Blask has been featured on NEXT.io with a new data snapshot revealing just how dominant slots have become in the global iGaming catalogue — and what that dominance means for operators, providers, and lobby strategy.

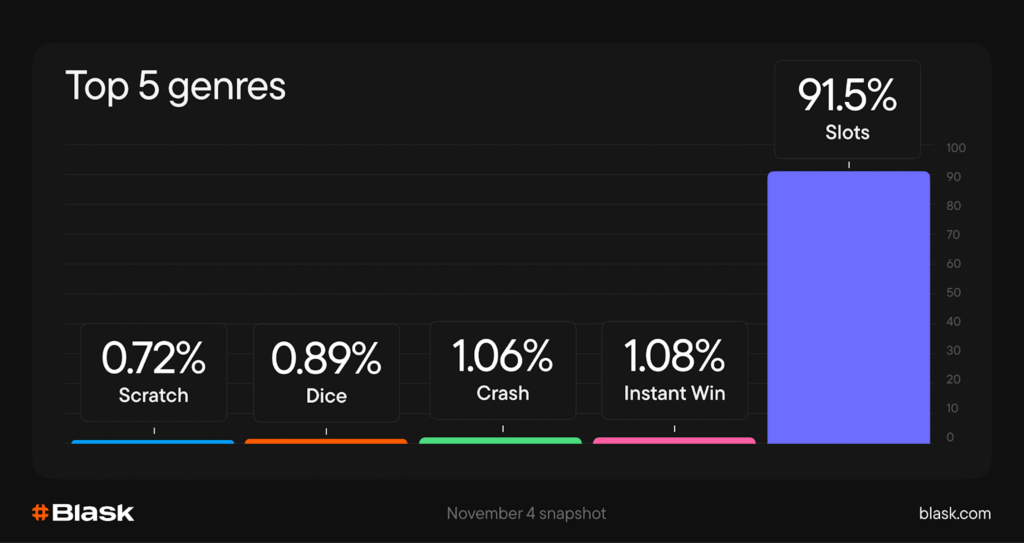

Based on data captured on 4 November 2025, the analysis shows that out of 26,000 casino titles tracked across 17 countries, more than 24,000 are slots.

That translates into 91.5% of all available games, effectively making slots the default structure of the modern casino lobby rather than just one genre among many.

This is not simply a matter of popularity.

According to the study, slots now shape how lobbies are built, how providers plan their pipelines, and how operators think about scale, localisation, and seasonal rotation.

How the data was captured

The findings are powered by Blask’s Global Games dashboard, which observes real-world casino environments rather than relying on declared catalogues or provider claims. Each day, Blask renders thousands of casino lobbies and category pages, applies computer-vision models to recognise individual game tiles, and assigns each title a Game Visibility Rank (GVR) — a seat-by-seat measure of where a game actually appears on screen.

Those signals are then aggregated by country, brand, and title, allowing Blask to measure not what exists, but what players are actually shown.

📌 Read more: Inside Blask’s lobby-position engine: pinpointing every game, every day

A genre monopoly with cracks

At the catalogue level, the market is overwhelmingly slot-driven. Beyond slots, all other genres occupy only single-digit fractions of total supply. Crash games, instant win titles, dice, scratch cards, and table games exist largely as a long tail.

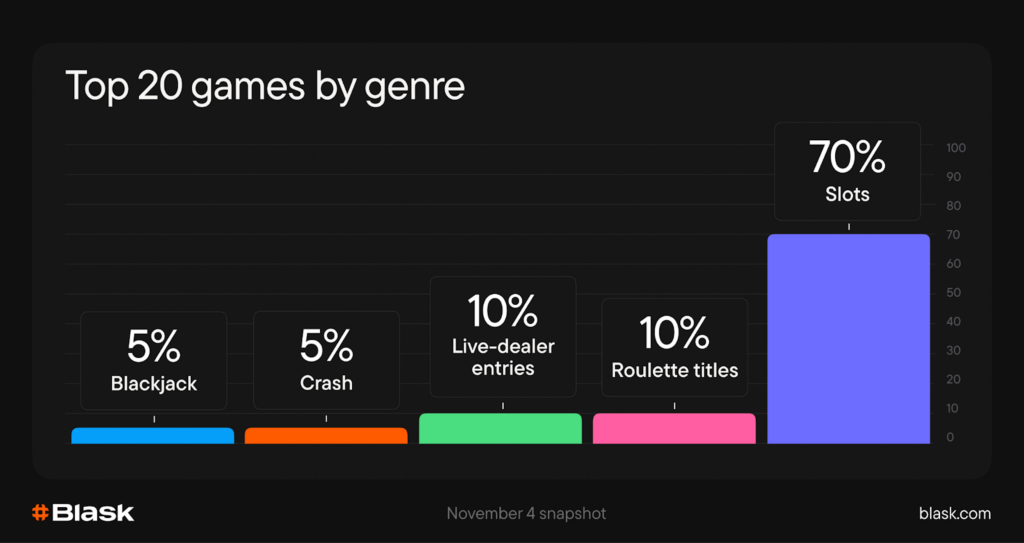

Yet when Blask looks at what reaches the top of casino lobbies, the picture becomes more nuanced.

Despite slots dominating volume, they do not fully monopolise the most visible positions.

In the global top 20 games on 4 November, nearly 30% of titles were non-slot experiences, including roulette (both classic and live), live-dealer formats, a leading crash game, and a blackjack entry.

In other words, slots provide the backbone of the catalogue — but the “front row” still leaves room for alternative experiences that deliver trust, speed, or social interaction.

Local preferences still matter

The analysis also shows clear country-level divergence.

- In markets such as Germany, the top of the lobby is almost entirely slot-driven.

- India and South Africa elevate crash games to the No. 1 position, reflecting strong local appetite for fast, high-risk formats.

- Denmark stands out as the most table-oriented market, with roulette and blackjack sharing top positions alongside slots.

- The UK and Argentina reserve visible space for blackjack or live roulette, even within an otherwise slot-heavy lineup.

The implication is clear: while slots dominate by sheer volume, operators still rely on local anchor genres to establish trust, familiarity, and engagement on the first screen.

Read more: Quick tour: the “Countries” view in Blask Games

What the data makes clear

Blask’s snapshot highlights a structural reality of modern iGaming. Slots are no longer just the leading genre; they are the default building material of casino catalogues. Their scalability, reskin potential, and localisation efficiency make them indispensable.

At the same time, the data shows that operators do not treat lobbies as purely slot showcases. A meaningful portion of prime visibility is reserved for genres that resonate locally — crash where speed matters, live games where trust matters, and tables where familiarity matters.