- Updated:

- Published:

iGaming market weekly report | Jan 19–25, 2026

How player acquisition interest shifted across global betting markets, measured by Blask Index week-over-week (WoW) momentum.

Week’s headline

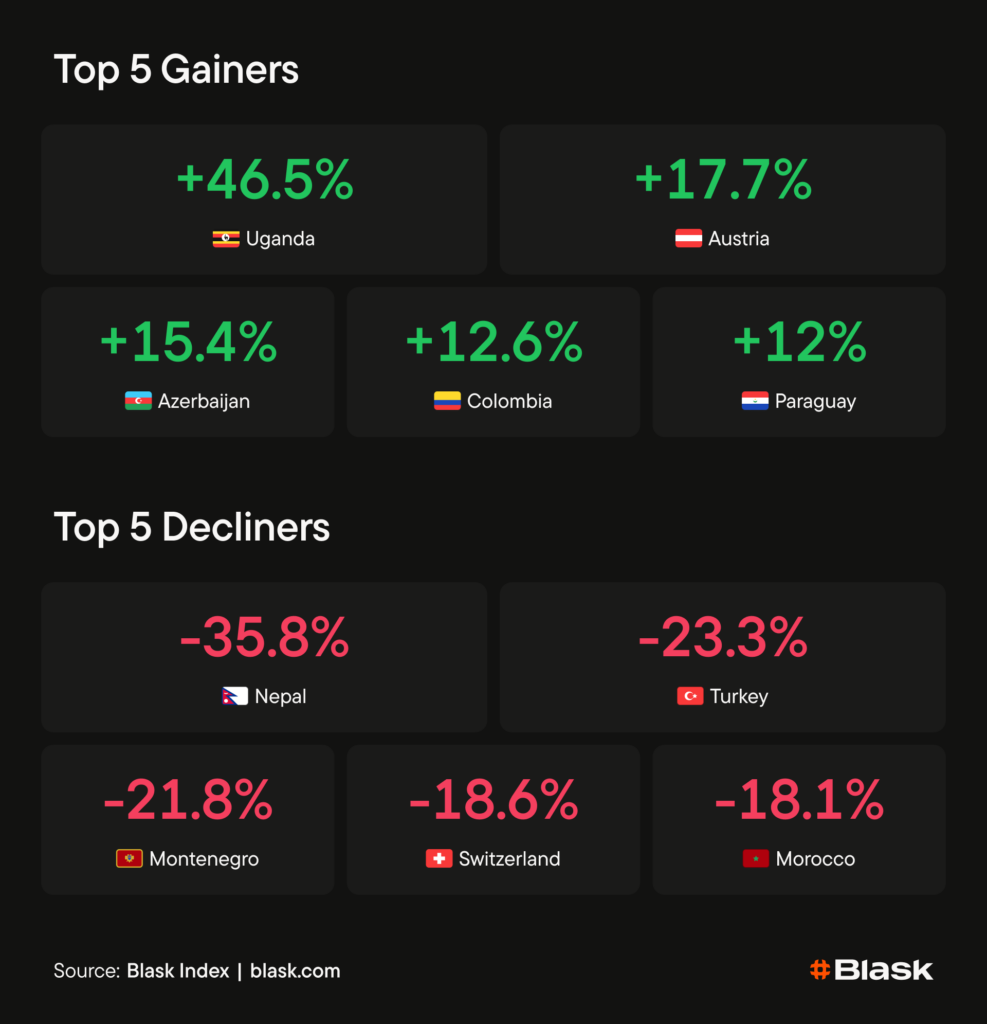

Event-driven demand dominated the tape, with upside concentrated in European calendar effects and downside shaped by suppression and post-event decay. Austria (+17.7%) led Europe on Kitzbühel’s Hahnenkamm weekend, while Sweden (+9.9%) and Norway (+8.5%) moved as a Nordic pair on EHF EURO main-round matchday density. Uganda (+46.5%) printed the biggest number, but it was a normalization bounce after last week’s election-linked connectivity disruption pushed acquisition intent below baseline.

The winners were clean mechanism markets: Austria’s Alpine attention funnel, Nordic tournament timing, and Colombia (+12.6%) on football-final intensity driving short-burst odds browsing and operator shopping. The Netherlands (+9.4%) was the structural outlier — illegal-market leakage narratives amplified regulated-vs-offshore comparison behavior and lifted acquisition intent without a sports anchor.

Losers split into three buckets. Turkey (–23.3%) was suppression-led, consistent with enforcement-driven access and payment friction. Switzerland (–18.6%), Morocco (–18.1%), and Montenegro (–21.8%) were event hangovers as attention rotated off prior peaks. Belgium (–12.7%) and Nepal (–35.8%) extended second-week declines with no visible external catalyst.

Top gainers

- Uganda +46.5% — A normalization bounce. Last week’s election-linked connectivity disruption compressed acquisition intent. During Jan 19–25, access stabilized and operator search activity reverted toward baseline, unwinding the prior drop rather than printing a durable expansion.

- Austria +17.7% — A textbook event gravity candle. Hahnenkamm weekend in Kitzbühel (Jan 23–25) concentrated mainstream attention into a three-day acquisition funnel. Reuters coverage amplified the mainstream signal as the weekend opened on Jan 23, sustaining odds-adjacent intent through Sunday.

- Azerbaijan +15.4% — the Azerbaijan Premier League matchweek kicked off on Jan 23, restoring a regular matchday rhythm that reliably converts into odds browsing and operator comparisons. For a mid-size market, league restart weeks tend to print outsized WoW volatility because baseline discovery is thinner and fixture-timed intent shows up fast.

- Colombia +12.6% — The Superliga BetPlay title match delivered the cleanest LATAM sports trigger of the week. A high-salience final concentrates casual fan attention, then converts into promo hunting and operator shopping within hours of the result. Independiente Santa Fe was crowned champions on Jan 21.

- Paraguay +12.0% — the Torneo Apertura kicked off on Jan 23, reopening weekly matchday rhythms that reliably convert into odds browsing and operator comparison. With the season starting earlier than usual ahead of the 2026 World Cup, fixture-timed discovery flows re-activated fast, which can print outsized WoW swings in a mid-size market.

Top decliners

- Nepal –35.8% — The market declined for a second consecutive week, with no visible external trigger.

- Turkey –23.3% — A major Istanbul illegal-betting operation enforcement shock disrupted payments and access, compressing the deposit funnel that drives casual discovery. Roughly 3bn TRY was reportedly seized on Jan 20, a high-friction catalyst that typically maps to short-term demand compression.

- Montenegro –21.8% — The drop tracks a tournament-exit fade. Switzerland’s win on Jan 20 in EHF EURO 2026 effectively ended Montenegro’s main-round path, removing the national-team “event gravity” that sustains short-burst sportsbook browsing. As a small base market, Montenegro is structurally volatile — even single-match outcomes can swing acquisition intent sharply week to week.

- Switzerland –18.6% — Event hangover with attention rotation: Wengen’s Lauberhorn races ran Jan 16–18, then the Alpine narrative shifted into Austria’s Kitzbühel weekend, leaving Switzerland without an equivalent domestic hook inside Jan 19–25.

- Morocco –18.1% — A clean post-AFCON hangover. The tournament hosting cycle ended on Jan 18, and with no follow-on domestic sports hook inside Jan 19–25, acquisition intent mean-reverted toward baseline. The AFCON final fallout kept headlines alive on Jan 19, but attention shifted from matchday betting intensity to post-mortem coverage, so discovery flows cooled rather than sustained.

Market spotlight: Uganda | +46.5%

Uganda posted the week’s largest upside move at +46.5% WoW, but the profile was normalization, not breakout growth. The prior week was distorted by election-linked connectivity disruption, which compressed acquisition intent and mechanically suppressed discovery flows. Once the disruption cleared, the market snapped back.

During Jan 19–25, access stabilized and operator search activity reverted toward baseline, effectively unwinding the previous week’s drawdown. The shape of the move matters: it reads as a rebound from an artificially low starting point rather than fresh demand creation.

Regional snapshot

Europe

Europe was dominated by event gravity winners and post-event losers. Austria (+17.7%) and Sweden (+9.9%) were clean schedule-driven upsides, while Switzerland (–18.6%) was classic Alpine hangover as Wengen cleared and attention rotated into Kitzbühel.

Middle East

Turkey (–23.3%) drove the region’s risk tone via enforcement-led suppression, where payment/access disruption compresses discovery flows fast. Azerbaijan (+15.4%) sat on the opposite side of the tape, but without a single dominant in-window public catalyst it should be treated as a momentum print rather than a proven story.

Africa

Uganda (+46.5%) was the region’s standout move, but it read as a normalization bounce after last week’s election-linked connectivity disruption suppressed discovery flows. Morocco (–18.1%) showed a post-AFCON hangover as tournament-driven intent cleared and the market reverted toward baseline.

Asia-Pacific

Nepal (–35.8%) was the deepest downside move, but it lacked a clean public driver. Malaysia (–10.9%) followed a similar compression pattern, consistent with baseline cooling rather than a single event shock.

Next week watchlist

Austria — Post-Hahnenkamm comedown

Kitzbühel is a classic three-day funnel: once the weekend clears, acquisition intent usually mean-reverts unless another national sports anchor lands immediately. Expect a cooling pattern as the Alpine headline window moves on.

Sweden — Tournament persistence into knockout attention

EHF EURO 2026 remains live through Feb 1, and host-market intent tends to stay elevated when fixtures stay high-salience. If Sweden’s match schedule stays headline-dense, expect continued operator shopping on matchdays rather than a full reset.

Turkey — Enforcement aftershocks and payment friction

Post-operation weeks typically keep channels unstable: friction suppresses casual discovery, but fresh follow-up headlines can also spike curiosity. The base case is suppression persistence with intermittent volatility candles.

Methodology note

Blask Index tracks real-time iGaming player interest via AI-analyzed Google search data, updated hourly and filtered to remove low-intent noise (scams, complaints). WoW% measures momentum: positive indicates growing attention; negative indicates declining attention.