Operators love a clean rule.

Friday night. Weekend peak. Late-night surge.

Blask’s latest dataset suggests that’s not a rule — it’s a habit.

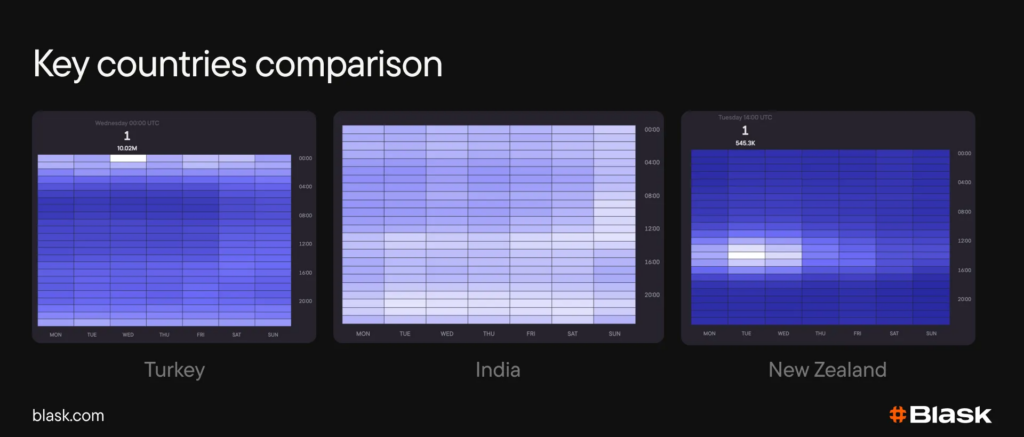

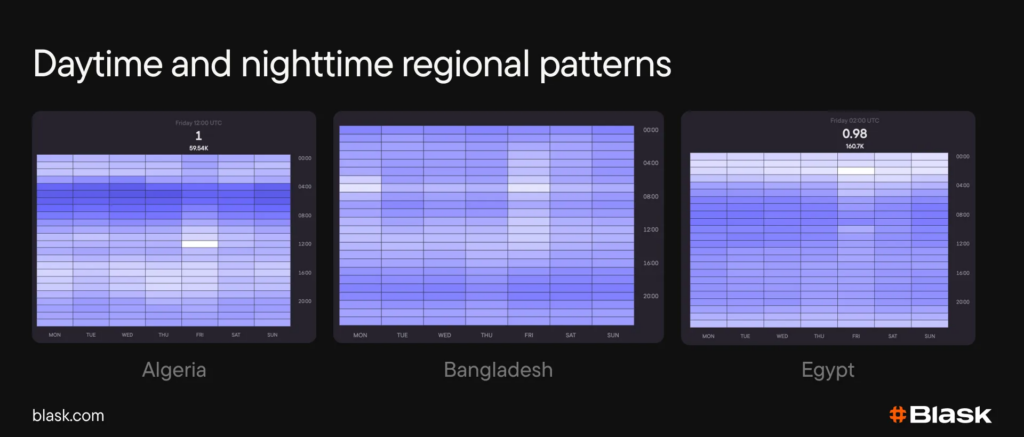

SiGMA News covers Blask’s analysis of hourly and daily iGaming engagement patterns across 110 countries, showing that player activity fragments rather than converges once you stop looking at the world through a handful of “big market” assumptions.

What the data challenges

The core finding is simple: there is no single global peak hour that can reliably guide campaign timing, staffing, or budget allocation across regions.

Yes, Saturday often leads — but even that breaks down in structurally distinct markets. And while many of the largest markets cluster between midnight and 5:00 a.m. local time, the pattern isn’t consistent enough to define a universal prime-time window.

Even more counterintuitive: across the full dataset, more countries peak during daytime hours than at night, despite the biggest markets leaning late-night.

Three examples that make “global defaults” look fragile

1) Armenia: one daily moment, almost perfectly repeated

Rather than ramping up through the evening like many European markets, Armenia shows an almost identical daily peak at local midnight, after adjusting for UTC effects — a pattern suggesting fixed routines over flexible leisure time.

2) New Zealand: midweek late nights beat the weekend

Instead of Friday/Saturday dominance, Blask data shows New Zealand peaking late at night on Wednesday and Thursday (12:00–2:00 a.m. local time) — a rhythm that challenges conventional “end-of-week leisure” logic.

3) Saudi Arabia: the only Thursday peak in the dataset

Saudi Arabia stands out as the single country in the dataset peaking on Thursday, explained by a different weekend/workweek structure where Thursday functions as the behavioural equivalent of Friday evening in many Western markets.

📖 Read also: When iGaming peaks — why every region follows its own calendar

Why this matters (and what to do with it)

SiGMA’s piece lands on a strategic takeaway operators can’t ignore:

- “Prime time” is market-specific. Plan by local behavioural peaks, not inherited global time slots.

- Budget allocation should be market-specific, not time-slot-centric.

- CRM triggers and promo schedules need localisation at the hour level — especially if you operate across multiple regions with different workweeks, nightlife habits, and time-zone dynamics.

In other words: the advantage isn’t knowing that peaks exist. It’s knowing which peaks matter in your market — and how narrow the margin of error becomes when engagement compresses into tight windows.