How Blask’s data helps identify undervalued markets in iGaming

Blask’s data platform uncovers undervalued iGaming markets, revealing emerging opportunities in less competitive regions. While big brands target saturated areas, Blask helps you secure an early advantage in high-growth markets.

While many companies are battling it out in high-profile regions like India, Brazil, and the Netherlands, the real untapped potential often lies in markets that are still under the radar. These undervalued markets offer unique opportunities for those ready to act.

Blask’s comprehensive data platform is designed to help you uncover these hidden gems, allowing you to make smarter, data-driven decisions and stay ahead of the competition.

Let’s explore how Blask can help you identify undervalued markets and why it’s crucial for your business growth.

Why does identifying undervalued iGaming markets matter?

Because growth isn't always found in the most obvious places.

While well-known markets offer large player bases, they’re also highly saturated and expensive to compete in.

On the other hand, emerging markets in Latin America, Southeast Asia, Africa, and Eastern Europe present growing player bases with much less competition, offering a more cost-effective way to expand.

Countries that were once considered "developing" are now seeing a rapid expansion of their middle class, which is driving increased disposable income and growing interest in online gaming. These economies offer significant long-term growth potential. By establishing a presence early, you can secure a foothold in markets that are set to experience explosive growth over the coming years.

Lower competition = higher rewards.

With fewer brands vying for player attention, your marketing spend can go much further, allowing you to build brand recognition and loyalty faster. This can result in higher returns on investment as you tap into an audience that’s not yet bombarded by big players.

For example, in a market with limited local competition, your iGaming expertise can be the differentiator that quickly positions you as a dominant player. By offering localized products and experiences, you can rapidly capture market share and establish your brand as a leader before competition intensifies.

First-mover advantage in emerging markets.

Being an early mover in an undervalued market allows you to set the tone for the industry, gain player trust, and secure a substantial portion of the market before larger brands even enter. This advantage is especially valuable in regions where iGaming is still in its infancy but showing strong growth potential.

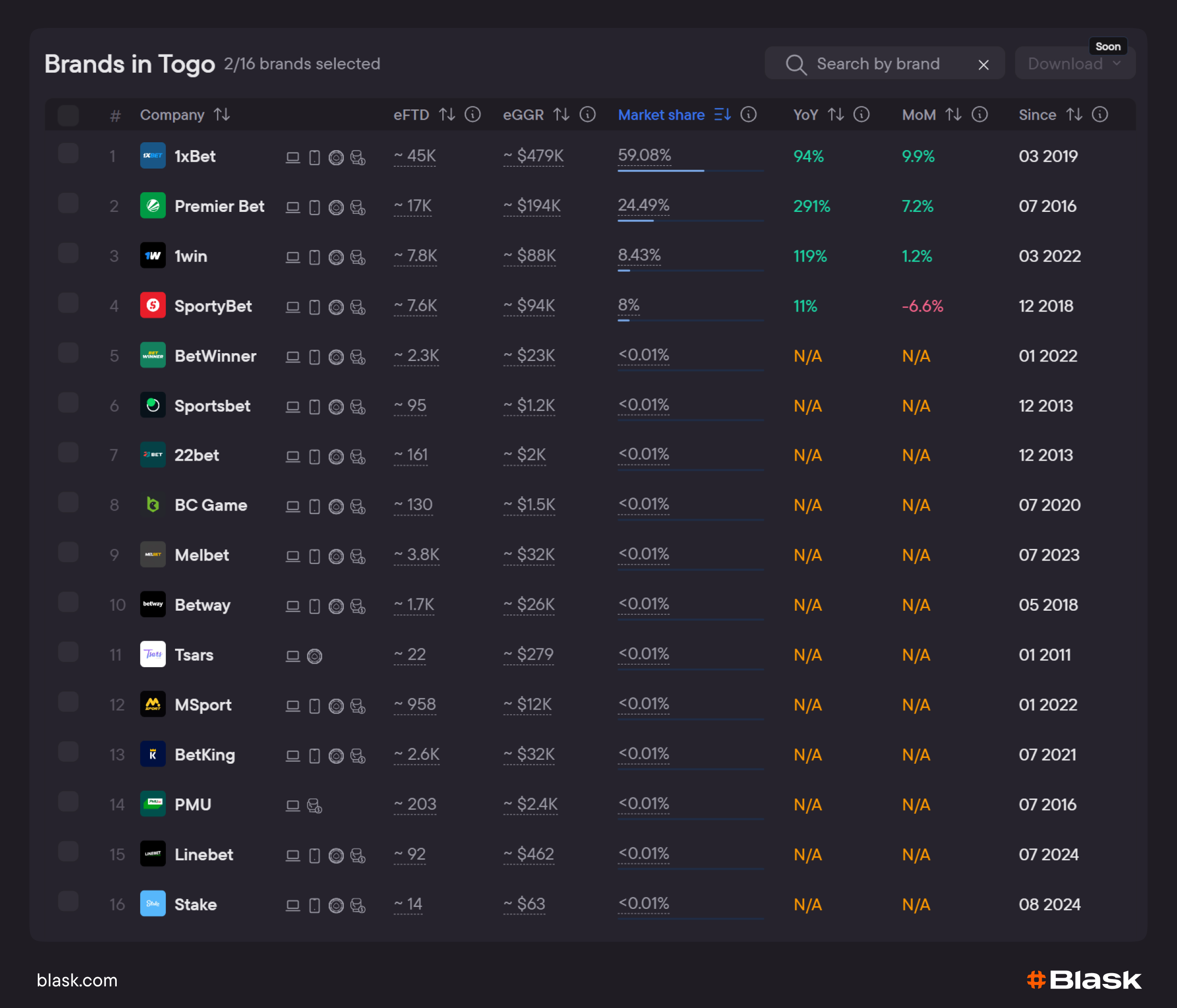

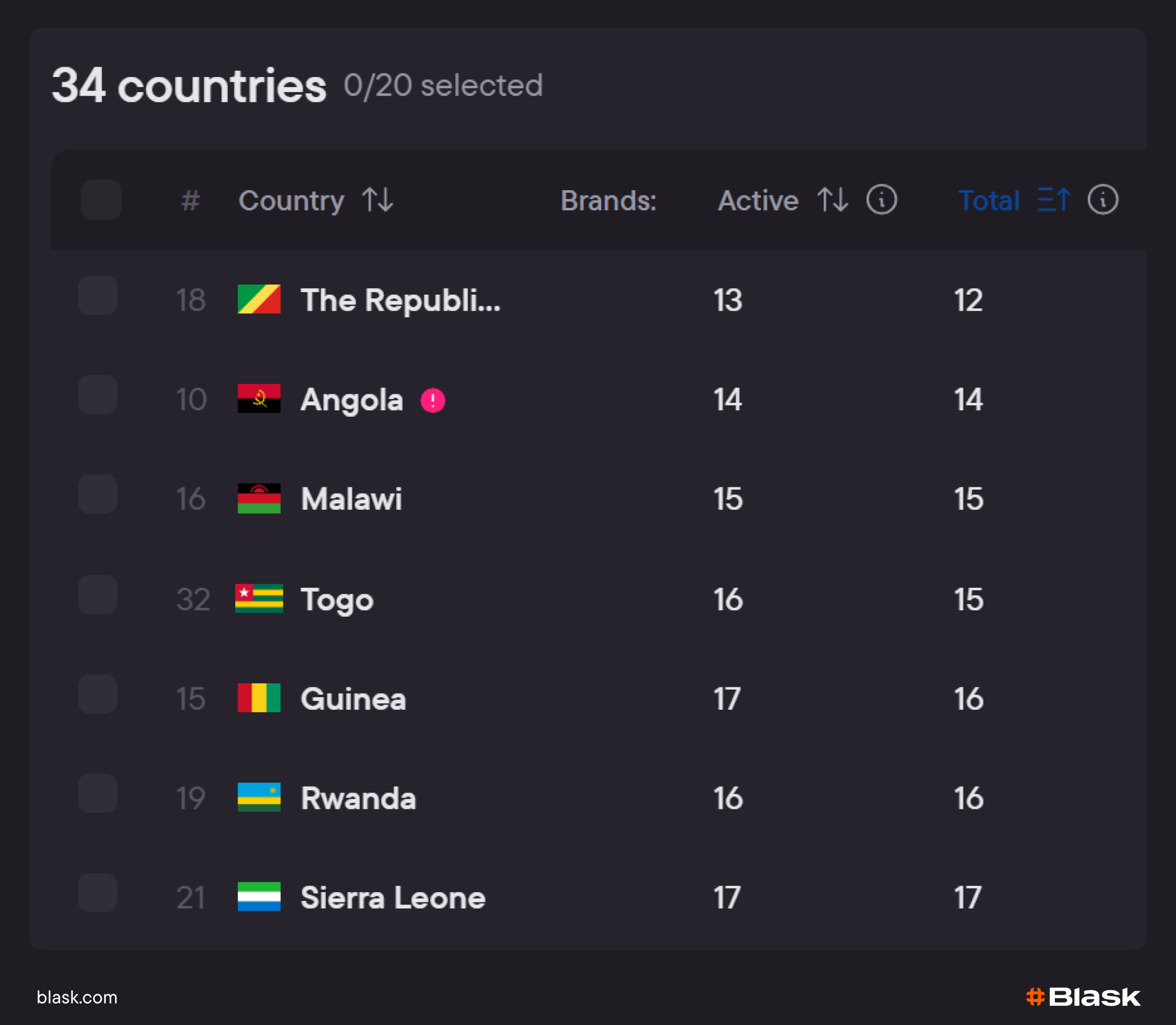

Consider Africa as an example, where mobile gaming is seeing rapid expansion. Countries like Togo and Angola currently have few established brands, but player interest is on the rise. By entering these markets early, with a focus on mobile-friendly experiences and localized payment options, your brand could become a market leader before international competitors have the chance to enter.

As these undervalued markets grow, both in terms of player numbers and infrastructure, you can continuously adapt to local preferences and changing regulations. This adaptability not only helps you maintain a strong presence but also allows you to grow alongside the market.

The Blask’s role in identifying the undervalued markets.

Relative Market Share (RMS) → Brand's Accumulated Power (BAP)

Estimated First-Time Deposits (eFTD) → Acquisition Power Score (APS)

Estimated Gross Gaming Revenue (eGGR) → Competitive Earning Baseline (CEB)

You can read more about the reasons for these changes here (BAP) and here (APS and CEB).

Blask is specifically designed to help you uncover these undervalued opportunities by providing comprehensive, real-time insights into player interest, market size, and financial performance across different regions. By analyzing key metrics like Blask Index, eGGR, and eFTD, you can get a clear picture of where the best opportunities lie.

Blask tracks the dynamics of iGaming markets through three key metrics:

- Blask Index: This is a measure of player interest in iGaming, based on search volume and online engagement. It’s your go-to metric for understanding how much attention a market is receiving and whether interest is growing or declining.

- eGGR (Estimated Gross Gaming Revenue): This financial metric estimates the total revenue being generated in a market, helping you gauge the financial health and potential profitability of entering a specific region.

- eFTD (Estimated First-Time Deposits): This metric tracks the number of players making their first deposits in iGaming platforms, providing a snapshot of player acquisition trends and market growth.

Together, these metrics give you a comprehensive view of market demand (Blask Index) and its financial potential (eGGR and eFTD), helping you make smarter decisions about where to allocate resources and enter new markets.

Find countries with low competition.

Blask provides a complete overview of every iGaming brand operating in any given country, giving you a strategic advantage in finding markets with minimal competition.

With Blask, you can easily identify countries where few, if any, brands are active. This means you can enter early, capture market share, and build strong brand recognition before the competition even considers the region.

You can focus on tailored marketing campaigns and localized product offerings that directly appeal to the local audience, just use the insights from Blask.

Spot markets that have declined due to political or regulatory issues.

Blask also helps you monitor countries where the iGaming market has sharply declined, whether due to political turmoil, regulatory restrictions, or other major disruptions. These markets may have been thriving before the disruption, and while they appear risky in the short term, they often offer huge potential for a comeback once the situation stabilizes.

With Blask, you can track how the Blask Index, eGGR, and eFTD metrics change in real time. Once you notice a slight uptick in these metrics after a downturn, it’s a signal that the market is starting to recover. This is your chance to go all in and enter the market during its rebound phase, positioning your brand to ride the wave of growth.

What looks like rapid expansion is often just the market returning to its previous levels, but entering at the right moment can lead to significant gains as the market bounces back.

Target small markets showing consistent growth.

Blask gives you the ability to spot small but promising markets by tracking steady increases in key metrics like the Blask Index, eGGR, and eFTD. Even if a market doesn’t show explosive growth, consistent, gradual increases are often indicators of strong long-term potential. By being the first to recognize and act on this steady growth, you can position your brand as a dominant player in that market before others even notice.

Once you’ve identified these markets, you can refine your approach by adapting to local market conditions, such as adjusting your offerings to suit player preferences or aligning with cultural gaming habits. This strategic entry allows you to build a foundation for sustained growth as the market continues to evolve.

Balance eGGR and eFTD for long-term success.

To fully understand a market’s potential, it’s essential to consider both eFTD and eGGR.

eFTD highlights how quickly new players are entering a market, signaling short-term growth potential. However, eGGR is a more critical measure of long-term success, indicating how engaged and loyal players are by showing ongoing revenue generation.

While acquiring new players (eFTD) is important, higher eGGR reveals a stronger, more sustainable market where players are likely to stay engaged, reducing acquisition costs. By using both metrics together, you can identify markets that offer both immediate opportunities and long-term profitability.

Frequently asked questions.

Why is it beneficial to explore undervalued iGaming markets instead of high-profile regions?

High-profile markets are highly competitive and saturated, driving up customer acquisition costs. Conversely, undervalued markets offer lower competition, cost-effective expansion opportunities, and the chance to establish a brand presence early. Emerging markets often have untapped player bases, allowing for rapid brand growth with lower marketing expenses.

What does Blask’s platform offer for identifying undervalued iGaming markets?

Blask’s platform provides real-time insights through key metrics like Blask Index, eGGR, and eFTD. These metrics help pinpoint markets with growing player interest, strong revenue potential, and rising first-time deposits, enabling informed market entry decisions and resource allocation.

What is the significance of Blask Index in analyzing market potential?

Blask Index measures player interest by tracking search volumes and online engagement, giving an immediate snapshot of a market’s attention levels. Markets with a high or rising Blask Index are likely to show strong demand, making this a valuable indicator of where interest is growing.

How does early entry in an undervalued market create a competitive advantage?

Early entry provides a first-mover advantage, allowing a brand to shape the local market, gain player trust, and establish dominance before competitors arrive. This head start can make your brand synonymous with trusted gaming experiences in the region, a status difficult for later entrants to challenge.

Why are eGGR and eFTD important for evaluating market health?

eGGR (Estimated Gross Gaming Revenue) highlights a market’s long-term revenue potential, while eFTD (Estimated First-Time Deposits) shows the rate of new player acquisition. Together, they provide a balanced view of both immediate growth and sustainable profitability, allowing for more strategic decision-making.

How does Blask help identify markets with minimal competition?

Blask tracks the competitive landscape by monitoring active brands in each country. This feature enables users to spot markets where few brands operate, offering the chance to capture market share early and develop a strong local brand presence with minimal interference from large competitors.

Can Blask help monitor markets impacted by political or regulatory issues?

Yes, Blask tracks downturns in player interest, revenue, and deposits, often due to regulatory changes or political instability. A slight recovery in these metrics can indicate market stabilization, offering a valuable opportunity for re-entry or expansion just as the market rebounds.

What makes small but steadily growing markets appealing for long-term investment?

Markets showing consistent increases in metrics like Blask Index, eGGR, and eFTD often indicate sustainable growth potential. By establishing a presence early in such markets, a brand can grow alongside the market, building a foundation for long-term success.

How does Blask handle data collection across multiple countries?

Blask currently gathers data from 34 countries worldwide and is continuously expanding its coverage. This broad dataset allows users to make cross-regional comparisons and spot emerging trends, providing a global view of iGaming market dynamics.

How can data from Blask support localized marketing strategies?

Blask’s insights into player interest and competition levels in specific regions enable brands to tailor their marketing and product offerings. For instance, brands can focus on mobile-friendly experiences or integrate localized payment options, enhancing appeal and resonance with the local audience.

Unlock your iGaming potential with Blask!

Blask empowers you to make data-driven decisions, optimize marketing strategies, and drive significant GGR increases by providing unparalleled clarity about the iGaming market and your performance.

Curious about our precision? Discover our article "What is Blask?" and how Blask's cutting-edge technology is transforming iGaming analytics.

Ready to experience Blask in action?

Request a personalized demo with full access to data tailored to your niche and objectives. Fill out the form at blask.com to help us prepare use cases specific to your needs.

Need assistance?

Our support team is always here to help. Click the chat icon in the bottom right corner of your screen to connect with us instantly and get the answers you need.