- Updated:

- Published:

iGaming market weekly report | Feb 2–8, 2026

Analyzing worldwide iGaming markets via Blask Index weekly shifts — identifying regions where operators are scaling up and markets experiencing slowdowns.

Week’s headline

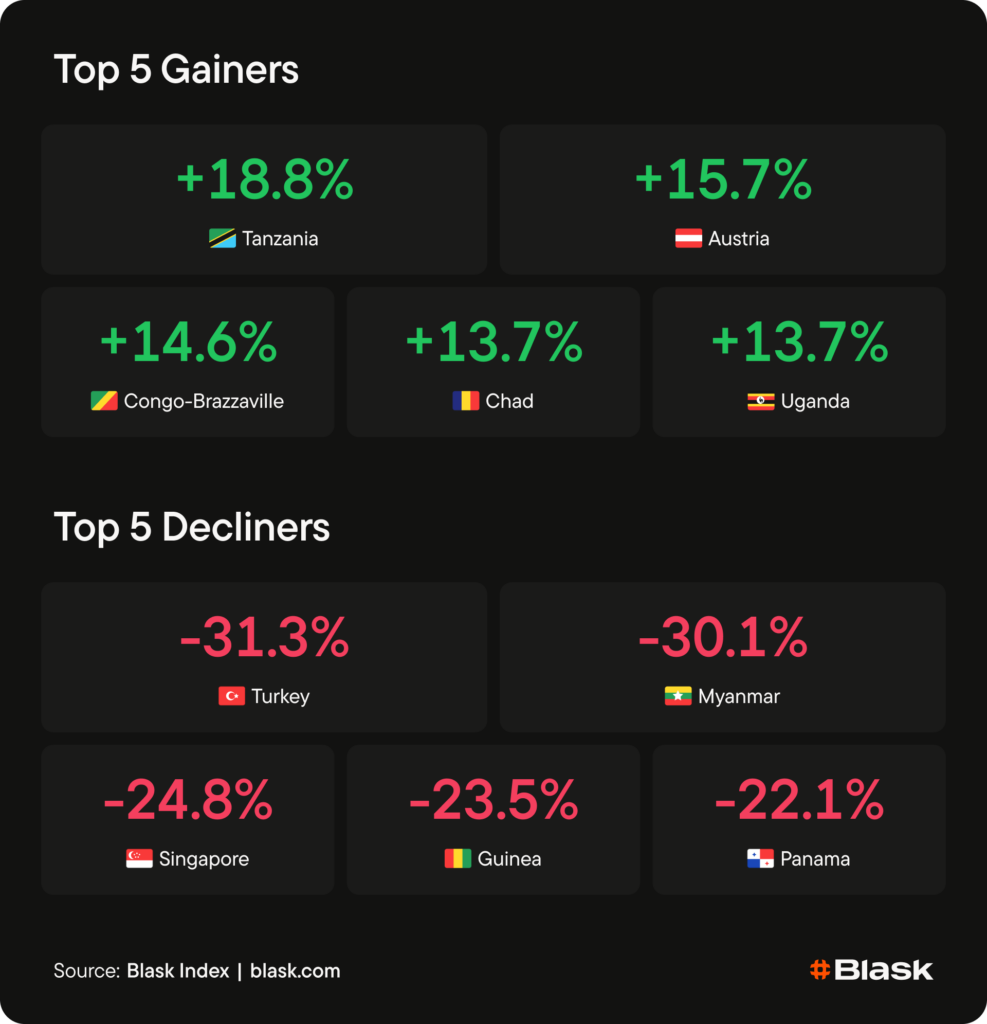

Event gravity dominated the tape, with upside concentrated in football-driven Africa and the first clear Olympics-linked lift in Europe. Tanzania (+18.8%) and a wider African cluster (Congo +14.6%, Chad +13.7%, Uganda +13.7%) moved in sync as CAF Champions League and Confederation Cup Matchday 5 (Feb 6–8) kept continental fixtures in the weekly newsflow, while Uganda also had domestic cup action on Feb 6 that added local football attention. In Europe, Austria (+15.7%) was the only market to show a clean early-cycle uptick tied to the Milano Cortina 2026 opening (Feb 6), suggesting the Olympics impulse has started but hasn’t yet broadened across other winter-elastic countries.

The downside was narrower and more headline-sensitive. Turkey (–31.3%) repriced on a crackdown week, with illegal-betting enforcement and crypto-linked asset-freeze headlines dominating Feb 2–8 and pushing the market into a clearly risk-off posture. Panama (–22.1%) was the opposite type of move: a mechanical pullback after last week’s lottery-driven spike, fading once the monthly draw cleared the immediate newsflow.

Asia-Pacific printed heavy declines without clean attribution in this pass. Myanmar (–30.1%) and Singapore (–24.8%) both sold off sharply, but no market-specific public triggers were identified inside the Feb 2–8 window.

Top gainers

- Tanzania +18.8% — Simba SC (Tanzania) played Petro de Luanda in the CAF Champions League on Feb 7 (Group D), keeping Tanzanian football in the continental matchday newsflow during the week.

- Austria +15.7% — The Milano Cortina 2026 Winter Olympics opened on Feb 6. Austria has long-standing winter-sports traditions and consistently strong performance across alpine and other snow disciplines, keeping national attention tightly coupled to the Games’ opening-week news cycle.

- Republic of the Congo +14.6% — AS Otohô played Stellenbosch FC on Feb 8 in CAF Confederation Cup Group D, keeping Congolese football in the continental matchday newsflow during this decisive week.

- Chad +13.7% — CAF Champions League and Confederation Cup matchdays drove pan-African betting engagement as the decisive final group stage round determined quarterfinal qualification across the continent.

- Uganda +13.7% — Uganda’s Stanbic Uganda Cup Round of 64 matches on Feb 6 (including Police FC 3-0 Mairye), combined with the Feb 7-8 CAF club competition matchdays that engage football fans continent-wide, drove betting activity as Uganda’s domestic cup winner earns CAF Confederation Cup qualification.

Top decliners

- Turkey –31.3% — The decline coincided with high-visibility illegal-betting enforcement and crypto-linked asset-freeze headlines during Feb 2–8, keeping the market under an active crackdown narrative across the window.

- Myanmar –30.1% — No clear triggers identified for the decline during Feb 2-8 week.

- Singapore –24.8% — No clear triggers identified for the decline during Feb 2-8 week.

- Guinea –23.5% — No clear triggers identified for the decline during Feb 2-8 week.

- Panama –22.1% — A straightforward pullback after last week’s lottery-driven spike. With the nationally shared monthly draw no longer in the immediate newsflow, attention mean-reverted toward baseline across Feb 2–8.

Market spotlight: Turkey | –31.3%

Turkey printed the week’s steepest downside move, sliding –31.3% WoW as enforcement narratives dominated the market’s public tape throughout Feb 2–8. The drop fits a familiar Turkey profile: when a crackdown becomes the headline frame, betting-related search activity typically compresses and volatility increases within the week.

The mechanism was unusually concrete. In-week reporting described a crypto-linked asset-freeze track tied to alleged illegal betting networks. Coverage included Tether freezing more than $500M at authorities’ request, with the enforcement push expanding throughout the window.

Turkey is also a structurally volatile market in this dataset: this is the fifth consecutive week it has appeared in our digest, reinforcing how quickly the country’s demand signal can swing when the headline tape turns.

Regional snapshot

Europe

For now, Austria is the only market showing a clearly visible lift tied to the Winter Olympics. The Games only opened on Feb 6, so this is still the early phase of the cycle — other winter-elastic European markets can still catch up as the competition schedule and headline density build.

Africa

Across Tanzania, Republic of the Congo, Chad, and Uganda, the upside week landed while two CAF club tournaments are in an active, decisive group-stage phase. CAF Champions League and CAF Confederation Cup — Matchday 5 ran Feb 6–8, with qualification pressure rising ahead of the final round.

Asia-Pacific

Myanmar and Singapore both moved sharply lower this week, but no clear, market-specific public trigger surfaced inside the Feb 2–8 window in this pass.

Next week watchlist

Austria

Olympics first-week momentum. The event gravity remains live as medal narratives compound. Winter-sports elastic markets typically hold an elevated baseline through the first dense competition block, then taper. Expect

Turkey

Volatility carryover. Country has appeared in our digest for five consecutive weeks, reinforcing how quickly its demand signal can swing. Expect another high-variance week as the market remains headline-sensitive.

Methodology note

Blask Index tracks real-time iGaming player interest via AI-analyzed Google search data, updated hourly and filtered to remove low-intent noise (scams, complaints). WoW% measures momentum: positive indicates growing attention; negative indicates declining attention.