- Updated:

- Published:

Britain is still betting — but the tax rise turns steadiness into a stress test

The story SiGMA tells, using fresh Blask UK data, is not the one Britain’s gambling debate usually prefers. For months, the political conversation has been dominated by pressure: affordability checks, public-health framing, and the promise that tighter rules would cool demand.

Yet Blask’s charts suggest the opposite. Britain’s iGaming market, at least through late 2025, has behaved less like an industry in retreat and more like a habit adjusting to scrutiny—bending, pausing, then returning.

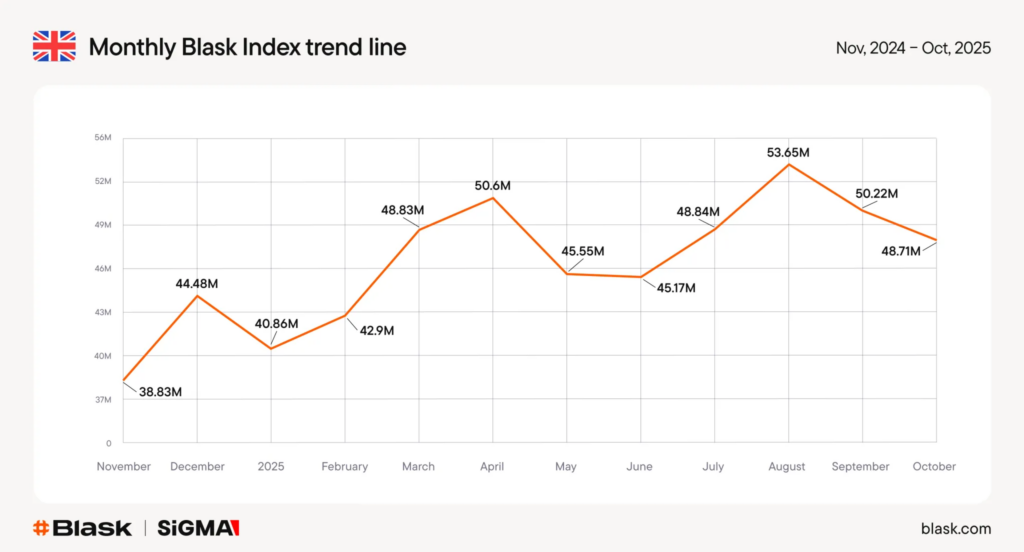

Blask’s Index — a proxy for market engagement and public interest — climbed over 21% from November to April, dipped roughly 9% in early summer, then rose again to a warm seasonal crest in August (53.6M) before settling into a calmer autumn rhythm.

The point the author keeps returning to is not just the peak, but the persistence: the curve rises and falls, but does not collapse.

And then the politics arrive.

On 26 November, the UK Budget introduced what the article frames as the most severe economic pressure on the sector in a generation: Remote Gaming Duty rising from 21% to 40% from April 2026, with additional changes to betting duty flagged for later years.

The question shifts from “Are Brits still betting?” to something more consequential: where will that betting flow when margins are squeezed—staying inside the regulated system, or leaking outward to the edges.

The market’s size — and its unusual dominance by local brands

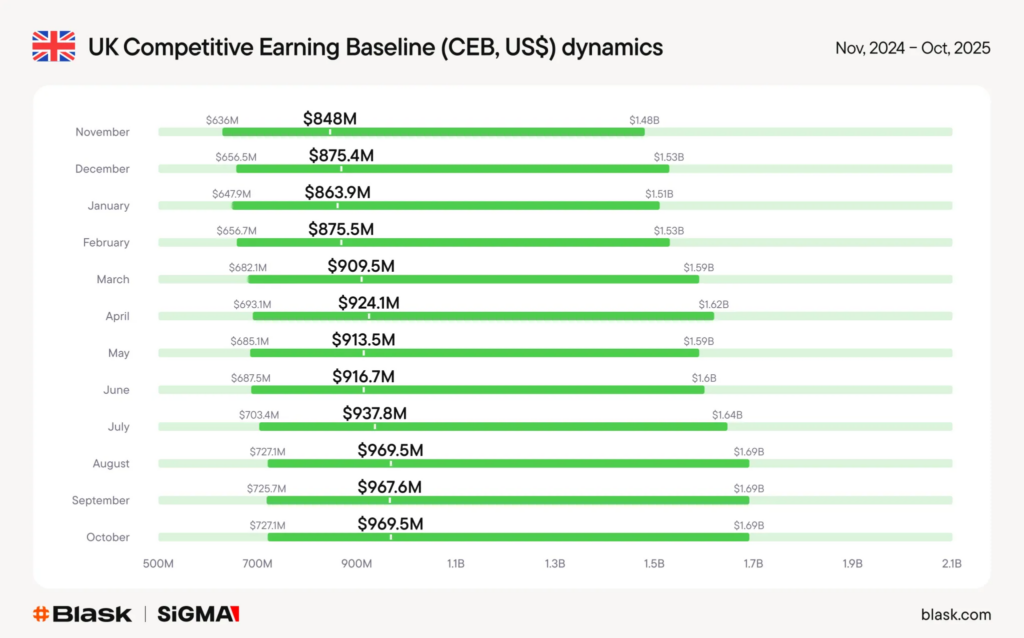

One reason the piece feels urgent is the scale. In Blask’s framework, the UK leads the monitored world for earnings potential. The country’s Competitive Earning Baseline (CEB ) grew about 14% year-on-year, from roughly $636M in Nov 2024 to $727M by Oct 2025 (the article also translates this into approximate euro ranges).

But the more revealing statistic is market structure: local brands maintained about 93% share of both attention and projected earnings throughout the year.

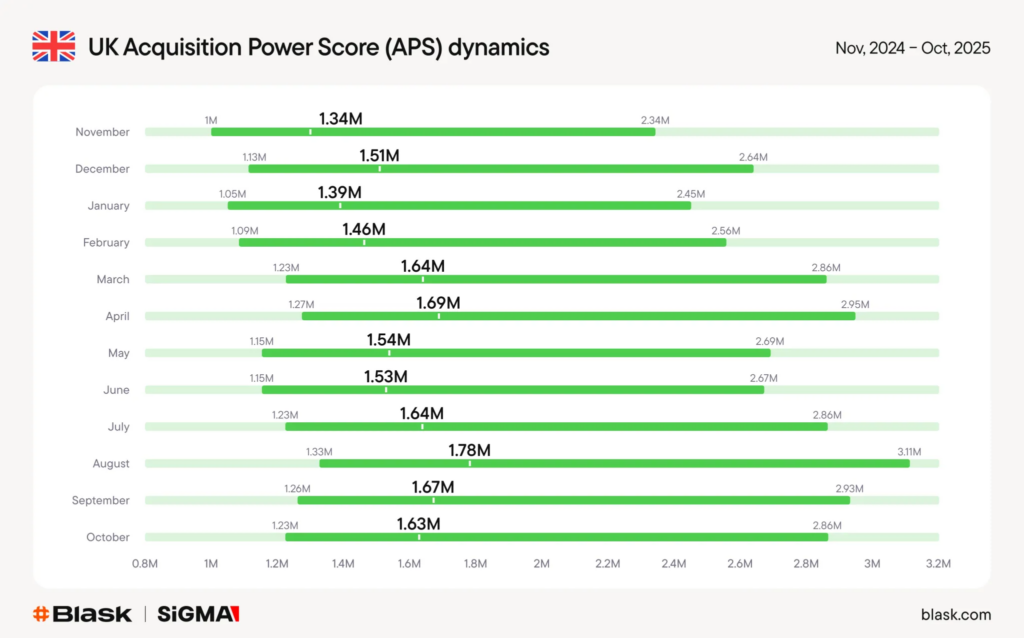

Offshore operators, in this dataset, sit in the single digits (around 7% of total CEB) and they account for only a small fraction of acquisition reach (about 3% of APS).

That dominance matters because the Budget’s tax shock does not land on a fragile market. It lands on one that appears, so far, remarkably consolidated inside the licensed ecosystem.

The rhythm of the UK market: weekends, summer, and one race that still moves the needle

The article spends time describing the UK’s “heartbeat”—the kind of texture numbers can show when you look beyond monthly totals.

In Blask’s readout, engagement concentrates around the weekend. The busiest hours cluster around Friday and Saturday nights (midnight UTC, roughly evening-to-midnight UK time) — a reminder that iGaming demand is still tied to leisure patterns as much as to sport.

And sport still matters. The sharpest spike in the year, as highlighted, comes on 5 April 2025, aligned with Grand National day — a moment that acts like a cultural lever, pulling attention upward in a way few policy announcements ever do.

A familiar top tier — and what steadiness really looks like

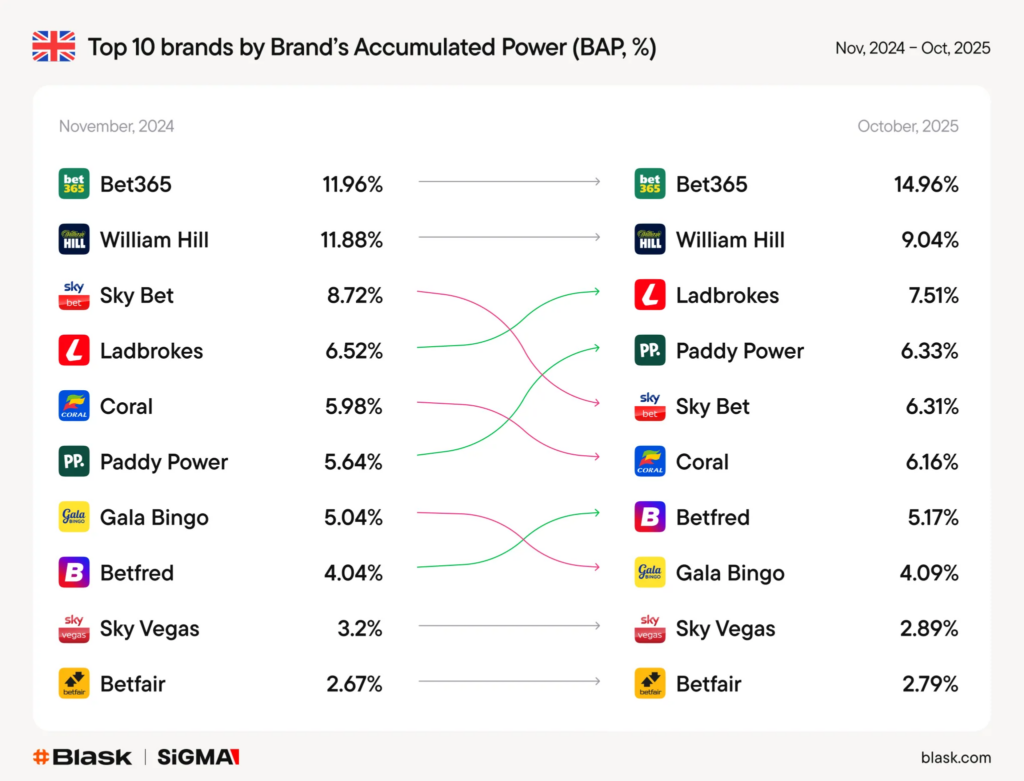

On the operator side, the author points to stability at the top: bet365 and William Hill trading the leading position, with the usual cohort — Sky Bet, Ladbrokes, Coral, Paddy Power — forming the recognisable upper tier.

The UK, in this telling, is a mature market where brand familiarity functions like consumer assurance: the digital descendants of the old high-street betting shops. It’s one of the reasons the data can show resilience even while the public argument about gambling grows harsher.

The Budget as inflection point: when policy stops being theory

Where the piece becomes less descriptive and more cautionary is in its framing of the April 2026 tax change. The author’s thesis is simple: the UK’s stability was measured before the Treasury rewrote the economics.

Higher duty means thinner margins. Thinner margins can mean less generous bonuses, tighter product terms, fewer promotional incentives, and — in the fear voiced by industry groups — a narrower price and experience gap between regulated and unregulated offerings.

The article explicitly raises the possibility of channelisation risk: if legal operators become less competitive, the illegal market does not need to grow through advertising; it only needs to wait.

It also notes the political logic: the Treasury forecasts substantial revenue upside, plus funding earmarked to combat the illegal market.

But the industry response quoted is blunt: trade bodies and major operators warn that tax harmonisation can backfire, pointing to other jurisdictions where higher taxes coincided with stronger illegal market gravity.

A carve-out for racing — and what markets think matters now

One clear exception is horseracing. The article highlights that horserace betting duty remains at 15%, a decision welcomed by the British Horseracing Authority, framed as protecting jobs and the sport’s economic ecosystem.

Investors, meanwhile, interpret the Budget in their own language. The piece describes a market reaction that ultimately rewards scale and diversification — companies with broader geographic portfolios can absorb UK pressure better than those heavily exposed to the domestic market.

The unresolved question Blask will answer next

The article ends where it began: with endurance. Britain’s market “breathes,” it argues—softening under pressure but returning.

What changes now is that the next cycle will not be shaped only by seasonality and sport, but by a structural shift in economics.

Through late 2025, Blask data suggests the regulated system still holds overwhelming market share. After April 2026, the test becomes whether that loyalty remains intact when the cost of being regulated rises sharply.

If the UK has been a story of steadiness, the Budget is framed as the moment that steadiness becomes a trial.