ecosystem within an unregulated market, with consistent engagement and growing visibility.

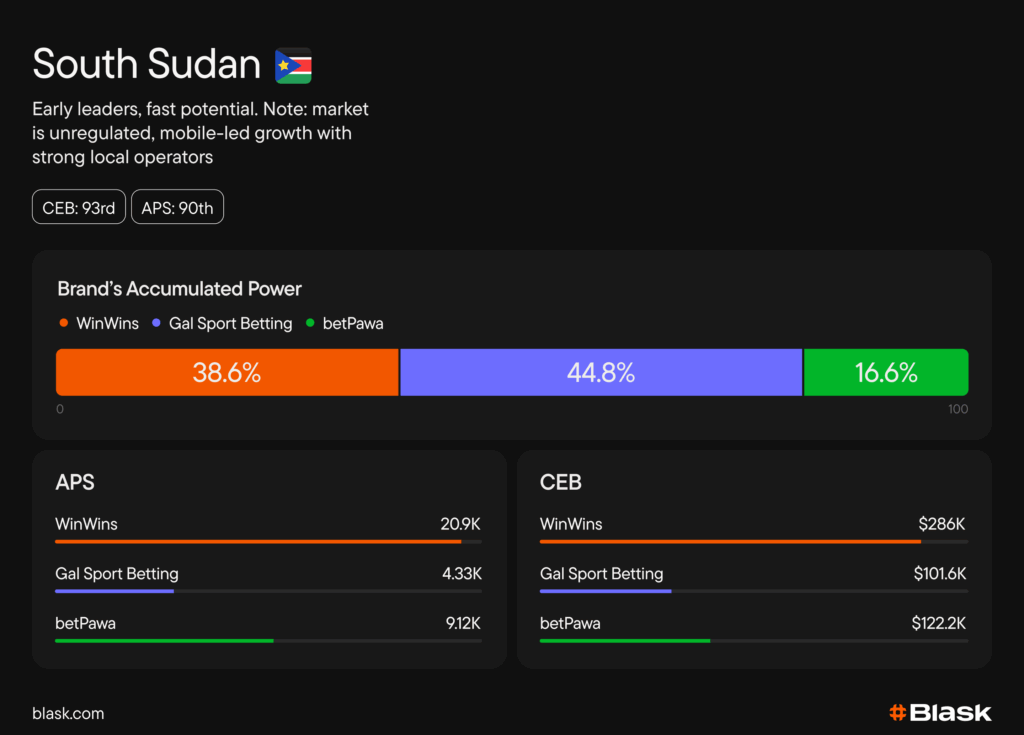

🇸🇸 South Sudan: Local operators lead early adoption

Early data from South Sudan highlights WinWins (38.6% BAP), Gal Sport Betting (44.8%), and betPawa (16.6%) as leading brands in an unregulated and fast-growing environment.

Despite a low internet user base, Blask data indicates a rapidly forming betting ecosystem driven by mobile access and regional operators.

Expanding Blask’s footprint

With these six additions, Blask continues to expand its analytical footprint across Africa and the Middle East, providing data on markets at different stages of maturity, from regulated frameworks to early, mobile-driven growth.

Each market now features live metrics for APS, CEB, and BAP, allowing operators and analysts to track competition, engagement, and performance trends in real time.