If you build infrastructure for iGaming — payments, content, platforms, KYC/AML, risk tools, analytics — you can’t scale on hunches. Blask turns open‑source market signals into a clear, comparable view of where demand is forming, which brands are accelerating, and what each country is likely to return. The result is fewer cold pitches, fewer dead‑end integrations, and smarter expansion into the right markets at the right time.

Why suppliers use Blask

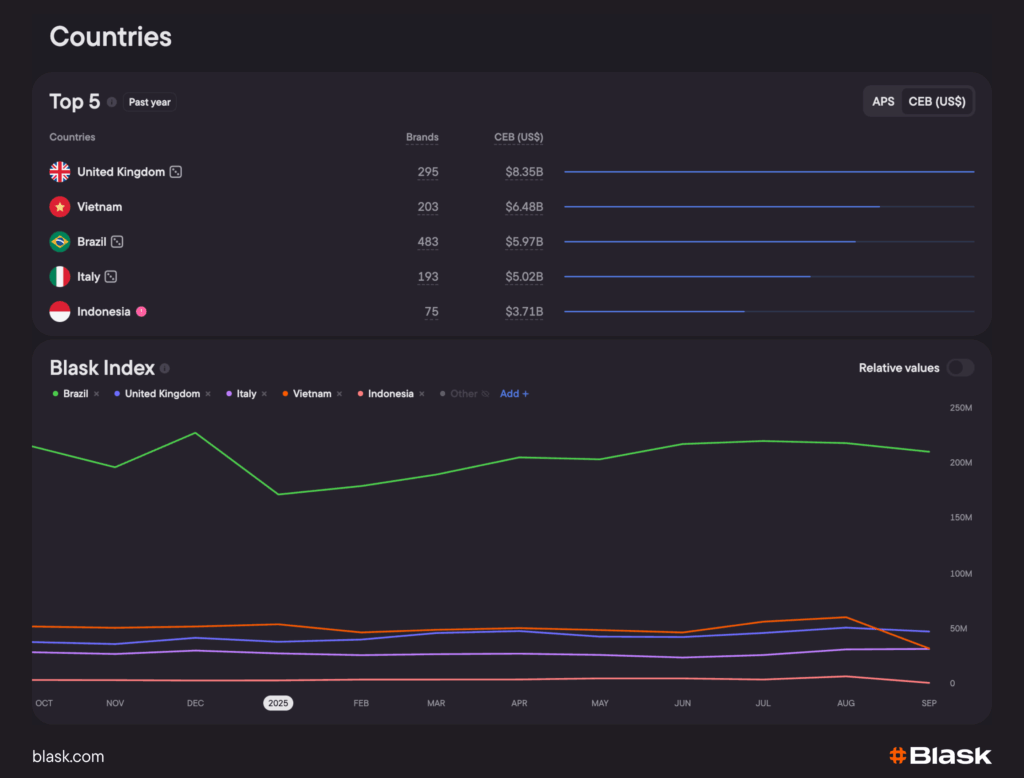

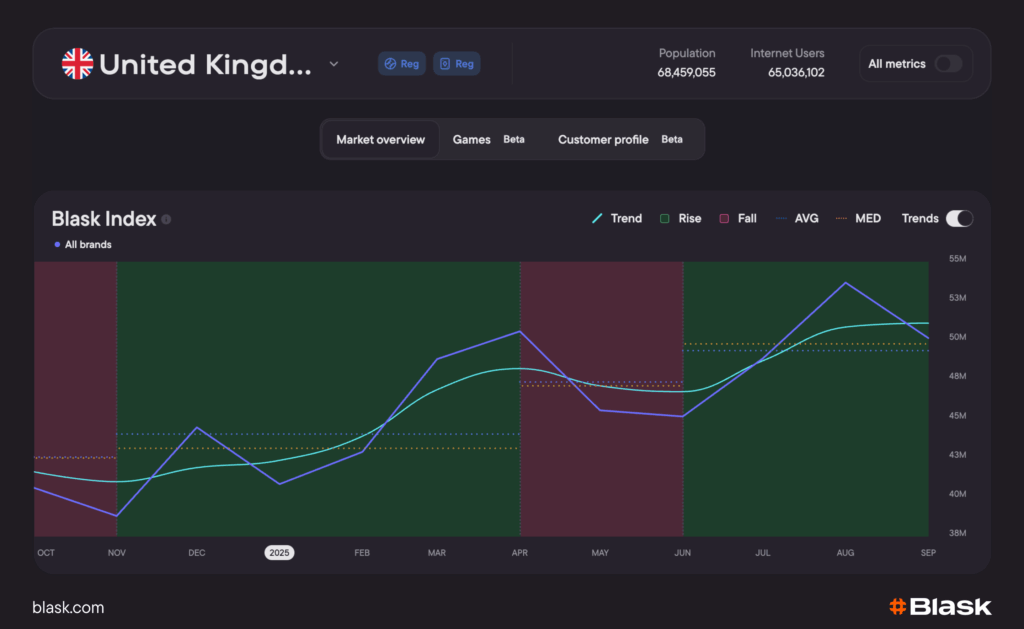

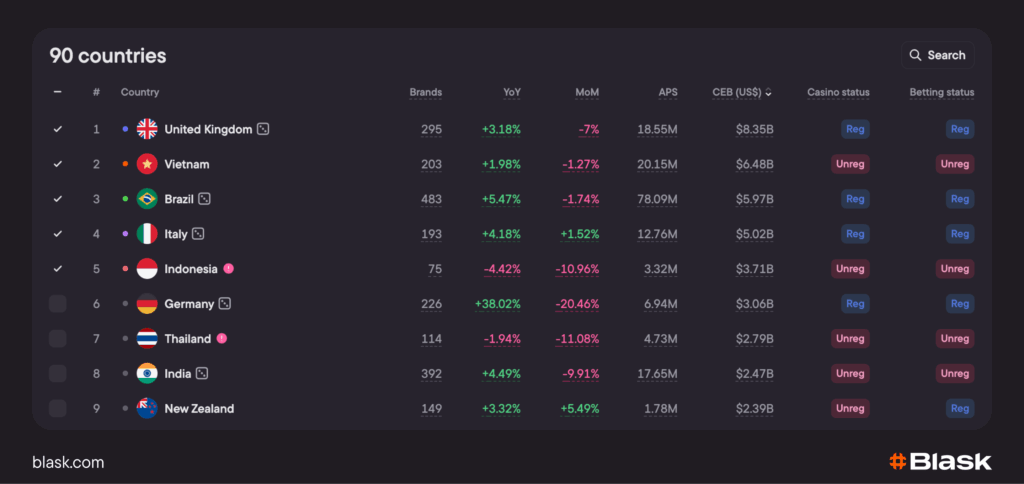

Expansion decisions usually begin with the same three questions: where to go next, who is worth the effort, and what the return will look like. Blask provides hard answers to each. It shows which countries and regions are heating up and which brands are responsible for that heat, allowing you to distinguish markets that are merely large on paper from those that are accumulating the real audience.

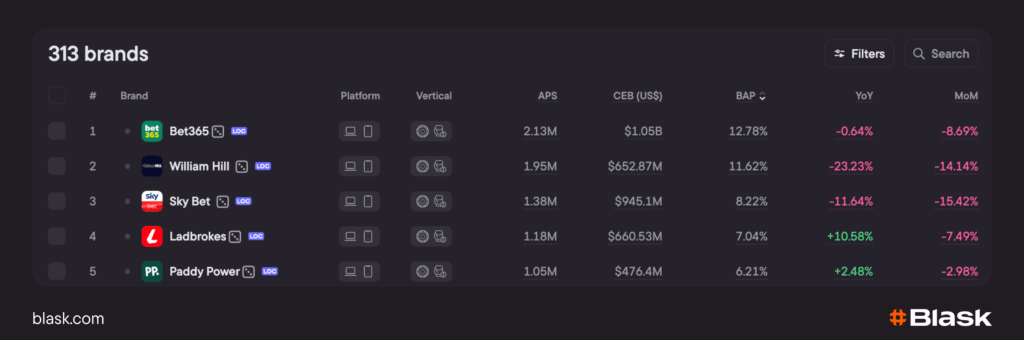

It also highlights merchant‑level momentum over the last 30–90 days so sales teams can replace scattershot outreach with focused, data‑backed pipelines. And because growth baselines and forward reads are part of the picture, product and finance leaders can estimate likely transaction or usage activity before they green‑light an integration.

What you get out of the box

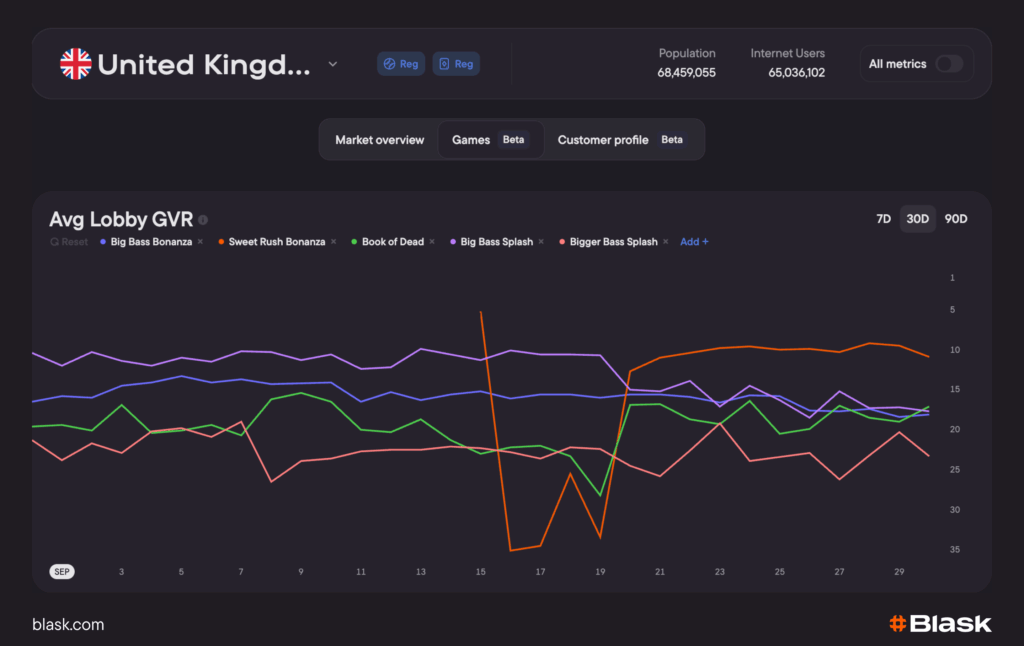

From day one you see how attention moves around the market and where it concentrates. Merchant analytics reveal daily and monthly patterns, seasonality and slowdowns. Geo heatmaps show where each merchant’s audience actually lives, down to country level, which removes guesswork from localisation and payments work. Country insights provide a quick but rigorous orientation to each market’s rules and economics. Transparency on who is gaining share right now keeps commercial plans honest, while activity forecasts help teams avoid flying blind when they plan capacity or launches.

How suppliers put Blask to work

Payment service providers (PSPs)

For payment service providers, Blask reduces the risk of entering the wrong country and the cost of pursuing the wrong partner. PSP leaders can compare markets by current demand and near‑term trajectory, then focus sales on merchants whose curves are rising rather than simply well known. The same data informs resource planning: it becomes easier to judge whether cards, instant bank rails or wallets will be decisive for onboarding given the audience and the market stage.

Game studios and content suppliers

Studios and content suppliers use Blask to sharpen distribution. Operator shortlists are built on audience overlap and timing, not hearsay, so pitches land when a partner’s market is expanding. Country dossiers feed road‑maps by clarifying accessibility, monetisation potential and compliance constraints. When it is time to brief a partner, teams can show where the category is trending and why their catalogue fits the window.

Platform providers and aggregators

Platform providers and aggregators apply the same lens to coverage strategy. Integrations are prioritised by market momentum instead of habit, and commercial cases improve because sales can explain “why now” with evidence.

KYC/AML, RegTech, and risk/fraud tools

KYC/AML and broader RegTech teams use Blask to target the geographies where regulation is tightening and to find the brands that are scaling fastest — typically the ones that feel new obligations first. Forecasts, in turn, support capacity planning by anticipating screening volumes as markets ramp.

Investors and fintechs adjacent to iGaming

Investors and fintechs adjacent to iGaming read Blask for landscape scans and timing. Because the platform ties brand and supplier performance to verified market dynamics, it becomes easier to separate durable signals from attractive stories. Capital is deployed when a country moves from a forming stage to a stable audience, not after the narrative has already peaked.

Typical workflows

A quick new‑country screen takes minutes. Choose a region, open the country dossiers, review regulation, demand trends and the brands gaining share, and share the shortlist with sales or business development.

The output is a realistic entry order and a contact plan based on momentum, not gut feel. Weekly partner prioritisation follows the same logic: filter merchants in your target geographies by recent growth, keep those with consistent month‑over‑month traction, and park those that are flat. Engineering time is protected by a simple pre‑integration check: open the forecast for the relevant country and cohort, stress‑test conservative, base and upside cases, and proceed only if the base case clears your payback threshold.

Who benefits inside the company

Leadership teams at PSPs gain expansion decisions anchored in comparable data rather than anecdotes. Sales and partnerships inherit accurate, refreshable hunt lists by geography. Business analysts and product managers gain an evidence‑based way to select and sequence markets. Investors and corporate development get faster competitor scans and trend validation when they brief stakeholders.

The real value: confidence

Blask gives suppliers a data‑driven posture that reads as professional and decisive. Market transparency, actionable insights and realistic forecasts help teams scale faster, spend smarter and carry less risk. If your organisation has ever debated which country to enter next, which brands are truly growing, or which integrations will actually pay back, you already know the cost of guessing. Blask replaces it with clarity.