From Eastern Europe to the Gulf and beyond, Blask’s coverage just expanded, revealing how seven fast-evolving iGaming landscapes are moving beneath the surface.

Now fully tracked: Ukraine, Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Chad, and Mauritania.

Market breakdowns

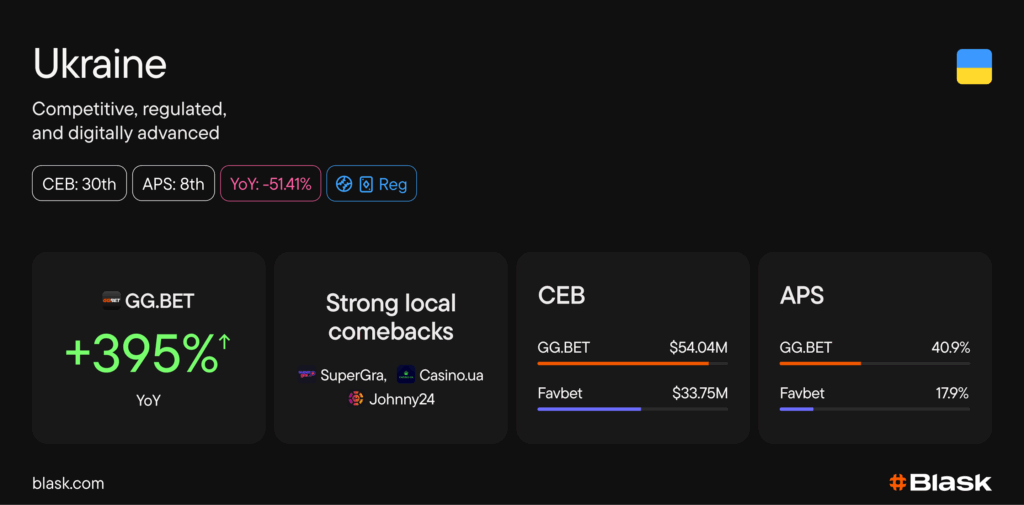

Ukraine 🇺🇦

A mature regulatory environment, high digital inventory, and strong brand competition make Ukraine a compelling addition.

- Leading brand: ~40.9% BAP | ~$54 M CEB | +395% YoY

- Major challengers: e.g., Favbet, Slots City; double-digit BAP and strong retention.

- Local brands: Casino.ua, SuperGra, Johnny24 posting notable YoY growth. This market illustrates how regulation, brand heritage and digital growth can coincide.

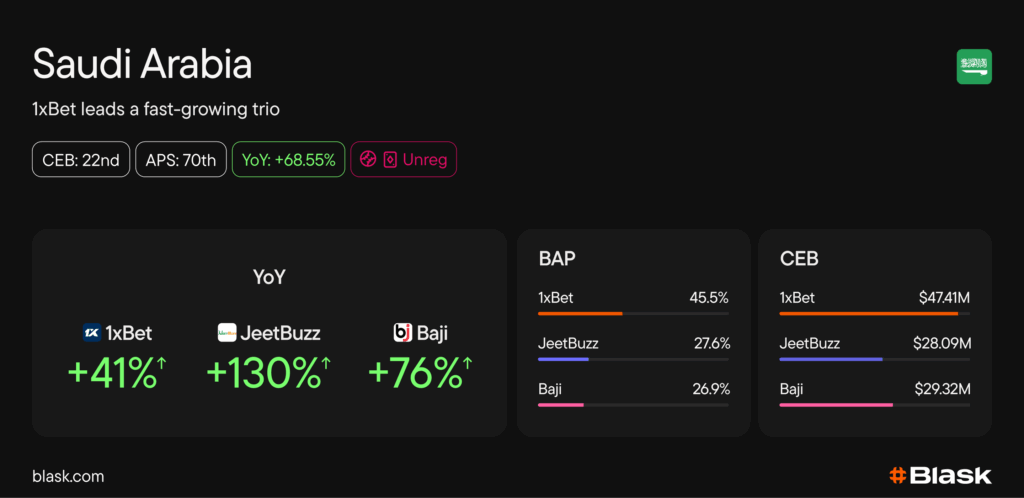

Saudi Arabia 🇸🇦

Unregulated but hugely mobile-first, Saudi Arabia is seeing top operators scale rapidly.

- 1xBet leads with ~45.5% BAP | ~$47.4 M CEB | +41% YoY

- JeetBuzz & Baji showing rapid momentum: +129%, +76% respectively. The mobile-only nature, English/Arabic language mix and favourable demographics make this a high-growth frontier.

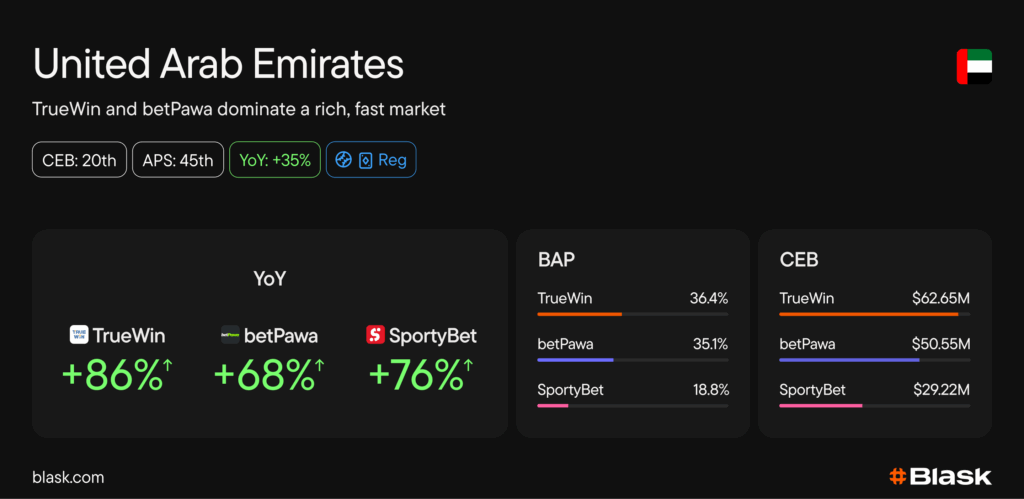

United Arab Emirates 🇦🇪

With high infrastructure maturity and disposable income, the UAE is a premium market for iGaming visibility.

- TrueWin: ~36.4% BAP | ~$62.6 M CEB | +86% YoY

- betPawa: ~35.1% BAP | ~$50.6 M CEB | +68% YoY

- SportyBet and others posting +70%+ growth. Operators in the UAE will need strong localised strategy, multi-language support and mobile optimisation to stay competitive.

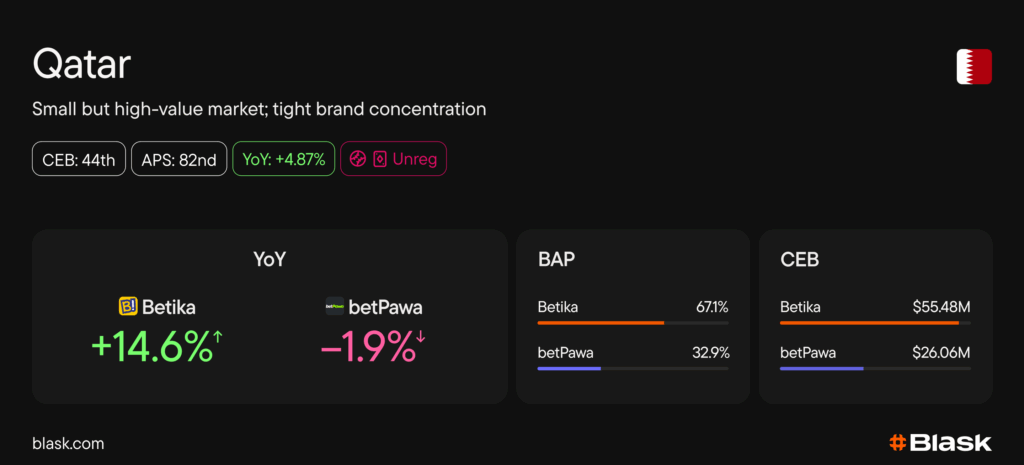

Qatar 🇶🇦

Small in scale but high in value. Market visibility is split almost entirely between two brands; dominance meets stability.

- Betika: ~67.1% BAP | ~$55.5 M CEB | +14.6% YoY

- betPawa: ~32.9% BAP | ~$26.1 M CEB | –1.9% YoY A niche yet strategic market for operators with international reach.

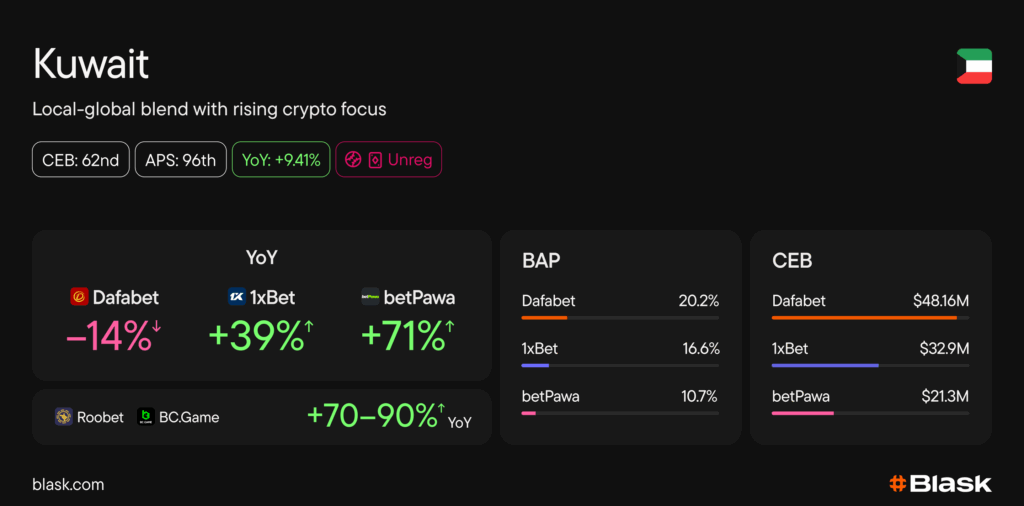

Kuwait 🇰🇼

Crypto-friendly, diverse in operator mix and showing strong growth in challenger brands.

- Dafabet: ~20.2% BAP | ~$48.2 M CEB | –14% YoY

- 1xBet: ~16.6% BAP | ~$32.9 M CEB | +39% YoY

- betPawa: ~10.7% BAP | ~$21.3 M CEB | +71% YoY Other brands (Roobet, BC.Game) showing +70-90% YoY; innovation, crypto & high-risk appetite thrive here.

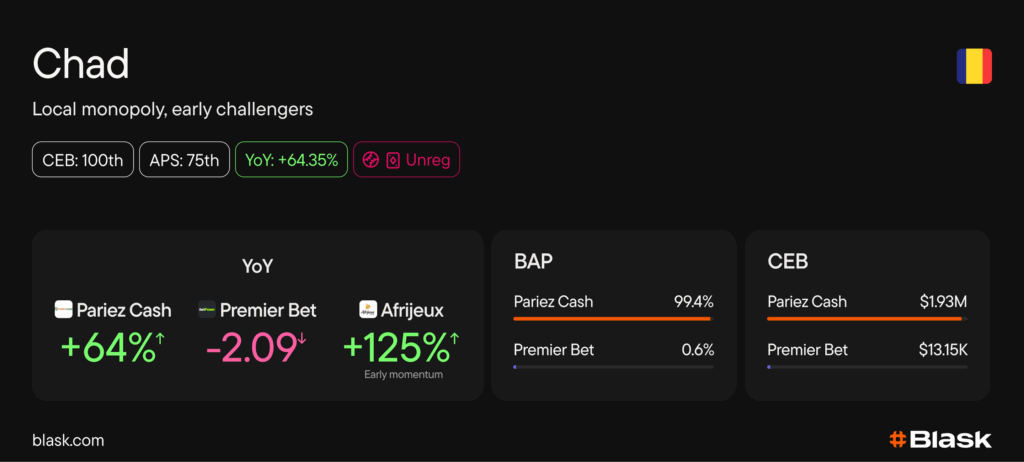

Chad 🇹🇩

Emerging market dynamics: heavy local leadership today, but space for challengers.

- Pariez Cash: ~99.4% BAP | ~$1.93 M CEB | +64% YoY

- Premier Bet: ~0.6% BAP | ~$13.15K CEB

- Afrijeux: Early-stage but showing +125% YoY growth. Mobile-first, unregulated settings and low competition make Chad a natural “future growth” country.

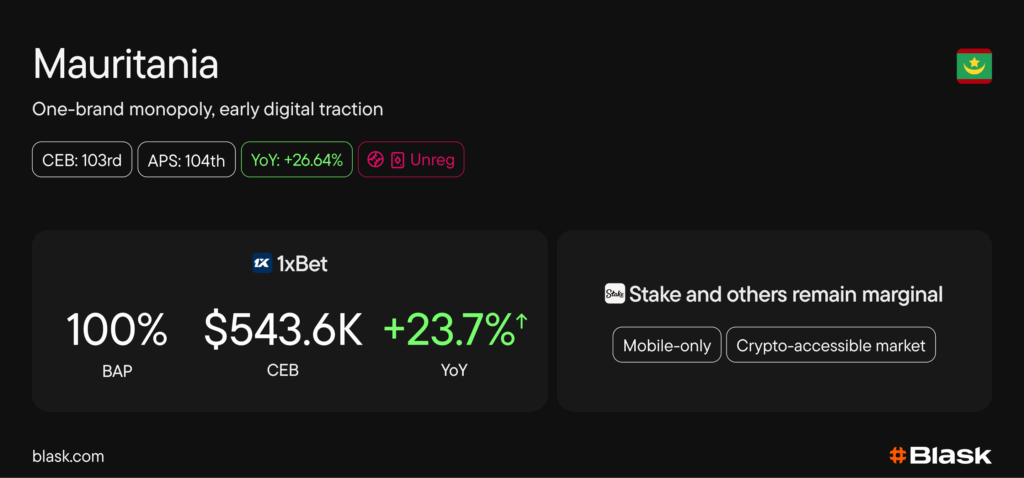

Mauritania 🇲🇷

Early-stage, mobile-led, unregulated; a frontier environment.

- 1xBet: 100% BAP | ~$543.6K CEB | +23.7% YoY

- Other brands marginal today, but potential is high. Operators entering Mauritania should treat it as a green-field: mobile-optimised, low CAC and first-mover advantages apply.

Why this matters

By adding Ukraine, Saudi Arabia, UAE, Qatar, Kuwait, Chad and Mauritania, Blask now maps brand visibility, market strength and momentum across continents and regulatory regimes, from regulated Europe to the Gulf’s crypto-open markets and Africa’s mobile-first frontiers.

This breadth brings unique value:

- Comparative insight: Watch how regulated vs unregulated markets behave, how mobile adoption intersects with brand growth.

- Emerging growth signals: Identify challenger brands early, track YoY momentum, find under-the-radar markets.

- Strategic foresight: For any operator or investor, these markets represent the next wave of global opportunity.

Get the full picture

Want to explore brand power, visibility, and momentum country-by-country? Visit Blask’s market analytics or book a demo