Once considered an untapped frontier, Latin America’s iGaming market is now setting the pace for global growth. A joint study by Blask and Growe Partners shows that in early 2025, the region’s digital gaming ecosystem moved from “potential” to “performance”, and it’s not slowing down.

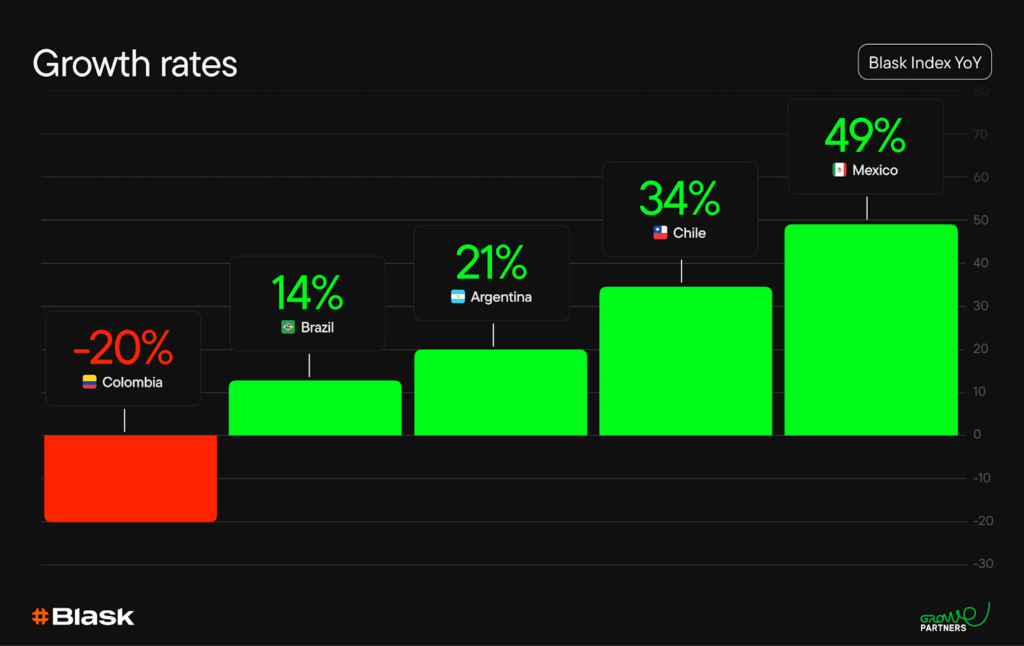

Across five leading markets — Brazil, Mexico, Argentina, Chile, and Colombia — activity rose more than 20% year over year, matching Tier-1 benchmarks in Europe. Together, these countries now generate roughly $4.4 billion in estimated iGaming revenue in just six months, with forecasts topping $9 billion by year-end.

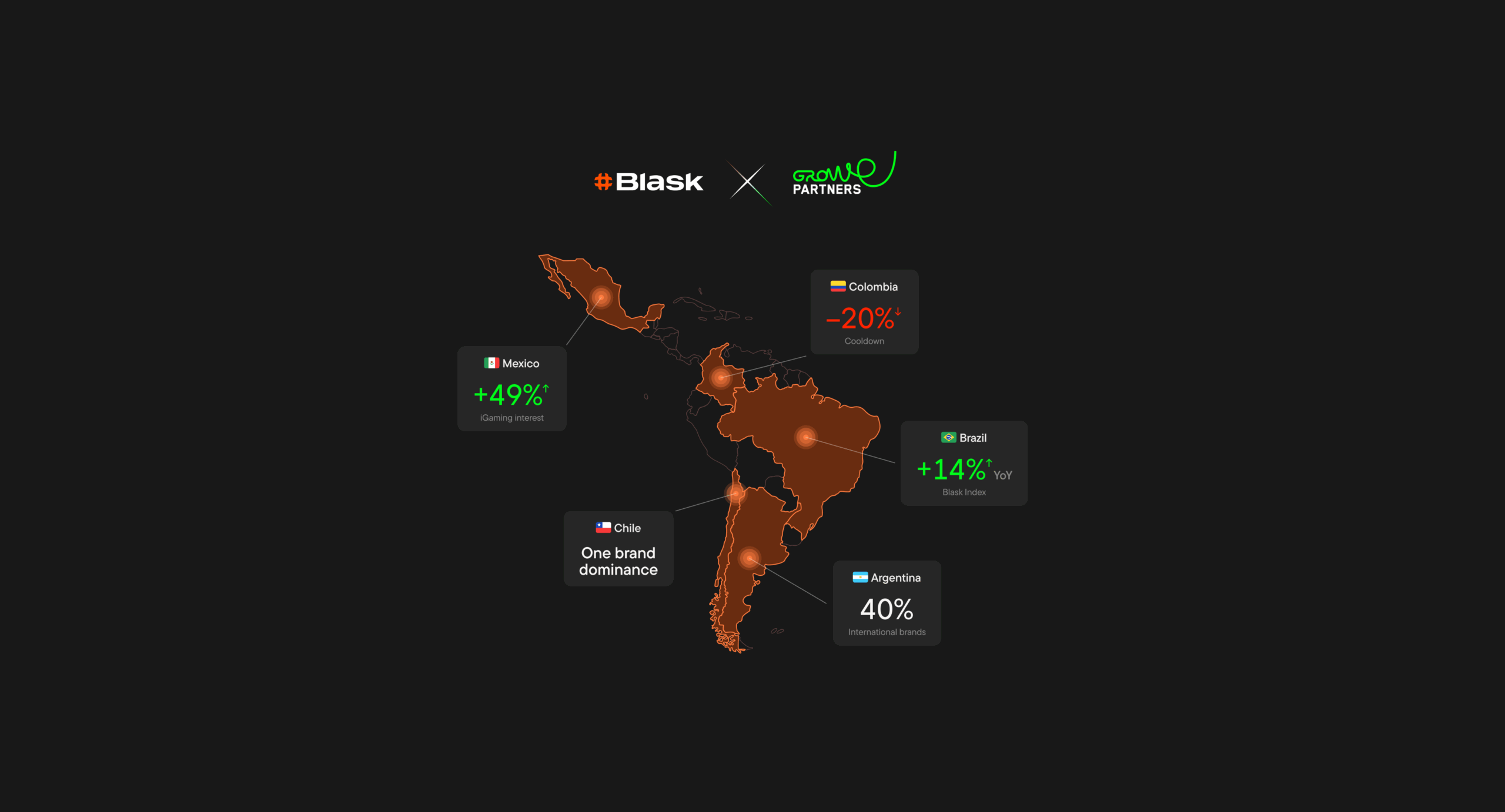

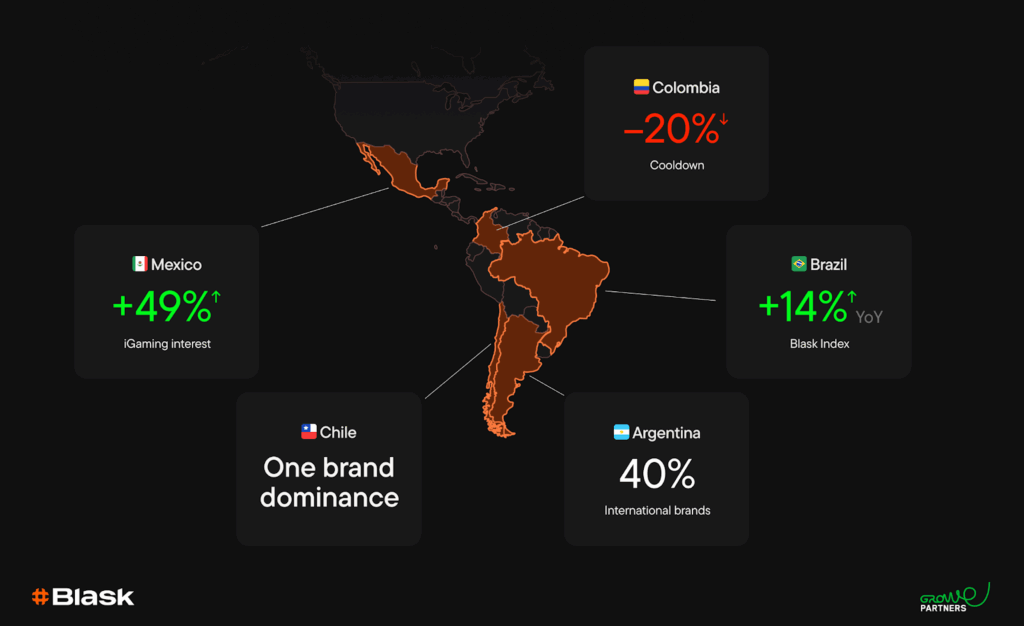

Countries overview

Brazil remains the heavyweight, anchoring two-thirds of regional value with $2.95 billion in average earnings and 136 licensed operators. Mexico, up 49% in activity, is the new growth star — driven by mobile campaigns, local creatives, and a young, smartphone-first audience. Chile and Argentina are finding their rhythm: the former expanding under pending regulation, the latter navigating volatility but staying inventive with hybrid entertainment formats. Colombia, long a model of regulation, has cooled slightly, but continues to show how compliance and profitability can coexist.

Behind the numbers stands a vast digital public: 450 million+ internet users, 80% mobile penetration, and an average age around 33 — the sweet spot for gaming and fintech adoption. LATAM isn’t catching up anymore; it’s shaping global trends, from micro-transactions to AI-assisted user acquisition.

For affiliates and partner programs, the region is now the engine of conversion. Organic channels like SEO and TikTok blend with paid campaigns on Meta and Google, delivering click-to-registration rates between 25–35%. Mobile dominates: four out of five users register or deposit via smartphone, and 60% prefer apps. Localization is everything — “Spanglish” ad copy wins Mexico’s Gen Z, while Brazilian slang boosts engagement at home.

But growth brings growing pains. Click-through rates in major markets dropped up to 15% in early 2025 as audiences tired of repetitive creatives. Fraud has evolved too — less about fake leads, more about subtle payment abuse. The response: faster creative rotation, influencer-driven content, and AI tools that refresh ads before they fade.

What’s next?

Precision over volume. Affiliates are moving from short CPA deals to long-term RevShare models as lifetime values rise. Operators who build trust through fast payouts and transparent terms are winning loyalty over those shouting the loudest.

As Blask’s data and Growe Partners’ fieldwork both show, the region is no longer just a growth story. It’s a maturity story — one where regulation, trust, and technology finally align.

Brazil provides the scale. Mexico and Chile bring acceleration. Argentina adds creativity. Colombia sets the benchmark.

The rest of 2025 will test who can turn that mix into sustainable growth — not just a surge, but a structure that lasts.