NEXT.io has published its new Market in Focus: Mexico report, powered by insights from Blask.

The study highlights how Mexico is rapidly becoming Latin America’s next digital gambling powerhouse, with Blask data used to map brand performance, market leaders, and the competitive dynamics shaping the sector.

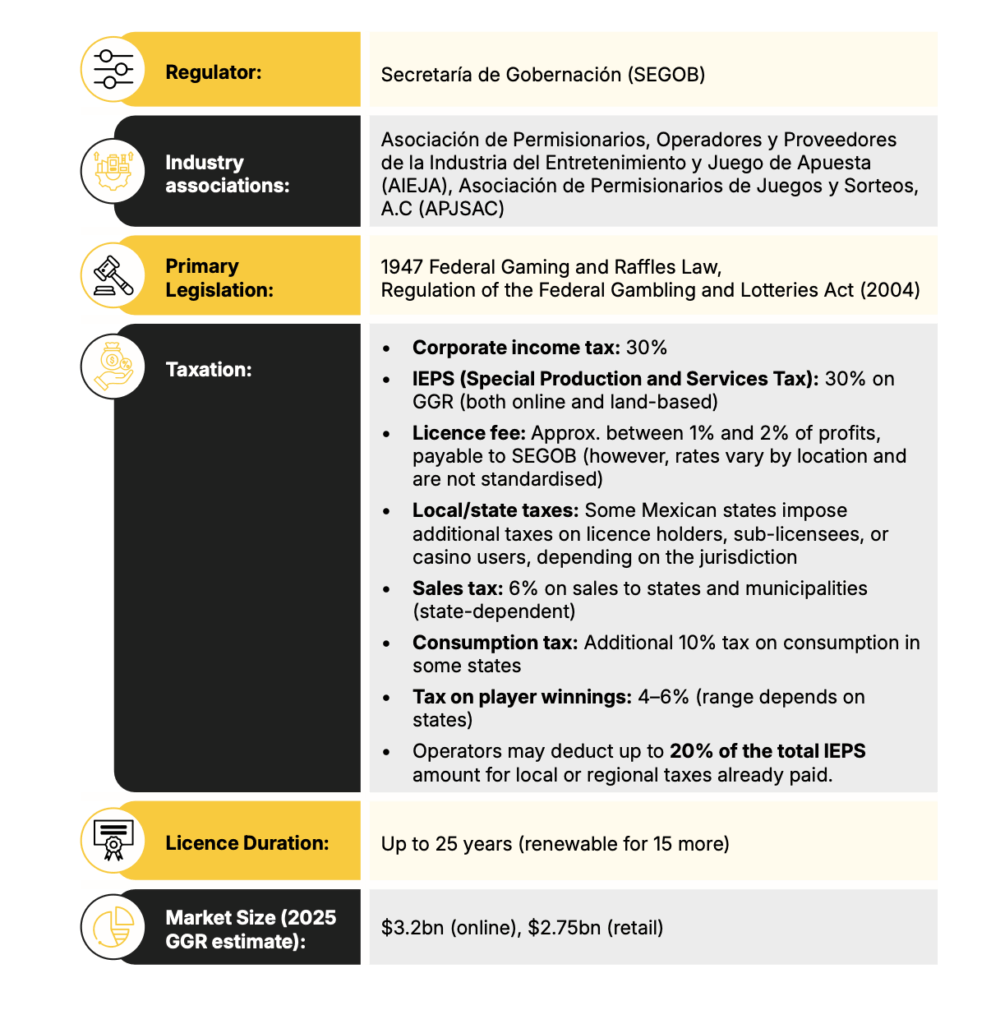

According to the report, 2025 is set to be the first year that online iGaming revenue surpasses land-based activity, with projections of US$3.2 billion online vs US$2.75 billion offline. For an industry long shaped by casinos and retail betting shops, this marks a historic shift.

Market Leaders and Challengers

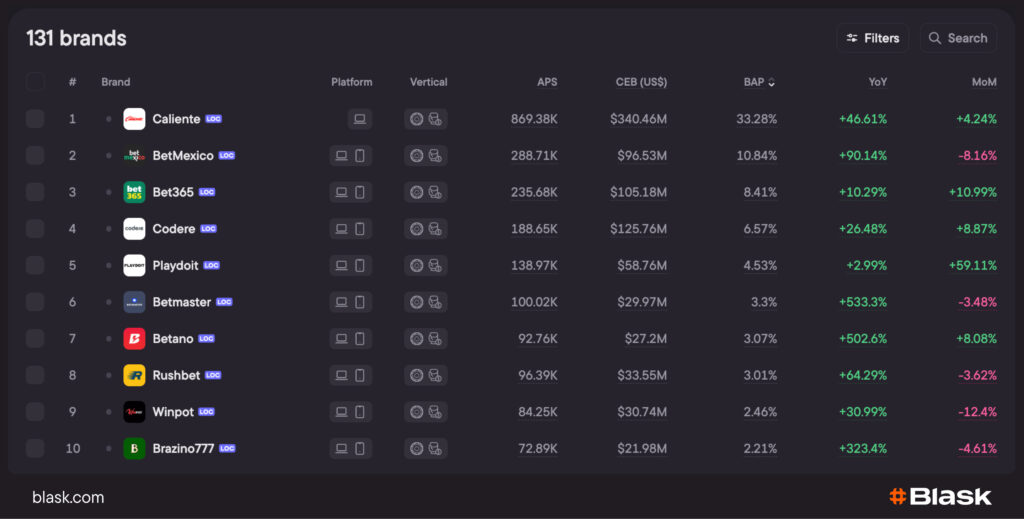

Blask data shows the extent of concentration at the top. Caliente is still the undisputed leader, with over 34% of total Brand Accumulated Power (BAP), an Acquisition Power Score of 824,000, and a Competitive Earning Baseline (CEB) of about US$320 million. Trailing but significant are BetMexico (10.54%), bet365 (8.56%), Codere (6.82%), and Playdoit (4.94%).

Yet the picture is not static. Challenger brands such as Betmaster, Rushbet, and Winpot are showing growth rates of 50% or more, carving out space by combining aggressive marketing with product differentiation. This suggests that while Caliente’s cultural resonance and omnichannel presence keep it on top, the competitive field is far from closed.

Players, Preferences, and Behaviour

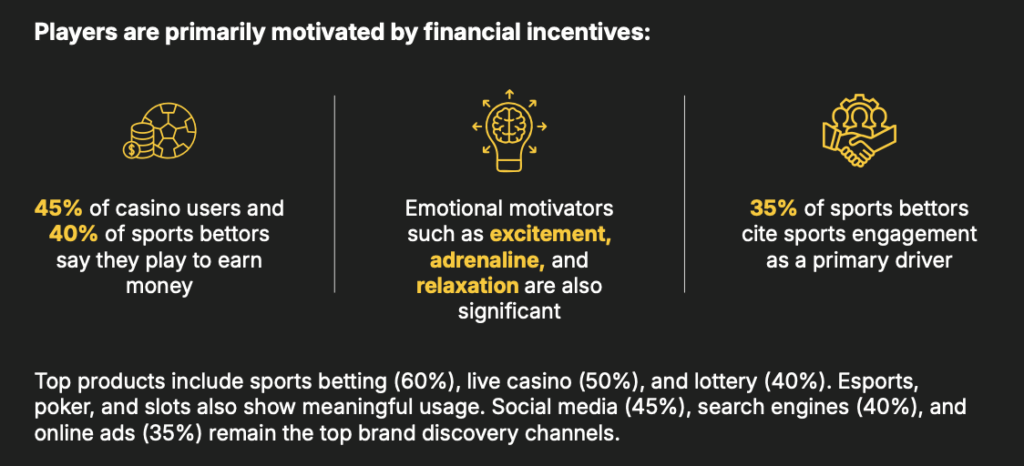

The Mexican online audience is young, mobile-first, and highly diverse in its interests. Over 55% of players are under 35, with 30% aged 18-24. Sports betting remains the top vertical, but unlike Brazil, it isn’t just about football. Mexican bettors are equally passionate about the NFL, MLB, NBA, and local leagues, which often makes them more valuable; in some cases, 2-2.5 times higher spend than football-focused users.

Casino games are also gaining ground, particularly among women, who now make up 40% of players, compared to 20–30% just a few years ago. Table games such as blackjack and poker are especially popular among higher-income users. This diversity of demand underscores why localisation is critical: strategies that succeed in Europe or Brazil rarely translate directly into Mexico.

Regulation: Complexity Meets Reform

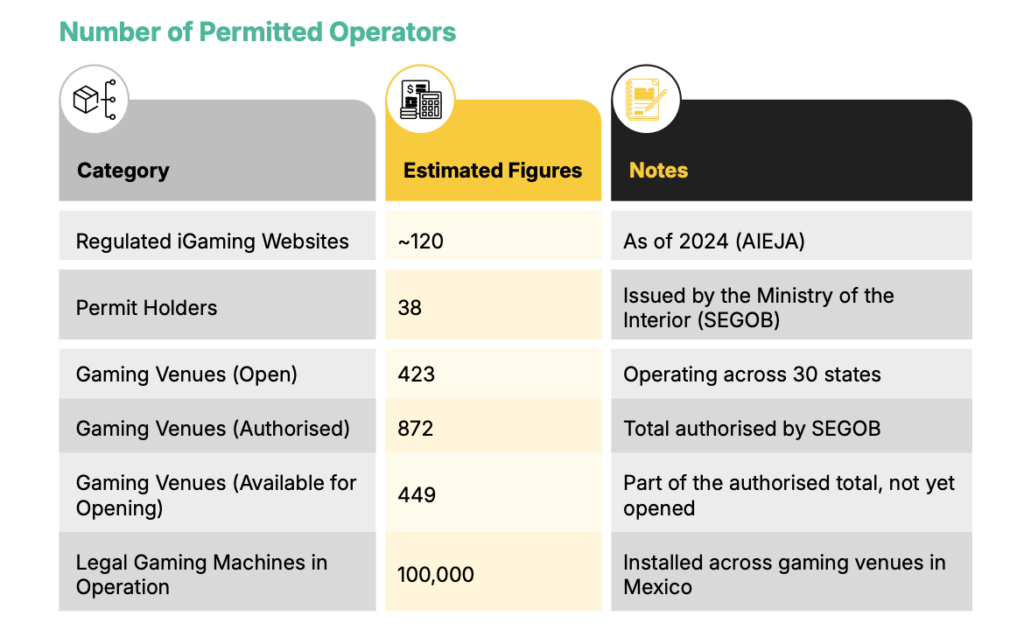

Behind the growth lies a complicated regulatory picture. Mexico’s iGaming industry is still governed by a law dating back to 1947, supplemented by partial reforms in 2004. Entry into the market requires partnerships with existing license holders, as no new licenses are currently issued. This has created a closed ecosystem where trust and negotiation are as important as financial muscle.

Reform, however, may be on the horizon. A new draft law is expected to reach Congress in 2026, potentially modernizing oversight, tax rules, and consumer protections. But with political shifts, economic headwinds, and a proposed tax hike from 30% to 50% of GGR, operators are wary. Until clarity arrives, the balance of risk and opportunity remains delicate.

Why Blask Insights Matter

Amid this uncertainty, Blask provides clarity. By tracking visibility, engagement, and conversion intent, our metrics go beyond static revenue estimates to reveal where brand power is moving. In Mexico, this means highlighting not only the incumbents but also the disruptors with the potential to redefine the market in the coming years.

The Road Ahead

Mexico is now firmly established as Latin America’s next digital gambling powerhouse. A youthful population, strong sports culture, and rapid digital adoption create fertile ground for growth. But with outdated laws, heavy taxation, and the presence of grey-market operators, success demands deep local knowledge and long-term commitment.

The NEXT.io Mexico report makes clear that the winners will be those who can adapt quickly, build trust with players, and turn visibility into lasting customer value. As online revenue overtakes retail for the first time, Mexico is no longer just a market to watch; it’s the one that will define the next chapter of iGaming in Latin America.