- Updated:

- Published:

Blask × NEXT.io: when iGaming peaks — why every region follows its own calendar

Blask has released a new data-driven study in collaboration with NEXT.io, exploring a deceptively simple question: when does iGaming activity actually peak — and why does the answer differ so sharply by region?

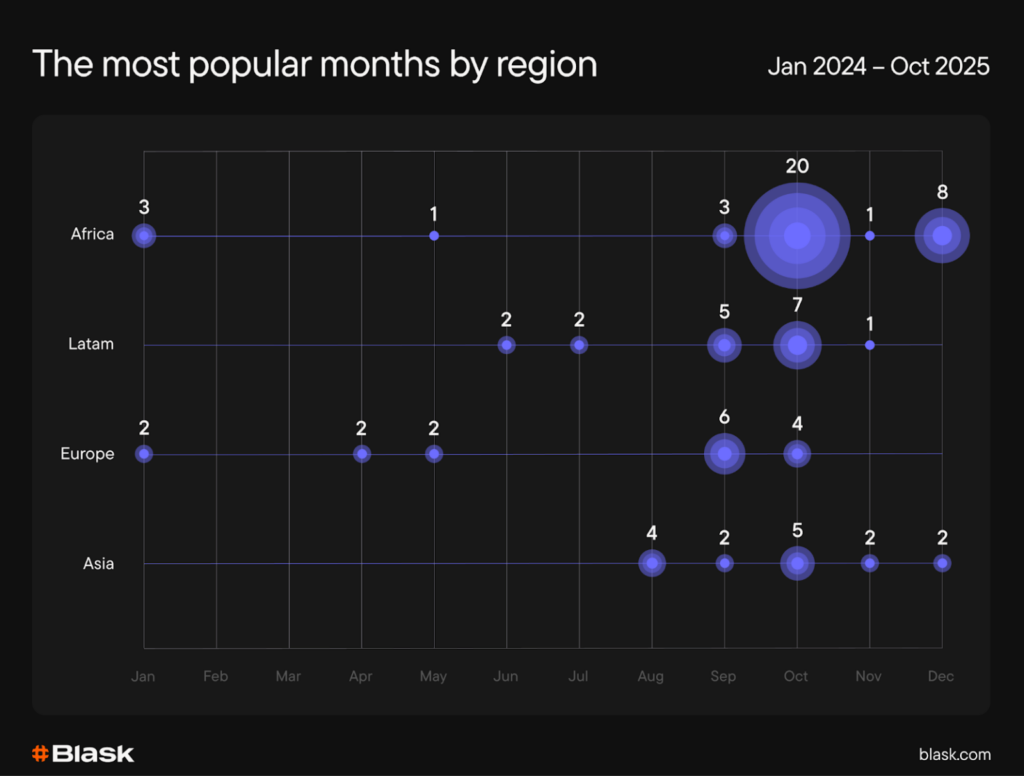

Analyzing market activity across 107 countries between 2024 and 2025, the research maps seasonal engagement patterns across Africa, Europe, Latin America, and Asia. What emerges is not a single global cycle, but four distinct calendars — each shaped by local sports schedules, cultural rhythms, and economic timing.

The findings challenge the idea of “universal” peak seasons. Instead, they show how iGaming demand moves in waves that rarely align across continents.

💡 Blask’s new Seasonality widget adds a time dimension to country-level insights, so you understand when activity happens, not just where.

📖 Read the article Seasonality: see when your markets actually move

One market, four calendars

In Africa and Latin America, October stands out as the dominant month. In Europe, activity consistently peaks in December. Asia follows a more fragmented pattern, but again October plays a central role, with late autumn and early winter driving sustained engagement.

Blask’s data shows that these peaks are not random. They coincide with overlapping forces: international football windows, continental tournaments, domestic league momentum, salary cycles, and the return to structured routines after summer breaks.

The result is a clear regional logic — and a warning against treating seasonality as a one-size-fits-all metric.

Africa and Latin America: the October surge

Across much of Africa, October emerges as the strongest month in the majority of tracked markets. International match windows, combined with renewed domestic routines after summer, drive a broad spike in betting and gaming activity. Continental competitions such as the CAF Champions League add momentum that carries engagement into the winter months.

Latin America shows a similar autumn surge, particularly across Mexico, Peru, and Central America. Here, October concentrates several engagement drivers at once: World Cup qualifiers, Copa Libertadores knockout stages, and the buildup to domestic playoffs. In contrast, Brazil and Argentina break the pattern, with summer spikes tied to major international tournaments — a reminder that even within regions, seasonality is not uniform.

Europe: December dominance

Europe tells a different story. December consistently outperforms all other months across many mature markets. The convergence of decisive European football fixtures, holiday downtime, bonuses, and extended evenings creates ideal conditions for sustained engagement.

While September and October serve as ramp-up months after summer holidays, December remains the undisputed peak — a pattern that holds even as league calendars and regulatory conditions evolve.

Asia: overlapping cycles, shared momentum

Asia presents the most complex picture. Engagement peaks vary widely, reflecting the region’s diversity — but October again emerges as a recurring high point across multiple subregions. In East Asia, late autumn momentum builds around domestic league finales and continental competitions. In Southeast Asia, August spikes dominate, driven by domestic season launches and the return of European football. South Asia splits between cricket-driven spring peaks and autumn football windows.

Despite the variation, the broader insight is consistent: iGaming activity follows local calendars, not global assumptions.

Why it matters

The Blask × NEXT.io study underscores a critical strategic lesson for operators, affiliates, and suppliers: timing is regional. Campaigns, launches, and budgets optimized for one market’s peak can easily miss another’s entirely.

Understanding when markets heat up and when they cool down is no longer a nice-to-have. It is a competitive advantage.

The full analysis, including country-level breakdowns and detailed regional comparisons, is available in the original feature on NEXT.io.