Blask, together with Growe Partners, has been featured in Gambling Insider with an in-depth analysis of what shaped Latin America’s iGaming markets in the first half of 2025 and why the region has moved decisively from potential to performance.

It presents a shared point of view on how growth is formed, sustained, and monetised across five core markets: Brazil, Mexico, Argentina, Chile, and Colombia.

From promise to performance

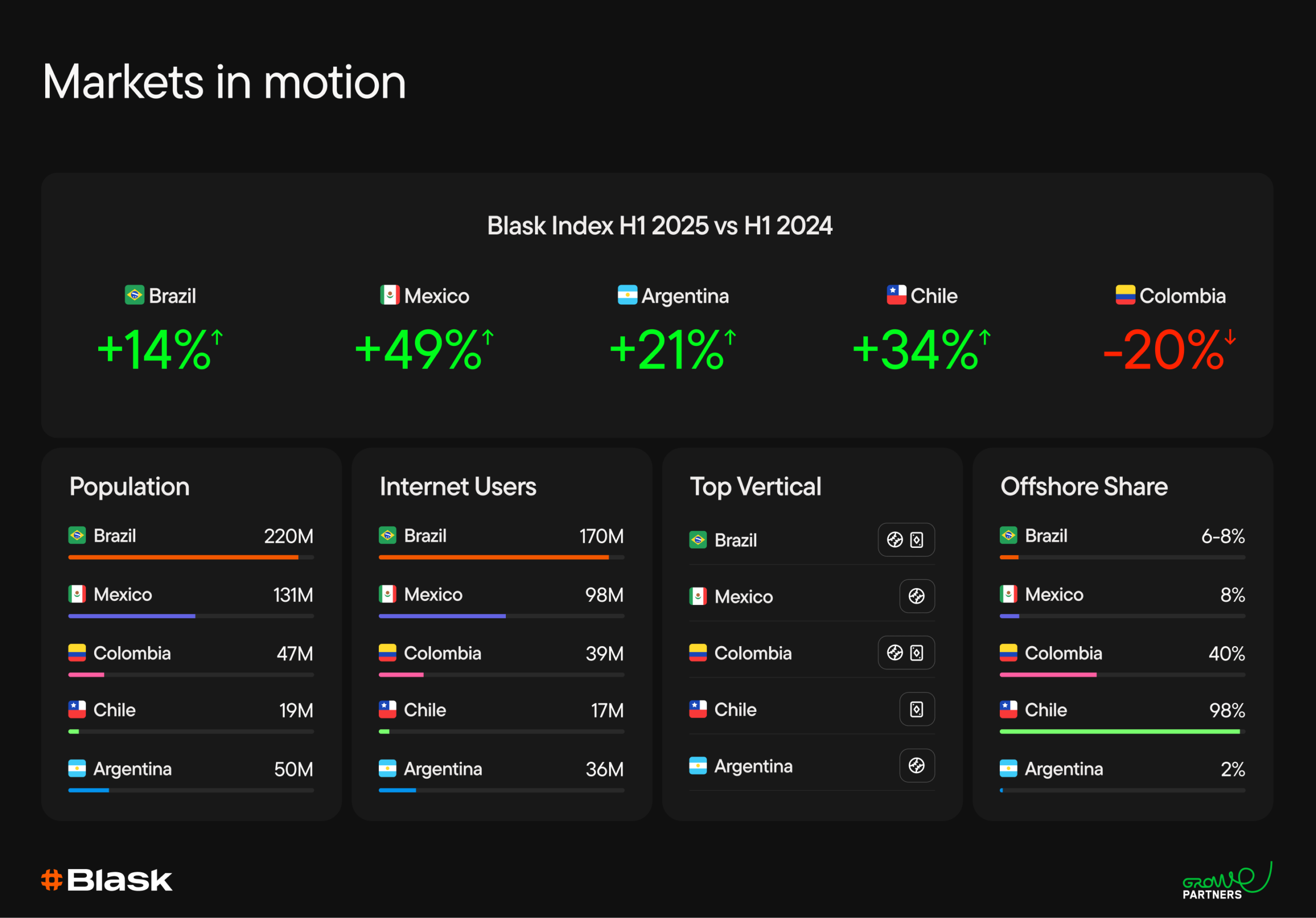

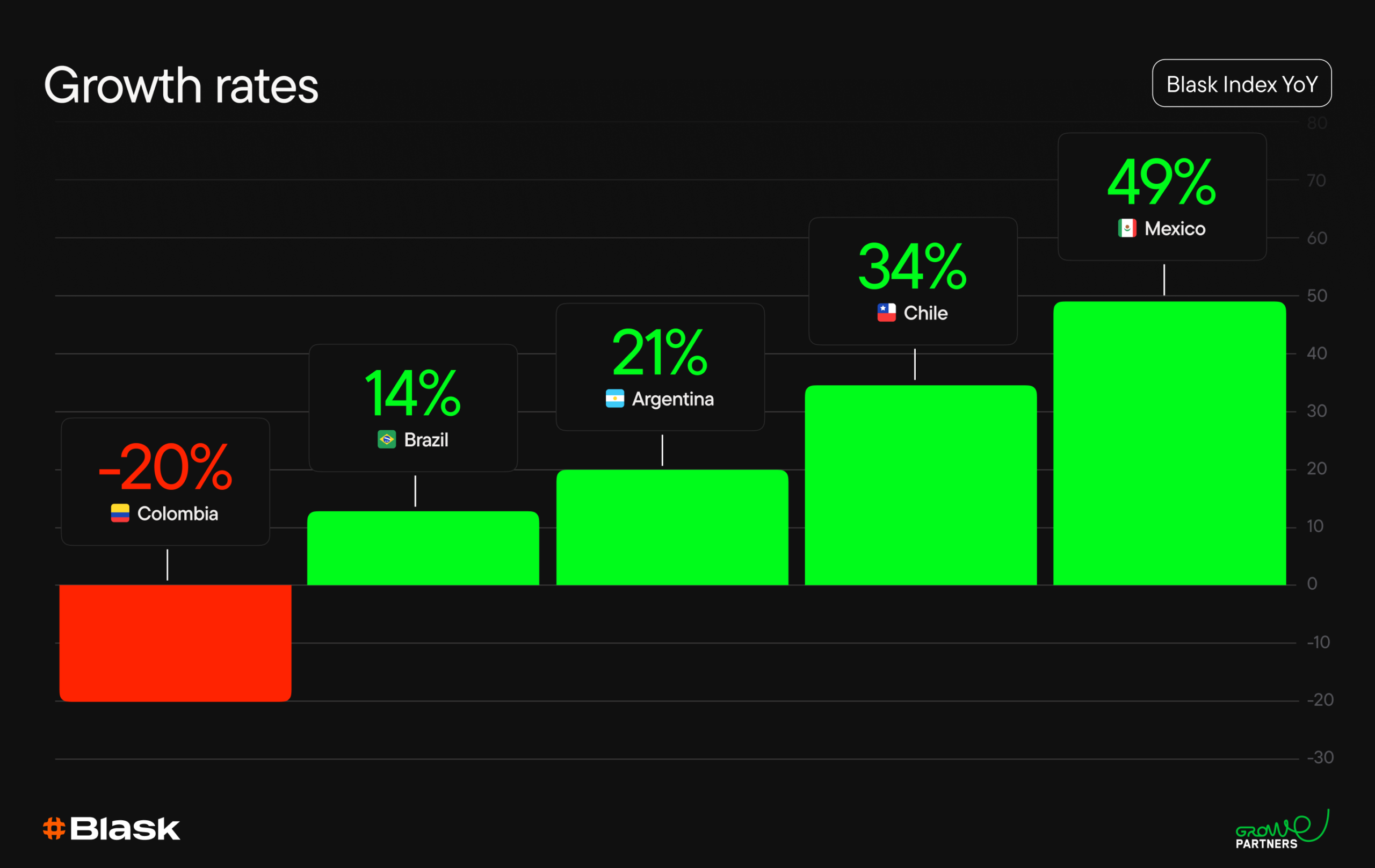

In H1 2025, activity across LatAm’s five largest iGaming markets rose by over 20% year on year, reaching levels comparable with Tier-1 regions.

According to the Blask Index, this growth was not driven by isolated spikes, but by broad-based engagement across mobile, sportsbook, and hybrid casino formats.

Mexico and Chile emerged as the fastest climbers, while Brazil — the region’s heavyweight — entered a phase of post-regulation consolidation. Argentina continued to show resilience despite economic volatility, and Colombia experienced a temporary cooling after its strong regulated run in 2024.

Behind the numbers sits a hyper-connected audience: more than 450 million internet users, mobile penetration above 80%, high urbanisation, and a median age squarely in the iGaming sweet spot. LatAm is no longer following global digital habits — it is increasingly setting them.

Revenue, acquisition, and the shape of opportunity

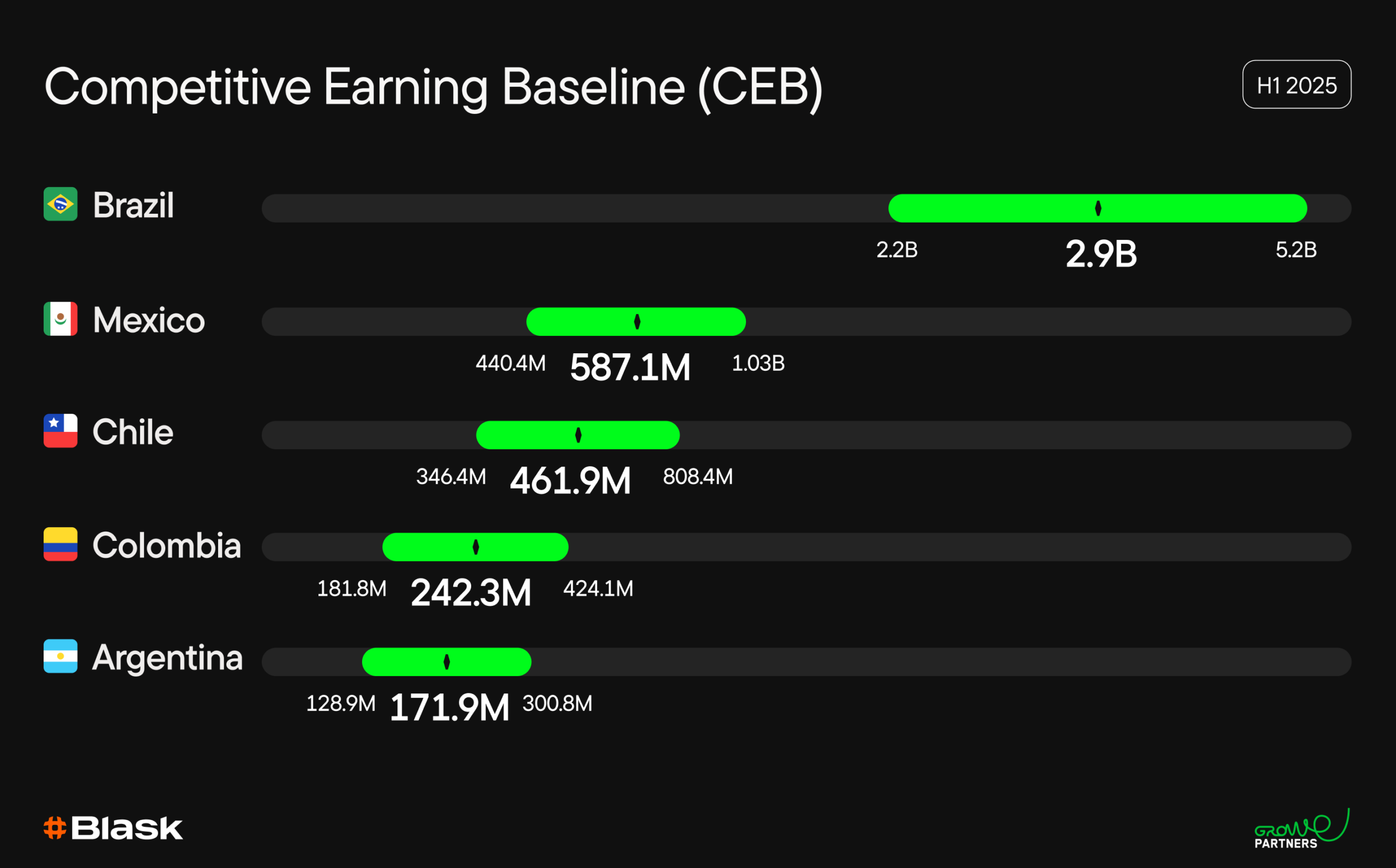

Blask’s revenue and acquisition benchmarks reveal a region scaling efficiently rather than chaotically. Brazil anchored total value with an average Competitive Earning Baseline (CEB) close to $3 billion in H1 2025, while Mexico, Chile, Argentina, and Colombia formed a fast-moving second tier with sharply improving acquisition efficiency.

Local brands gained ground as licensing expanded, particularly in Brazil and Mexico, while offshore operators still dominated in Chile and Argentina.

Across markets, APS figures showed that affiliates were converting traffic with increasing precision — not merely volume — reinforcing the shift toward RevShare and hybrid earning models.

💡 Read more: Brazil’s betting seasons, explained

Five markets, five distinct rhythms

Each of LatAm’s core markets followed its own logic.

- Brazil remained the region’s economic engine, defined by scale, rising lifetime value, and a gradual shift toward longer-term monetisation models.

- Mexico stood out as the fastest-growing market, where localisation, Spanish-first creative, and mobile funnels delivered outsized gains.

- Argentina balanced growth with volatility, maintaining strong engagement despite a high offshore share.

- Chile combined rapid growth with regulatory uncertainty, while Colombia illustrated the stabilising power — and eventual cooling — of early regulation.

Together, these markets generated an estimated $4.4 billion in average CEB in H1 2025, up roughly 22% year on year, with Brazil still accounting for the majority of value and Mexico and Chile closing the gap through faster digital adoption.

Affiliates, traffic, and behaviour on the ground

The affiliate landscape mirrored the region’s maturation. SEO and social remained core traffic drivers, but paid media — particularly TikTok — doubled its converting share compared with 2024. Conversion benchmarks stabilised, with click-to-registration rates between 25–35% and registration-to-FTD at 15–25%, strongest in Mexico and Brazil due to localised funnels and frictionless payments.

Mobile now dominates the user journey. More than 80% of players register or deposit via smartphones, with apps accounting for the majority of deposits. Across markets, fast payouts and transparent terms consistently outweighed promotional noise as retention drivers.

💡Read more: Brazil’s iGaming market overview: a new era of opportunity and risk

Growth, friction, and what comes next

The report also highlights the region’s growing pains. Creative fatigue has begun to surface in mature markets, fraud has shifted toward subtler forms of abuse, and competition between local and offshore operators is intensifying.

At the same time, underexplored geographies — including parts of Peru, Ecuador, and Central America — are starting to show early momentum.

The conclusion is clear: LatAm’s next phase will reward precision over speed. Regulation, AI-driven marketing, and trust-based communication are becoming decisive factors in sustaining growth.

As the study notes, Latin America has already emerged. The challenge now is learning how to grow well.