- Updated:

- Published:

Volatility

What volatility is today

In online slots, volatility (also called variance) is the risk profile of a game — how the size and frequency of wins are distributed around the game’s long-run return.

Two titles can share the same RTP and feel nothing alike: one sprinkles many small hits, the other goes quiet until it pays in bursts. Critically, RTP only “shows up” after very large numbers of plays; in the short run, volatility dominates the player experience.

💡 RTP vs Volatility

RTP is the long-term average; volatility is how bumpy the road to that average feels. Labs verify RTP with large simulations; your players live inside the volatility.

The levels you’ll see in the market

Studios usually publish a qualitative label — low, medium, high — and some use a five-point scale (e.g., lightning-bolt icons) to show gradations.

Labels aren’t standardized across suppliers, but the logic is consistent: higher volatility means rarer wins with larger top-end potential; lower volatility means frequent small pays.

What actually drives volatility in a slot math model

Under the hood, volatility is the standard deviation of outcomes per spin — a function of the paytable, hit rate, feature incidence, multipliers, and maximum exposure caps. Academic work on casino games and slot design uses standard deviation to quantify this spread and shows it is a decisive driver of felt experience.

Design choices that push volatility up include lower base-game hit frequency, heavier weight on bonus rounds, steeper paytable ladders (high symbol multiples), and large multipliers or jackpots with low probability. The reverse choices flatten volatility and produce steadier play.

What actually drives volatility in a slot math model

Under the hood, volatility maps to the dispersion of outcomes per spin. Design choices push it up or down:

- Lower base-game hit rate and heavier reliance on bonus rounds raise volatility; the reverse flattens it.

- Steeper paytables (bigger symbol multiples) and rare multipliers increase top-end exposure and the variance that comes with it.

- Jackpots and super features concentrate return into low-frequency events; removing or nerfing them spreads return more evenly.

The RTP target stays the same; what changes is the journey to it.

Why volatility matters for B2B teams

- Portfolio construction. Balance low/medium/high titles so the lobby can serve different appetites (steady “coffee-break” play vs. streamer-friendly spikes). Use volatility bands when planning events and hero slots to avoid rows of games that all behave the same way.

- Cash and liability planning. Volatility doesn’t change house edge, but it changes cash-flow variance. Operators and analysts use volatility/standard deviation to set reserve and promo budgets; a floor heavy in high-volatility titles needs more headroom for swings.

- Bonus economics. High-volatility games can over-reward outliers during free-spin or bonus-buy campaigns. Weight contribution, set max-bet during wagering, and cap exposures by title so marketing upside doesn’t become risk downside.

- CRM and placement. Segment by tolerance for droughts vs. drip-feed wins. New or budget-sensitive cohorts tend to engage longer with low/medium-volatility tiles; VIP cohorts may prefer high-volatility features with clear max-win storytelling. Move seats accordingly and test copy that sets expectations honestly (e.g., “fewer hits, bigger peaks”).

- Supplier conversations. Ask for the math sheet, not just a label: base hit rate, free-spin frequency, top-symbol multiples, max exposure, and (ideally) the published standard deviation or volatility index. Labs certify fairness and RTP via large-sample simulations; those documents help align merchandising with reality.

How to measure and monitor

- Before launch: run Monte-Carlo style simulations on vendor math (or your own test client) to estimate session length, bankroll risk and promo liability for typical stakes. Then sanity-check against the studio’s volatility label. (Any large-sample method works; the goal is dispersion, not just average.)

- After launch: compute empirical volatility as the standard deviation of net win per spin by title and cohort; track alongside RTP drift monitoring required by regulators to ensure games behave as designed.

Using Blask to make volatility operational

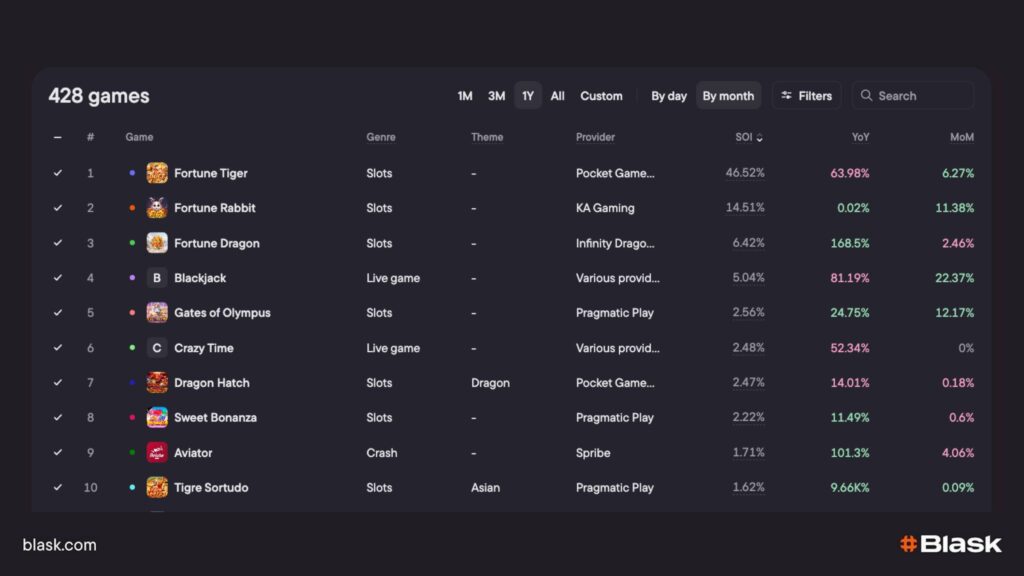

Blask Games — visibility vs. appetite.

Volatility only earns if players see the right game at the right time. Use Game Visibility Rank (GVR) to check where each title actually sits in every lobby, and Share of Interest (SoI) to gauge current demand for that game or theme in each country. A high-volatility game with rising SoI but deep GVR is free money you haven’t reached for; move it up, fix the tile copy, and re-sample.

📚 Read more: Quick tour: the “Countries” view in Blask Games

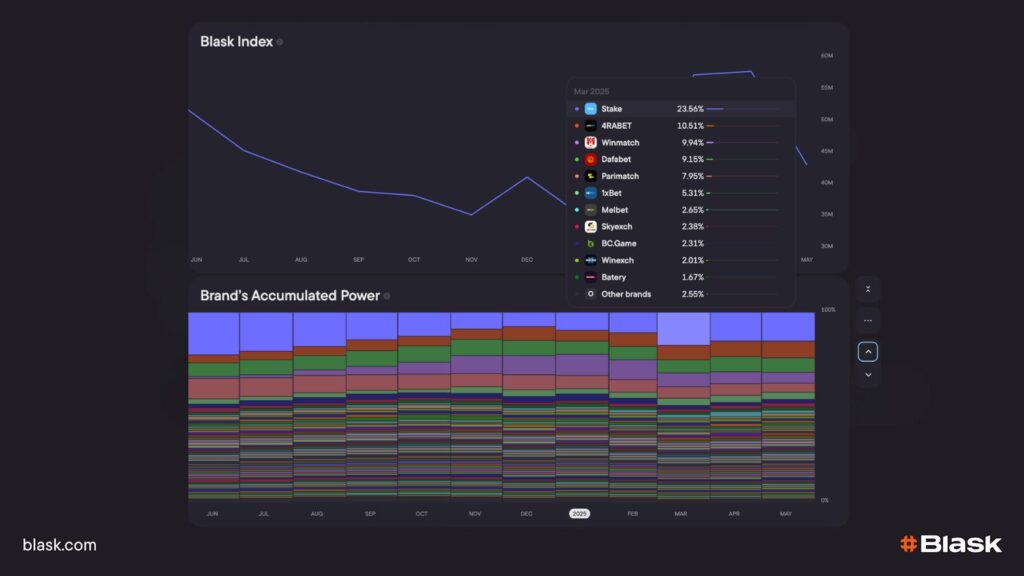

Blask Index — backdrop heat.

When the market warms (seasonal spikes, sports calendars), players accept more variance. Use Blask Index to decide when to lean into swingier hero rows and when to favor steadier titles that stretch sessions.

📚 Read more: How to use Blask for analyzing the iGaming industry: 6 use cases

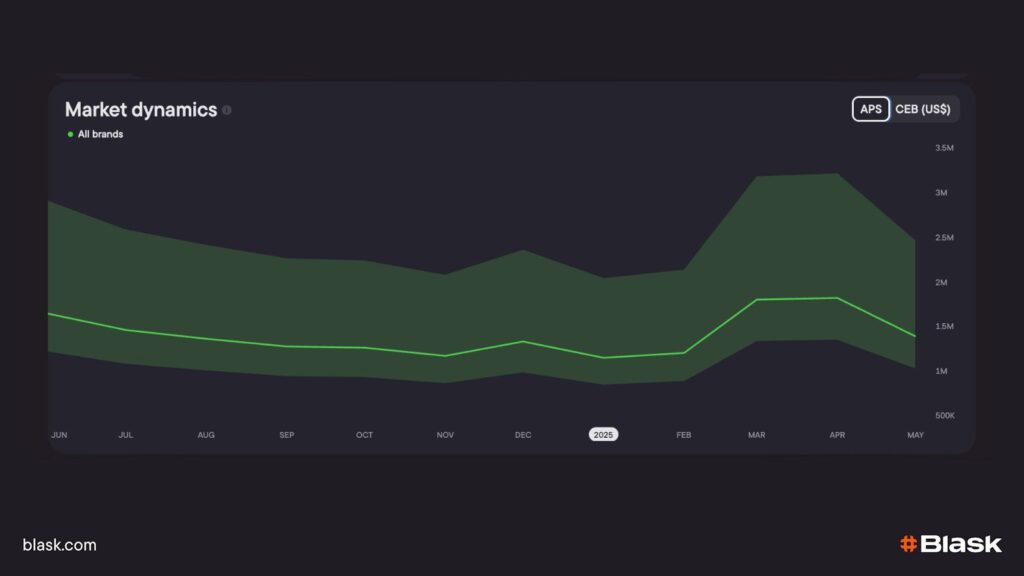

APS and CEB — quality and revenue reality.

If a volatility-heavy push lifts Acquisition Power Score (APS) but leaves Competitive Earning Baseline (CEB) flat, you probably attracted short-lived curiosity rather than durable customers; rebalance the mix toward medium-volatility clarity for newcomers. If APS and CEB both step up and hold, the bet was right.

Three dials, one loop

Read SoI to learn what the audience wants, GVR to see if you put it above the fold, and Index to time the push. If APS rises and CEB holds, keep going; if not, rotate bands and rewrite the headline.