- Updated:

- Published:

Lobby CTR

What lobby CTR is

Lobby click-through rate is the simplest way to ask whether your storefront works — how many players who see a game tile actually enter it.

Formally, it’s clicks on a game card divided by qualified lobby impressions for that card over a period. Qualified impressions exclude tiles that never came into view, auto-rotations that flashed for a fraction of a second, and duplicate views from the same session.

🚀 In practice, lobby CTR is your first conversion: from shelf to game.

- The number is sensitive to context. Above-the-fold tiles earn attention by default; row-three tiles must be chosen.

- Copy matters: “buy feature available” or “jackpot live now” can lift CTR without touching mechanics.

- Art direction matters more than most teams admit — recognisable IP, legible symbols at phone size, and a dominant colour that stands out against the shelf.

- Timing matters, too. A festival skin promoted two weeks early will underperform; the same skin, raised three days before the event, can double CTR with no code change.

Measurement should be honest.

Count an impression only when 50–60% of the tile is on screen for, say, 700–900 ms. De-dupe within a session.

Track qualified CTR — clicks that lead to at least one spin within 30 seconds — alongside raw CTR, so you can tell curiosity from intent. Keep device and country cuts separate; mobile thumbs and desktop mice read layouts differently.

🚀 The lobby is your front page

Think like an editor. Headlines above the fold, clear subheads on row two, and no mystery meat navigation.

How teams actually use lobby CTR

- Operators treat CTR as the first health check on merchandising. If a top-row card underperforms, fix the headline before the mechanics: rewrite the tile line in plain language, test a badge (“new”, “tournament”, “buy feature”), switch to art that reads at a glance, and reconsider position.

Map position curves (using GVR) — average CTR by row and slot — so you can judge whether a card is weak or simply in a weak seat. Then tie CTR to downstream metrics: first-minute bounce, time to first spin, and day-7 return. A card that clicks well but bounces fast is selling a promise the game can’t keep.

Providers read CTR as leverage. If a title earns above-benchmark CTR wherever it gets a fair seat, that’s an argument for a better one.

If CTR collapses only with one operator’s skin or copy, it’s a creative issue, not a product one. Studios that ship clean, phone-first logos and a one-line “why click” give themselves an advantage before negotiations begin. - Affiliates influence CTR by expectation-setting. A pre-roll that shows the real tempo of a title — not a jackpot highlight reel — sends players to the lobby ready to click and stay.

That alignment between story and store is worth more than a louder CTA.

A practical playbook

- Close the loop. Judge success on CTR and first-minute bounce, time-to-first-spin, day-7 return. Keep the winners; retire the liars.

- Measure cleanly. Count an impression when ≥50–60% of the tile is on screen for ~700–900 ms; de-dupe within session; track qualified CTR (click→spin).

- Fix copy. Replace metaphors with promises a newcomer understands in one glance (“Free spins from the start,” “Buy feature available,” “Jackpot live”).

- Fix art. Use high-contrast icons, recognisable IP marks, and legible symbols at phone size; avoid busy key art.

- Test badges. “New,” “Hot,” event tags, or “Buy feature” labels often move CTR without touching mechanics.

- Move the seat. Promote from seat 6→3 for 72 hours; if CTR doubles and bounce falls, negotiate a permanent row.

- Mind the clock. Align seasonal skins with the real calendar; lift three to five days before peak.

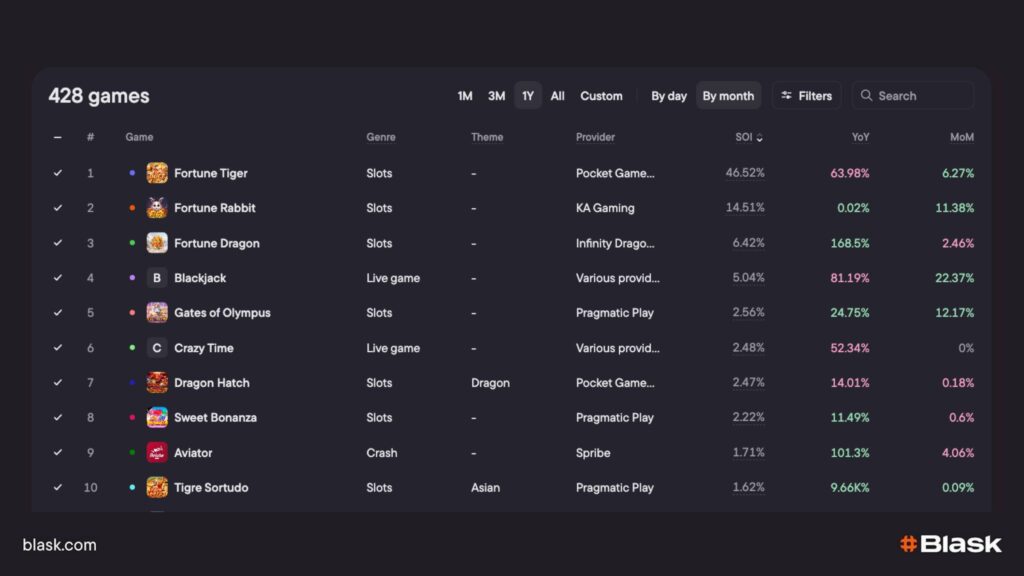

Reading and scaling with Blask Games

CTR is a house metric, but distribution and visibility are what let it scale. This is where Blask Games complements your telemetry by showing how widely — and how prominently — a title is placed across the market.

In Games you can track for any game:

- number of brands carrying it

- number of lobbies where it appears

- Avg Lobby GVR (Game Visibility Rank) the average position within each lobby page)

- Avg GVR across all surfaced placements.

🔍 Read the Blask Games quick tour for more insights.

Read these with your CTR:

- Healthy CTR in your app but thin brands/lobbies and deep Avg Lobby GVR means a distribution problem — broaden coverage and negotiate higher seats.

- Excellent Avg Lobby GVR with weak in-house CTR points to copy/asset issues on your skin.

- Pair with Game Visibility Rank (GVR) and Share of Interest (SoI): rising SoI with flat CTR usually means the card isn’t telling the truth the audience wants.

- Use Blask Index as backdrop: when market heat rises, move proven high-CTR cards into headline seats; when it cools, rotate to evergreen clarity.

🚀 Placement scales persuasion. CTR says how the card sells. Brands, lobbies, Avg Lobby GVR and Avg GVR say where it can sell next.