Blask has been featured on NEXT.io with a three-month analysis of Europe’s most visible casino games, asking a deceptively simple question: when the market is observed over time rather than in daily snapshots, which titles truly hold their ground and which only spike on seasonal hype?

Using Blask’s game visibility data, the study tracks how the five most prominent games in several key European markets shifted between early August and early November 2025.

How Blask reads movement

The analysis relies on Blask’s core game-level metrics. Game Visibility Rank (GVR) measures a title’s average position across casino pages, while Avg Lobby GVR isolates placement on the main lobby — the first screen players see.

Reach is captured through the number of brands and lobbies featuring a game. Movement is assessed through 90-day trendlines, focusing on sustained shifts rather than daily volatility.

📖 Read more: Inside Blask’s lobby-position engine: pinpointing every game, every day

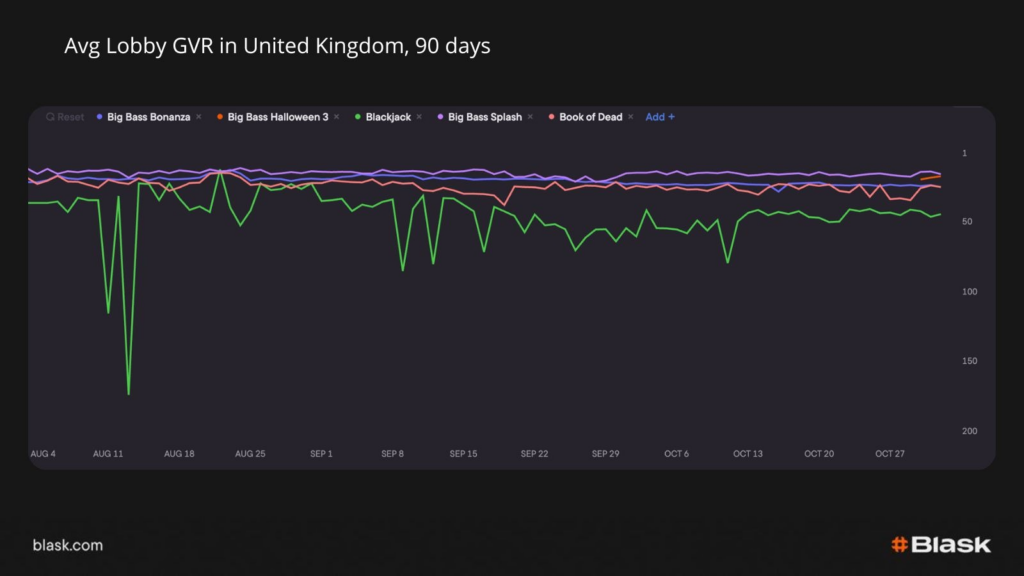

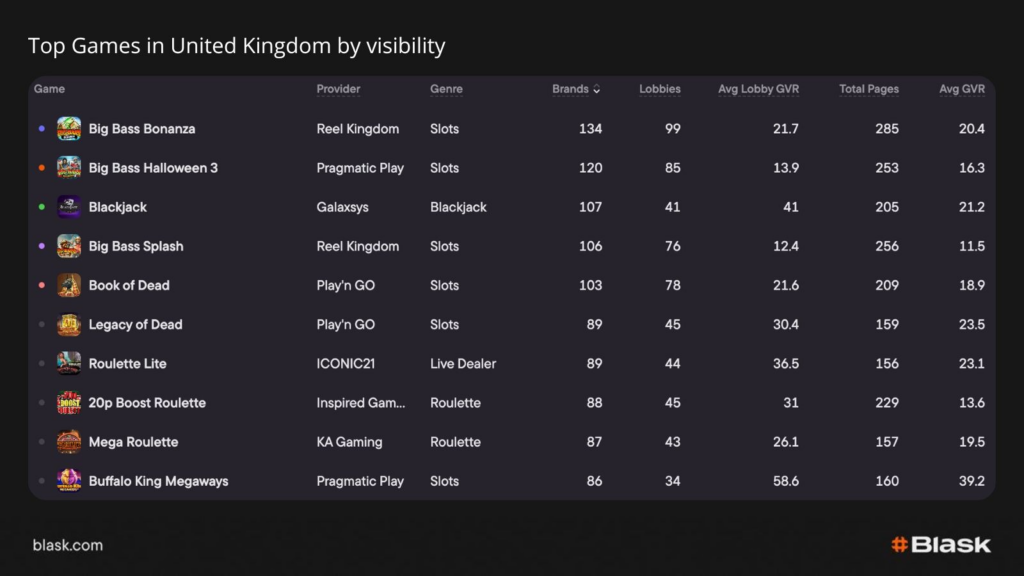

United Kingdom: seasonality breaks the spell

The UK market is typically dominated by evergreen franchises. Over this quarter, however, one seasonal variant broke that pattern.

Big Bass Halloween 3 entered the lobby from outside the top tier and stayed there, securing a genuine first-row position through October and into November.

While classics such as Book of Dead and Big Bass Bonanza retained broad reach, their lobby positions softened. The Halloween variant, by contrast, combined strong reach with premium placement — not a one-week novelty, but a quarter-long disruption.

📖 Read the report: Slots outnumber every other genre

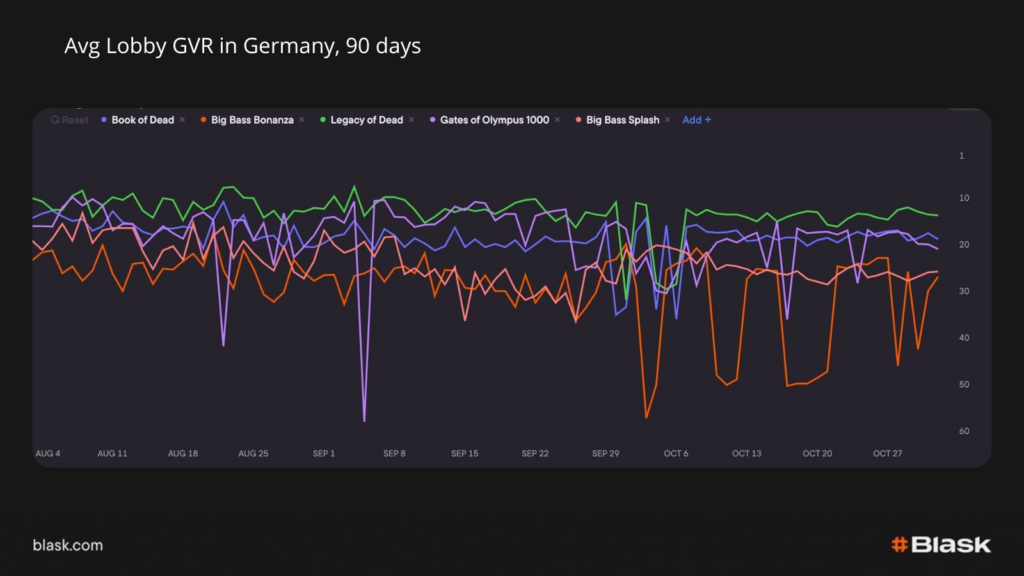

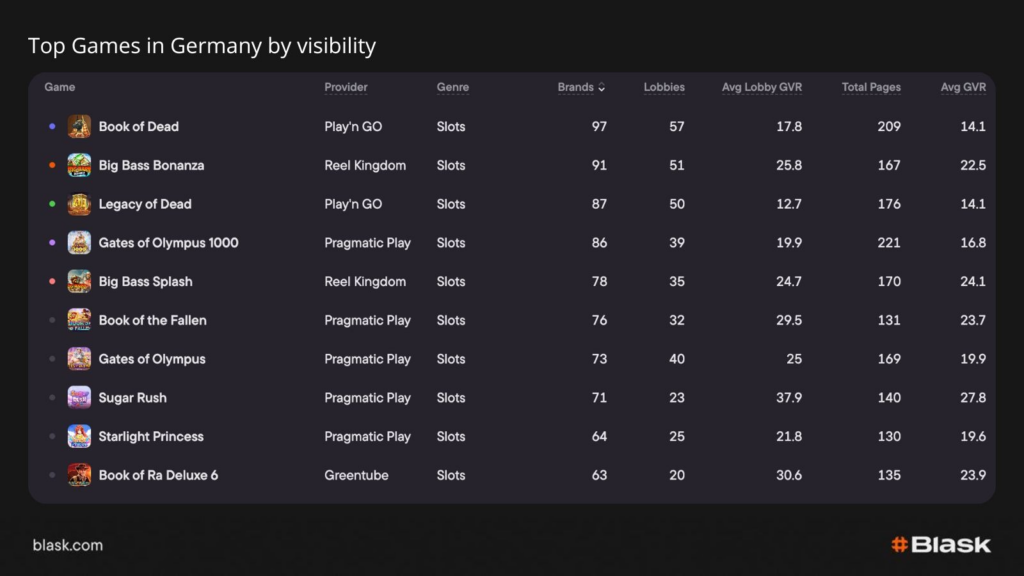

Germany: a blue-chip market

Germany told a very different story. Here, the quarter unfolded with almost textbook discipline.

The same five titles dominated throughout, drifting only gradually deeper in the lobby without sharp breaks or surprises.

Legacy franchises such as Legacy of Dead and Book of Dead moved in parallel, maintaining relative order. Other hits oscillated slightly but never challenged the hierarchy. Even after three months, the lobby looked fundamentally the same — a slow, predictable market where newcomers struggle to claim premium real estate.

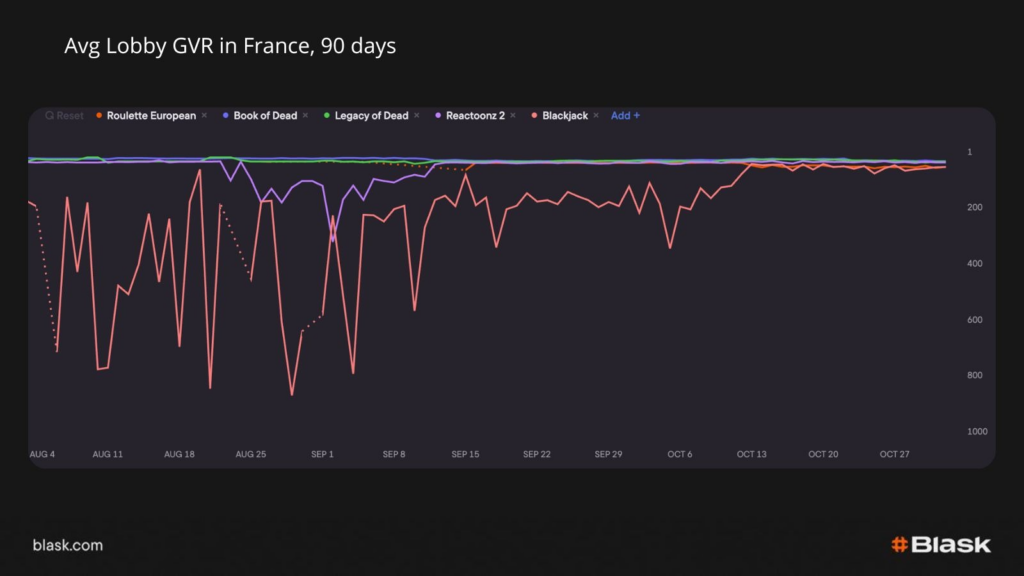

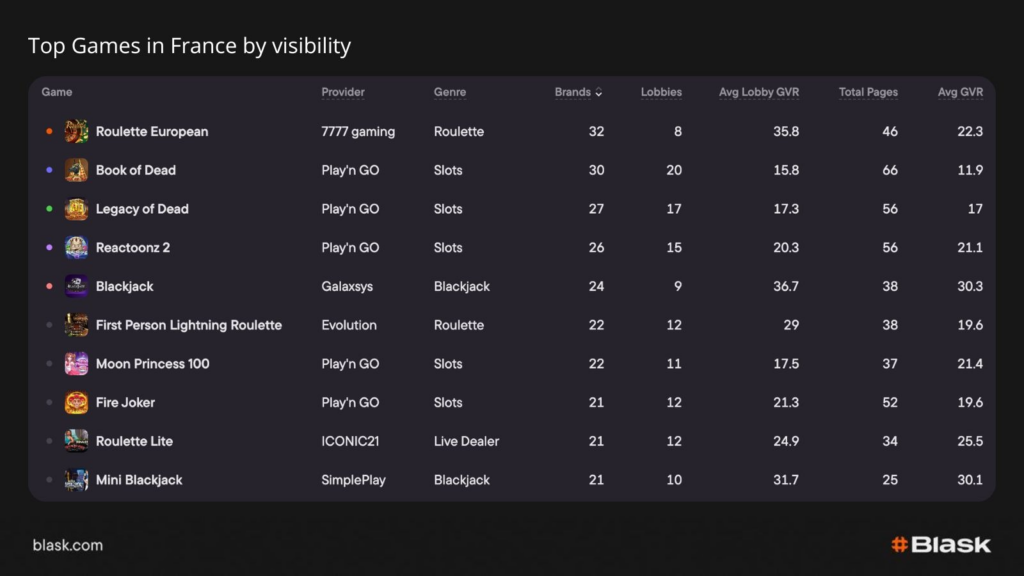

France: movement from the margins

France combined slot stability with unexpected motion from table games. While core slots softened modestly over the quarter, Blackjack surged dramatically from near-invisibility into a stable mid-lobby position. Roulette European also entered the visible tier, claiming meaningful reach despite deeper placement.

By November, slots still defined the core of the lobby, but the quarter’s real movement came from tables rather than seasonal slot variants — a reminder that genre shifts can matter as much as new releases.

📌 Read more: Halloween iGaming Report 2025: Who Wins the Spooky Season?

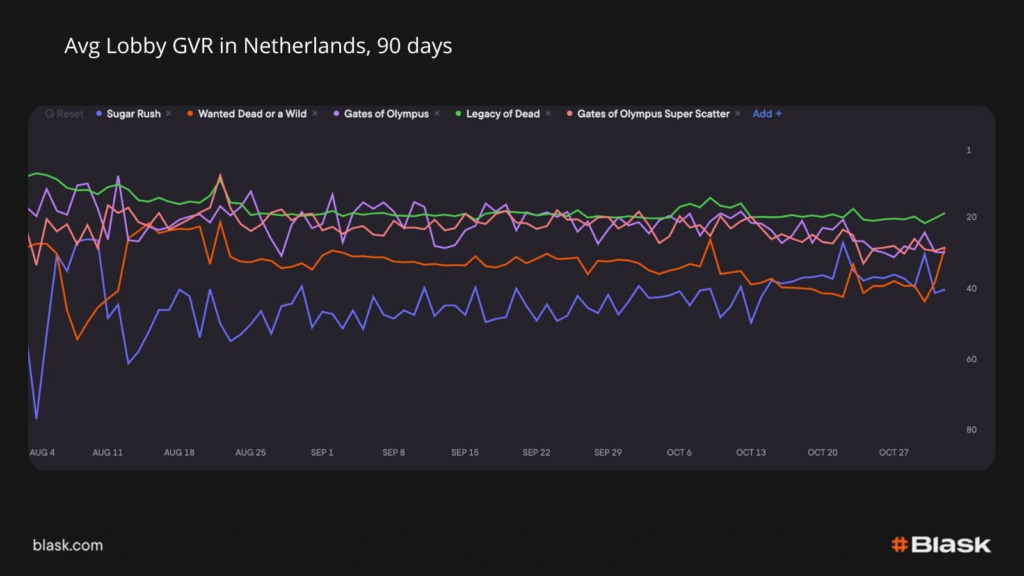

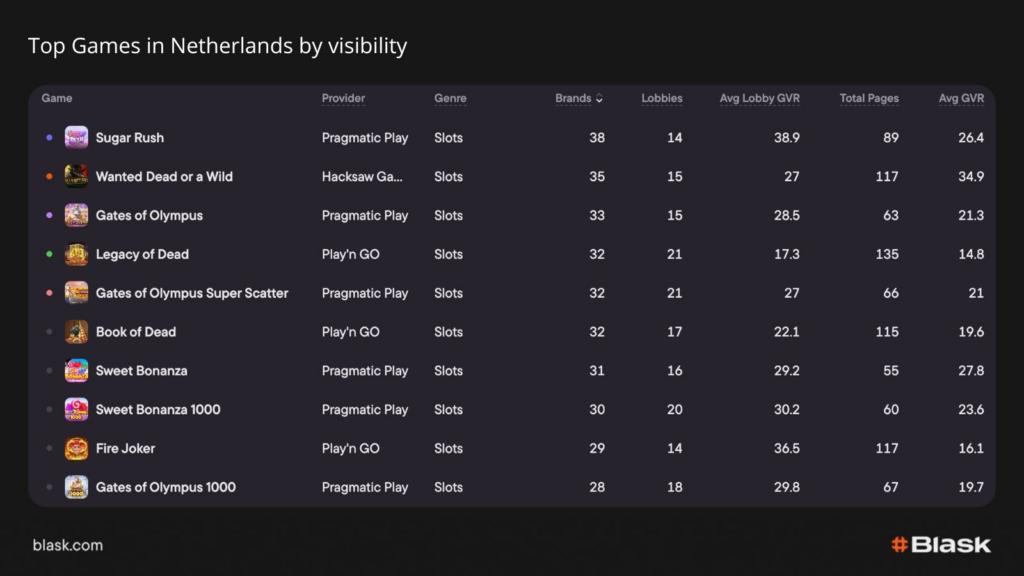

Netherlands: a “Sugar Rush” effect

The Netherlands stood out as the one market where a non-seasonal slot delivered the strongest sustained climb. Sugar Rush rose from deep placement into a stable mid-tier position and held its gains across the quarter.

Unlike the UK’s Halloween effect, this uplift was driven first by reach — appearing across more brands and lobbies — before consolidating visibility.

Meanwhile, established franchises such as Legacy of Dead and the Gates of Olympus line lost altitude but remained structurally important.

What the quarter reveals

Across all markets, the same pattern emerges. Play’n GO and Pragmatic Play franchises continue to form the backbone of European lobbies, with relatively narrow bands of movement that reflect mature-market inertia.

But the cracks are real. Seasonal variants can win premium placement and hold it. Certain slots can climb steadily without relying on hype. Table games can resurface when operators rebalance trust and familiarity.

The key operational insight is to distinguish reach from placement quality. A game can appear everywhere and still slide deeper on the lobby. Another can hold a smaller footprint but dominate the first screen.