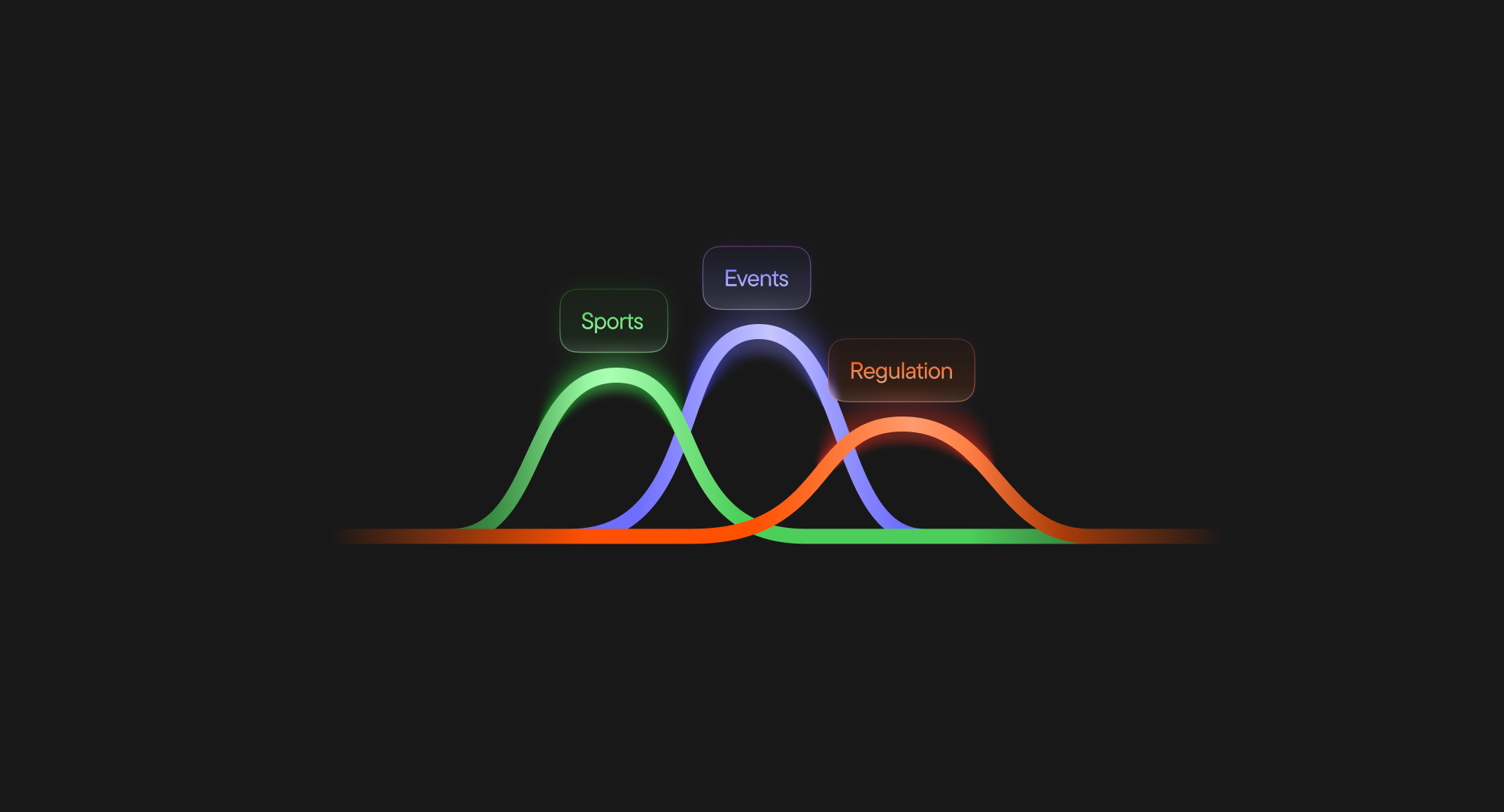

How sports calendars, cultural events, and regulation cycles shape demand waves across regions.

✍️ TL;DR iGaming demand doesn’t move in neat, upward-only curves. Instead, it follows recognizable waves driven by sports fixtures, cultural moments, and regulatory change. By tracking these signals with Blask Trends, operators and affiliates can time acquisition, retention, and promotional strategies with greater precision, reducing wasted spend and capturing demand exactly when it peaks.

The myth of linear growth

When entering a new market, it is tempting to forecast demand as a steady month-by-month increase. Investors, regulators, and even internal teams often plan on smooth growth curves. Reality looks very different.

Demand in iGaming is cyclical, spiky, and shaped by external factors far outside any single operator’s control. Markets rise and fall around local sports calendars, cultural events like national holidays, and structural changes such as new tax rules or licensing frameworks.

Understanding these waves is not optional. It is the difference between overspending in a trough and owning the conversation at the peak.

Three forces that drive demand waves

1. Sports calendars

Sports are the heartbeat of most iGaming markets, especially in regions where football, cricket, basketball, or baseball dominate.

LatAm: Weekly Liga1 fixtures in Peru or Brasileirão matchdays in Brazil generate steady “heartbeat” demand, while Copa Libertadores or World Cup Qualifiers create sharp spikes.

Europe: The Champions League midweek effect is visible across multiple countries. Interest climbs on matchdays, then subsides almost immediately.

Asia: Cricket seasons and tournaments like the IPL produce some of the sharpest surges in betting traffic globally.

💡 What Blask Trends shows: When charted, these markets reveal steep peaks around fixtures, followed by valleys. Operators who plan month-on-month miss the opportunity; those who plan window-on-window extract higher ROI.

2. Cultural events

Beyond sport, cultural and national events shape attention and betting behaviour.

National holidays: Demand often spikes during long weekends or festivals, when players have more leisure time. In Spain, online casino activity consistently rises around Semana Santa and Christmas.

Local traditions: In some Asian markets, the Lunar New Year brings both a surge in online casino play and a pause in sporting calendars.

Political events: Elections, strikes, or major public disruptions can suppress activity temporarily but often create rebound surges once normal routines resume.

📈 What Blask Trends shows: Cultural signals appear as “off-season bumps.” A week with no significant sports fixtures can still generate above-baseline activity if it overlaps with a holiday.

3. Regulation cycles

Few forces reshape markets as dramatically as regulatory change.

Enforcement: When regulators block offshore operators, players migrate to licensed brands. Demand does not vanish; it reallocates.

Licensing: New frameworks often create a short-term dip as operators adjust, followed by renewed growth as consumer trust builds.

Taxation: Adjustments in GGR or excise tax affect operator economics, shifting promotional intensity and marketing visibility.

📊 What Blask Trends show: In markets like Peru and Colombia, enforcement and licensing introduced visible inflection points. The “before and after” view clearly illustrates how formalisation reduces volatility and concentrates demand.

Why this matters for operators and affiliates

Plan campaigns by windows, not months. Football qualifiers or cricket tournaments are the true units of planning. Blask Trends flags these demand windows so spend can be shifted with precision.

Budget for peaks and troughs. High CPAs on matchdays are offset if you prepare acquisition pools during quieter weeks.

Use cultural context. Blend sports calendars with cultural peaks. For example, combine match-led promos with holiday-specific casino offers.

Stay alert to regulations. Licensing is not just compliance; it is a conversion asset. Use local authorisation badges and trust cues in campaigns to win newly migrating cohorts.

🚀 Discover: 30 Ways Blask Games empowers iGaming professionals

How Blask Trends helps you ride the waves

Blask Trends provides a real-time map of demand cycles:

- Regime shifts: Automatic signals when attention moves from rising to falling.

- Brand movers: Identify which licensed operators are capturing the most share during surges.

- Market comparison: See how different regions peak around different sports or events, helping prioritise expansion.

Instead of reacting to spikes after they happen, you can forecast them, allocate budget early, and convert migrating demand.

Final word

iGaming markets do not grow in straight lines. They pulse, dip, and surge according to sports, culture, and regulation. The operators that treat demand as a wave, not a staircase, are the ones that win.

Blask Trends turns these waves into signals. If you align your campaigns with them, you don’t just follow the market, you ride ahead of it.