- Updated:

- Published:

iGaming market weekly report | Jan 26–Feb 1, 2026

Tracking global betting markets through Blask Index WoW momentum — where operators are ramping up player acquisition and where interest is cooling off.

Week’s headline

Week 5 split cleanly between headline-driven repricing and calendar-led flow. The upside concentrated where mainstream narratives widened discovery: Singapore’s earnings news cycle pulled casual attention into casino-adjacent searches, Panama’s lottery moment lifted broad gambling curiosity, and Turkey’s enforcement headlines drove substitution browsing around access and funding routes.

The rest of the winners were pure sports density. Botswana’s packed matchday and Zimbabwe’s U-19 World Cup coverage translated broadcasts into short, high-intensity bursts of odds-adjacent intent and operator comparison behavior.

The downside was defined by missing hooks and policy salience. Czech Republic and Bulgaria moved lower without a clear in-window trigger. Poland softened under elevated compliance risk, while Bangladesh mean-reverted after the BPL cycle ended and Finland’s reform framing shifted attention from play to policy, muting acquisition intent.

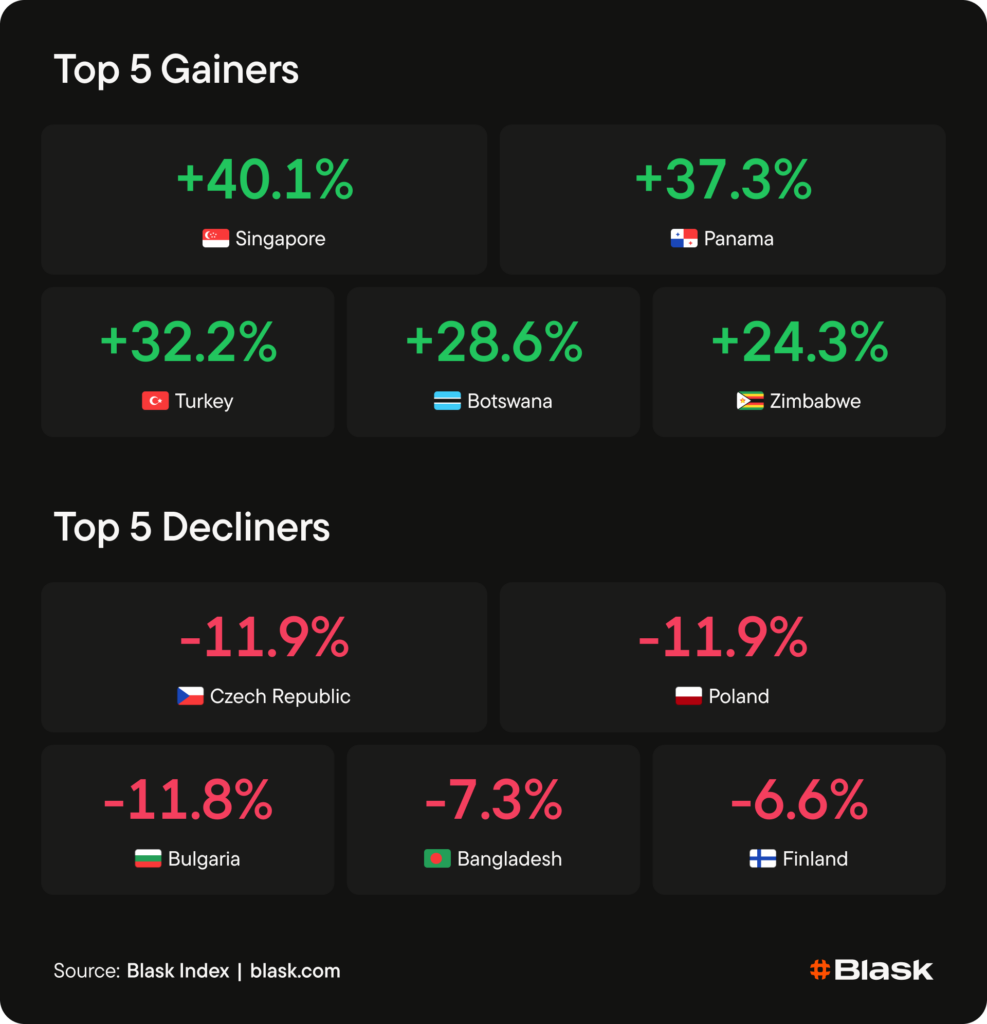

Top gainers

- Singapore +40.1% — Corporate headline gravity did the work. Marina Bay Sands’ record quarter and earnings coverage spotlit the flagship asset, pulling mainstream attention into casino-adjacent queries.

- Panama +37.3% — The nationally shared monthly lottery draw drove a sharp increase in gambling-related search activity, lifting overall market attention. Elevated interest typically translates into more operator and bonus comparisons, as audiences shift from checking results to exploring available gambling options and platforms.

- Turkey +32.2% — authorities continue its crackdown on illegal gambling: police raided a network accused of laundering funds for illegal bookmakers. This time, the market printed positive WoW momentum, reversing the prior week’s softness.

- Botswana +28.6% — Domestic Premier League matchday intensity peaked on Jan 31 with multiple fixtures landing the same day, which typically concentrates weekend sports attention and lifts odds-adjacent browsing into operator comparisons.

- Zimbabwe +24.3% — U-19 World Cup Super Six coverage dismantled Zimbabwe in mainstream cricket headlines, a classic “event gravity → odds browsing” funnel. Tournament match density tends to create short, high-intensity spikes in operator comparison and promo searches.

Top decliners

- Czech Republic –11.9% — No clear country-specific trigger surfaced during Jan 26–Feb 1.

- Poland –11.9% — Policy and compliance headlines raised perceived risk. Reports on moves to strengthen criminal penalties around gambling-related offences typically dampen affiliate activity and shift consumer interest toward legality and safety checks.

- Bulgaria –11.8% — No clear country-specific trigger surfaced during Jan 26–Feb 1.

- Bangladesh –7.3% — The Bangladesh Premier League ended on Jan 23, removing a dense stream of match-day betting moments. With no comparable national sports anchor inside Week 5, tournament-led attention washed out and operator/bonus browsing reverted to baseline.

- Finland –6.6% — Institutional reform noise cooled the funnel. The government announcement on adding licence fees for gambling services formalized the regulatory frame. These stories shift attention from play to policy and often compress promotional aggression in the short cycle.

Market spotlight: Singapore | +40.1%

Singapore printed the week’s cleanest outlier move, jumping +40.1% WoW in a mature, tightly controlled gambling environment where organic swings are usually small. The lift aligned with a concentrated corporate news burst around Marina Bay Sands’ record quarter, which kept the integrated resort in mainstream business coverage and extended the headline half-life beyond a single earnings print.

Mechanically, this is earnings-headline demand rather than a sports calendar effect. When a jurisdiction’s flagship casino becomes a business-desk story, casual users who wouldn’t normally search operators get pulled into adjacent queries. That attention then leaks downstream into classic acquisition behavior — offer comparison, operator discovery, and “where to play” browsing — because the newsflow normalizes gambling as part of the broader entertainment/IR narrative.

Regional snapshot

Europe

CEE stayed risk-off, with Poland (–11.9%), Czech Republic (–11.9%), and Bulgaria (–11.8%) sliding in a tight band while Finland (–6.6%) added drag. Hungary (+20.8%) broke the pattern as Men’s EHF EURO matchdays concentrated national sports attention, lifting odds-adjacent discovery even as the rest of the region cooled.

Africa

Sub-Saharan Africa skewed risk-on as a cluster, with Botswana (+28.6%), Zimbabwe (+24.3%), and South Africa (+20.0%) moving together. The pattern reads like synchronized sports-and-promo uplift: broad discovery flows improved across multiple markets, even where no clean country-specific catalyst dominated the public tape.

Next week watchlist

United States

Super Bowl week buildup should lift bookmaker activity. As coverage intensifies and bettors start comparing lines and promos, odds-adjacent browsing typically translates into an operator shopping.

Turkey

Post-enforcement volatility. If payment/access rails tighten further, substitution searches can stay elevated, but conversion quality deteriorates under friction.

Singapore

Earnings afterglow comedown. Without fresh follow-through, Week 5’s corporate-news lift should mean-revert as business coverage cycles out and casual attention reallocates.

Nordic countries

Milano Cortina 2026 opening (Feb 6) should lift winter-sports markets. As prime-time broadcasts and medal storylines ramp up, winter nations often see a short-term spike in odds-adjacent browsing.

Methodology note

Blask Index tracks real-time iGaming player interest via AI-analyzed Google search data, updated hourly and filtered to remove low-intent noise (scams, complaints). WoW% measures momentum: positive indicates growing attention, negative indicates declining attention.