- Updated:

- Published:

Crash game

Why crash games are rewriting the iGaming playbook

Once considered a niche format, crash games are now reshaping how players interact with online casinos. Their influence extends beyond gameplay—they’re changing how B2B teams read, respond to, and monetize player behavior.

For operators, crash games drive higher session volume and improve early retention metrics. Affiliates benefit from their viral appeal and short-form compatibility. Meanwhile, game providers now treat crash mechanics as a standalone product category that challenges traditional slot logic.

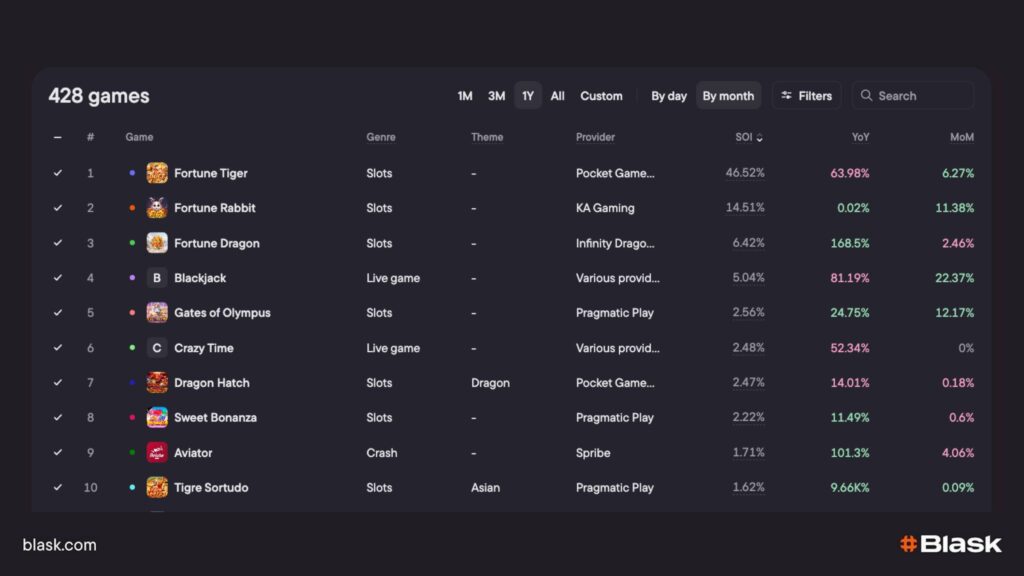

One reason for this shift is visibility. Blask enables teams to track crash game momentum in real time using tools like the Blask Index, Share of Interest, and Game Visibility Rank. These metrics turn raw interest into actionable insights—across brands, markets, and platforms.

What is a crash game?

A crash game is a round-based multiplayer betting experience. A multiplier starts climbing the moment a round begins. Players must choose when to cash out before the game crashes. The longer they wait, the higher the potential payout — but the risk increases by the second.

Unlike traditional slots, crash games don’t use reels or symbols. Instead, they rely on real-time decision-making and visible volatility. Their gameplay is transparent, often supported by provably fair or blockchain mechanics.

As a result, crash games appeal to mobile-first players and younger audiences who expect speed, control, and social elements. Many sessions include leaderboards, public bets, or streamer overlays — features that make crash games easy to watch, but hard to walk away from

How Blask categorizes crash games

Blask classifies crash games as a separate genre—distinct from slots or instant wins. This allows operators and providers to isolate their impact and benchmark them more accurately.

For example, you can filter crash titles in the Games dashboard or compare their visibility in the Country view. In both cases, crash-specific signals are fully supported: GVR over time, Index and SoI trendlines, cross-operator comparisons, and regional breakouts.

Additionally, Customer Profile lets you analyze crash game interest by player segment. That’s critical for tailoring promotions, or managing risk in volatile formats.

Why B2B teams should care

Crash games are not just another seasonal hit. They’re changing how acquisition and retention work at a structural level.

Operators who feature crash games in their top 10 GVR slots often see a spike in session starts and lower bounce rates. These games are naturally viral—designed for quick, shareable moments.

Affiliates also benefit. With Blask, they can identify which crash games are gaining traction in specific markets. That means landing pages and review content can align with actual player interest—not assumptions.

Game providers rely on Blask’s Game View to monitor how crash titles perform across brands. They use that data to A/B test mechanics like auto-cashout, round length, or payout curve.

Meanwhile, marketing teams use the Blask Index to track when crash games surge. For example, if a crash game sees a sharp SoI increase in India, marketers can reallocate creative budgets that same day. That level of reactivity simply isn’t possible without real-time visibility.

How to track performance using Blask metrics

Blask gives you a framework to measure the true impact of crash games on your brand.

With BAP (Brand’s Accumulated Power), you’ll see whether a crash game lifts overall brand awareness. A strong performer in the top GVR slots can influence your BAP in days.

APS (Acquisition Power Score) shows whether that visibility translates into new players. And CEB (Competitive Earning Baseline) lets you validate whether earnings are aligned with market expectations.

All of these metrics are updated daily. You can filter them by country, provider, or operator, giving you complete clarity on what works — and where.

Key crash game trends in 2025

Blask data shows that crash games are entering a maturity phase. Across regions, several patterns stand out:

- In LATAM and Southeast Asia, crash games now outperform traditional slots in session frequency

- Features like auto-cashout and real-time leaderboards drive longer session chains

- Games with crypto or esports branding show faster SoI growth than legacy designs

- Mobile UX is critical — poor optimization leads to GVR drop-off within days

- Micro-tournaments and influencer streams generate viral bursts in Tier 2 markets

These trends aren’t based on anecdotes. They come directly from Blask’s real-time analytics.

Crash isn’t chaos — it’s opportunity

Crash games may feel unpredictable. But behind every sudden spike is a pattern — and Blask reveals it.

Slot games defined the last decade of iGaming. Crash games may define the next. And with Blask, you won’t just react to the market.

You’ll shape it.

👉 Book a Blask demo to see how crash game analytics can drive your next competitive edge.ine the 2020s.

With Blask, you don’t just keep up — you lead.