Brazil’s betting seasons, explained

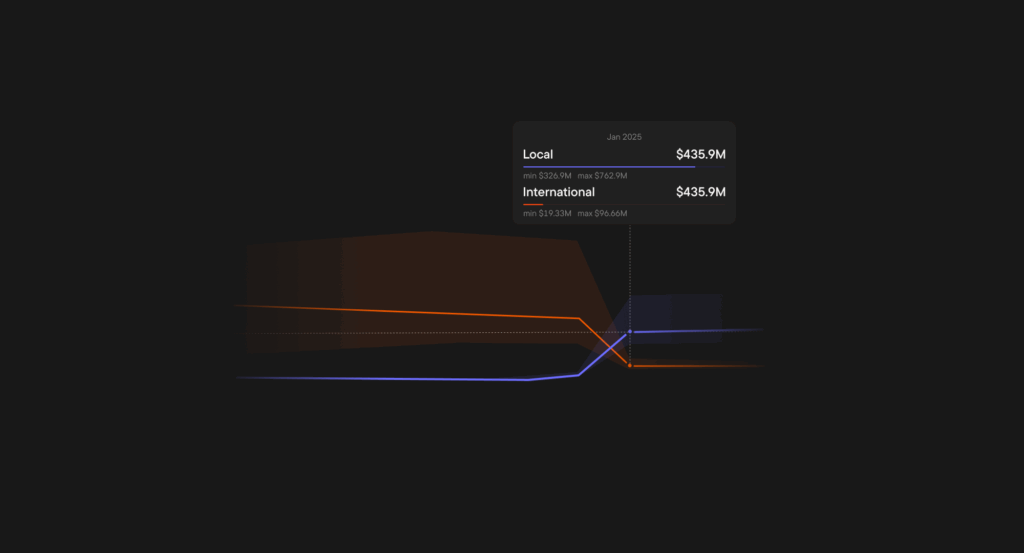

Brazil’s online wagering market doesn’t move in a straight line. It breathes in rhythms that mirror the country’s sports calendar and cultural life: autumn climbs, Saturday-night spikes, and a brief early-year lull. Using Blask Index — an attention barometer for betting and casino brands — this analysis reads those cycles and turns them into practical […]